10 Years of Building the Circular Economy

April 11, 2024

Closed Loop Partners is proud to celebrate 10 years of building the circular economy. This is part of a series of insights to mark this milestone, highlighting key advancements over the last decade––and the continued work needed over the next decades to accelerate the transition to the circular economy.

In January 2014, Doug McMillon, the CEO of Walmart, invited the CEOs and leadership of Unilever, P&G, PepsiCo, The Coca-Cola Company, Kenvue (formerly Johnson & Johnson Consumer Health) and Keurig Dr Pepper to join him on stage at the annual meeting of Walmart’s suppliers. It was a groundbreaking moment. Some of the world’s largest corporations announced that they had joined together as the founding investors in the Closed Loop Fund, the inaugural fund of Closed Loop Partners, and one of the first investment funds focused on financing the development of the circular economy.

It was a monumental first step toward changing the trajectory of how we use our planet’s resources––away from a ‘take-make-waste’ economy and toward a waste-free world designed around resource efficiency, driving economic growth. This is the beginning of our story at Closed Loop Partners.

Several key factors led to that moment on stage. My journey before Closed Loop Partners had given me a clear view into the economic opportunity of rebuilding antiquated and inefficient supply chains into efficient and circular supply chains that continually reused materials in local markets. An urgent waste crisis, an increase in environmental regulation and growth in consumer demand for environmental responsibility, coupled with the emergence of circular innovations, made developing the circular economy so important to the future of business that it brought competitors together to form the Closed Loop Fund. This collaboration by industry leaders helped lay the foundational infrastructure for the circular economy in the U.S.

A few years later, as the circular economy gained momentum, our original Closed Loop Fund attracted additional corporate investors, including 3M, Amazon, BlueTriton, Colgate-Palmolive, Danone and Starbucks, catalyzing more capital into circular economy infrastructure. As our ecosystem grew, adding more strategies and asset classes, it attracted capital from financial institutions, including funds and accounts managed by BlackRock, leading family offices and foundation endowments. To meet the growing interest in the circular economy, the vision of Closed Loop Fund was expanded into other strategies, now comprising Closed Loop Partners.

What started with one fund a decade ago has grown into three businesses that form the Closed Loop Partners ecosystem, focused on three key development areas of the circular economy: our investment arm, Closed Loop Capital Management, invests in circular solutions across venture capital, catalytic private debt and buyout private equity strategies; our innovation and advisory group, the Center for the Circular Economy, advances critical research and manages unprecedented pre-competitive industry collaborations; and our operating group, Closed Loop Builders, houses our first operating company, Circular Services, the largest privately held recycling company in the U.S.

As I look back, some of Closed Loop Partners’ earliest catalytic investments demonstrate our founding vision and the foundation of the circular economy:

- A decade ago, as changes in global policy highlighted the need for local circular economy infrastructure in the U.S., investments in recycling capacity expansion became critical. Eureka Recycling, a recycling company servicing Minneapolis and St. Paul, Minnesota, was a first mover in elevating U.S. recycling, leveraging their operational experience and engaging with policymakers, industry leaders and community advocates to influence systems change. Financing from Closed Loop Partners over the past 10 years supported a three-fold increase in Eureka’s polypropylene plastic recovery. Since then, they continue to be a leader in setting the standard for best-in-class recycling operations and infrastructure.

- As the circular economy grew in the U.S., upgrades to municipal recycling systems were needed to keep pace with a growing volume of recovered materials. When aging recycling equipment needed replacing, the Waste Commission of Scott County pursued the change from dual- to single-stream recycling to improve material collection. Closed Loop Partners’ first loan nearly 10 years ago enabled the purchase of larger carts for curbside recycling and a redesigned single-stream MRF. The success of our first municipal loan catalyzed follow-on loans in 2018 and 2022, now enabling the county to serve 185,000+ households and process over 40,000 tons of paper, metal, glass and plastic per year.

