Why We Invested in Aerflo: Making Reuse an Everyday Norm

September 12, 2024

Photo Credit: Fast Company

At this point, we know that reuse is a critical part of the circular economy. It keeps valuable materials in circulation longer, and is part of an essential suite of solutions that also includes upstream material reduction and downstream recovery solutions.

Over the last decade, the use of reusable water bottles in particular has grown––many of us are familiar with the ubiquitous airport water fountains––but broader options for refill remain somewhat underwhelming. It’s, in a word, still.

Many circular reuse models today are appealing to environmentally driven consumers. While this is a growing demographic, it is still not scaled. The question remains: how do we get reuse into the mainstream? How do we get it to, in a word, sparkle?

To gain mainstream traction and drive a shift, solutions need to be better without compromise. Along with environmental benefits, they need to be more delightful and cost less to the end consumer.

Enter Aerflo. John Thorp and Buzz Wiggins, co-founders of Aerflo, started on this journey as outdoor adventurers frustrated that the beverages they wanted to drink only came in single-use, disposable packaging. Together, they embarked on building a solution that would make it possible to enjoy these beverages without waste and create a user experience that catered to the on-the-go lifestyle––all driven by a circular model.

Demand for sparkling water is on the rise in the U.S., with the market anticipated to grow at a compound annual growth rate of over 12% from 2023 to 2032. Today, we are not only seeing a diversity of options on retail shelves, but also a wave of innovations making it possible for consumers to make their own sparkling water. We have seen the growth of at-home countertop devices, such as Soda Stream and Aarke, and in-office spaces with Bevi, introducing a shift away from single-use packaging. But for consumers who want sparkling water on the go, single use has been the only option.

After years of building, John and Buzz launched Aerflo with the first-of-its-kind portable Aerflo Aer1 System that can turn any drinkable water source into refreshing sparkling water with the press of a button. The bottle houses a carbon capsule that can carbonate four full bottles of water. It is designed so that users can see carbonation happen, to gauge how much sparkle to add. The small bubbles mimic those in sparkling water sold in stores, bringing sparkling water to consumers without the need to ship glass bottles or cans filled with water thousands of miles. By inspiring and enabling reuse, Aerflo helps reduce waste and greenhouse gas emissions.

John and Buzz started with the concept of bubbles-on-the-go. How delightful would it be to add bubbles to beverages anywhere in the world, elevating the experience of drinking water, whether someone was on top of a mountain or running through New York City?

Every detail was carefully considered and crafted, ensuring that convenience and taste were not compromised for circularity––a critical factor to the success of reuse.

When capsules are empty, customers ship them back to Aerflo (in the same packaging, and with a return label pre-affixed). This immediately triggers the customer’s next order to be sent––so no subscription is needed. In the company’s fully automated, circular refill facility in New Jersey, the returned Aerflo capsules are cleaned, inspected and refilled before being shipped out to the next customer.