- The onset of corporate waste reduction goals also meant a rise in demand for alternative packaging. TemperPack was one of our first investments to advance new sustainable materials. TemperPack developed the first high performance, curbside recyclable thermal packaging for shipments of perishable goods such as food and pharmaceuticals. Today, they continue to be a leader in packaging innovation, with a range of solutions that protect products, strengthen brands, and keep waste out of supply chains.

- Innovative circular solutions include new technologies that can work alongside material reduction, reuse and mechanical recycling to recover hard-to-recycle materials. One of our first investments was in PureCycle Technologies––its patented recycling process, developed by P&G and licensed to PureCycle Technologies, separates color, odor and any other contaminants from plastic waste feedstock to transform it into virgin-like resin. PureCycle closes the loop on the reuse of recycled plastics while making recycled plastics more accessible to companies looking to use a sustainable, recycled resin.*

Since these catalytic investments were first made, the market has matured and Closed Loop Partners’ work has expanded to include venture capital and buyout private equity, as well as innovation advancement, infrastructure development and circular materials management. These early investments were a market signal, and our work today is a foundation upon which we will invest in and build the circular economy over the coming decades––as profitability attracts more investment and as supportive policy accelerates tailwinds for incumbent supply chains to transition to circularity.

Closed Loop Partners now supports over 1,000 jobs across its ecosystem, all dedicated to advancing the circular economy. We are proud to work with leading organizations, cutting-edge innovators and over 50 of the world’s largest corporations committed to reducing waste across multiple areas––including plastics & packaging, organics, textiles and electronics. Closed Loop Capital Management manages over $500 million and has invested in over 80 companies, municipalities and organizations accelerating circular solutions. Together, our investments have kept 4.8 million tons of material in circulation and avoided 10.1 million tonnes of greenhouse gas emissions to date. The Center for the Circular Economy has led groundbreaking industry-leading pre-competitive collaborations that are focused on solving some of the most complex supply chain and manufacturing challenges, including reduction, reuse and recovery solutions for foodservice packaging and retail bags. And most recently, with over $700m in commitments from Brookfield, Microsoft, Nestlé, PepsiCo, SK Group, Starbucks and Unilever, we launched Circular Services, which is now the largest privately held recycling company in the U.S. It operates 20 recycling facilities and serves some of the largest municipal contracts in the nation including New York City, Palm Beach County, Austin, San Antonio and Phoenix.

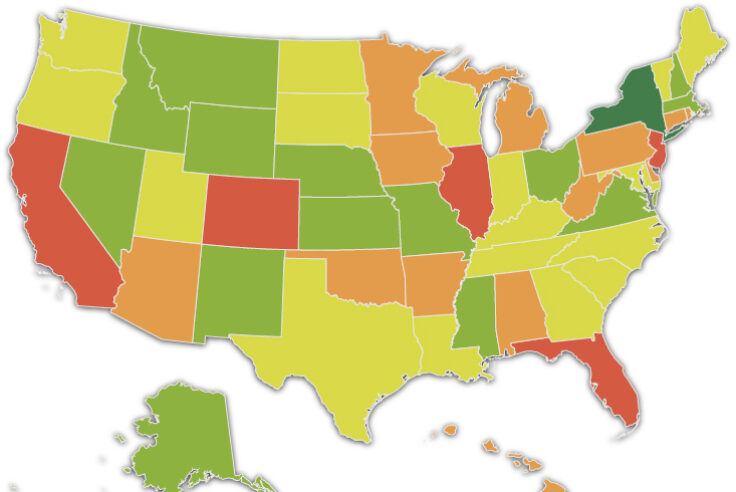

Closed Loop Partners has evolved as the circular economy has advanced. Today, the circular economy is recognized as a core solution to climate change mitigation as we all as a template for more efficient business operations. As more stakeholders recognize the financial and environmental opportunity of the circular economy, billions of dollars are beginning to move toward circular systems. More industry leaders are collaborating around shared waste reduction goals, leaders of countries are working together on a global plastics treaty, U.S. states are proposing and passing bipartisan Extended Producer Responsibility (EPR) legislation to fund recycling programs, and C-suites of Fortune 100 companies are pushing to achieve ambitious publicly stated circular economy and climate goals.

Transforming entire supply chains across multiple industries is the work of generations, but the world is changing faster today than it was 10 years ago. As Closed Loop Partners enters a new decade of action and impact, we see a future ripe with opportunity. We are now at a pivotal point, and the next decade will be critical to delivering outcomes and building transparent, circular systems. There is much more work to be done in the next phase of this systemic shift, but together with strategic partners, and across our platform, we are focused on expanding our impact and rebuilding industries to follow nature’s lead––grounded in resource regeneration and positioned for a resilient future.

As we celebrate this milestone in 2024, we will be sharing key insights on our impact over the last 10 years, and what is to come in the next decades of building the circular economy.

We invite you to join us in the transition to the circular economy.

—

*In October 2020, PureCycle Technologies fully paid off its loan from Closed Loop Partners, thus exiting the Closed Loop Infrastructure portfolio as a borrower. The Closed Loop Partners team, however, continues to engage with the PureCycle Technologies team as they continue growing their operations.

*This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Partners or any company in which Closed Loop Partners or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Information provided reflects Closed Loop Partners’ views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision.

Related posts

Press Release

Closed Loop Partners Provides Financing to Olyns, a...

The catalytic loan will help scale production of Olyns’...

Press Release

Does Compostable Packaging Actually Break Down? Composting...

Data in new report reveals that certified food-contact...

Press Release

First-of-Its-Kind Study by the Composting Consortium...

Commonly held assumptions about contamination were...

Blog Post

Many Americans Don’t Understand What to Do with Compostable...

As countries and corporations get one year closer to...

Press Release

Circular Services Acquires Midwest Fiber Recycling,...

The acquisition of a leading Midwest recycling company...

Press Release

Closed Loop Partners Invests in Circular Manufacturing...

The loan from Closed Loop Partners’ Infrastructure...

Blog Post

What Brands Need to Know to Increase the Recovery of...

Permitting for composting facilities is complex, but...

Reuse Series

Blog Post

Debunking Durability: How Durable Does Reusable Packaging...

New reuse innovations are expanding what is possible,...

Blog Post

How a South Carolina Paper Mill Started Recycling Your...

In July 2022, Sonoco announced it would accept paper...

Press Release

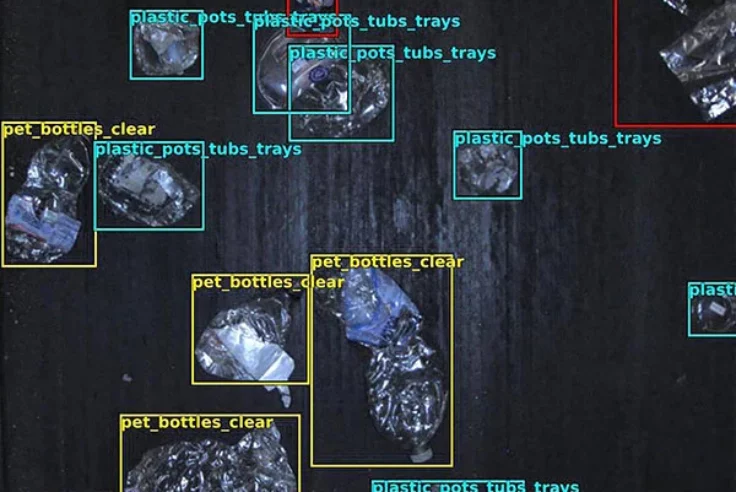

How AI Could Change the Way We Think About Recycling

Closed Loop Partners’ Center for the Circular Economy...

Reuse Series

Blog Post

Making Reuse an Everyday Reality: 3 Things We Must...

Reuse is now at a critical stage of development. A...

Blog Post

How Closed Loop Partners’ Multi-Million Dollar Investment...

This is Closed Loop Partners’ third loan to LRS,...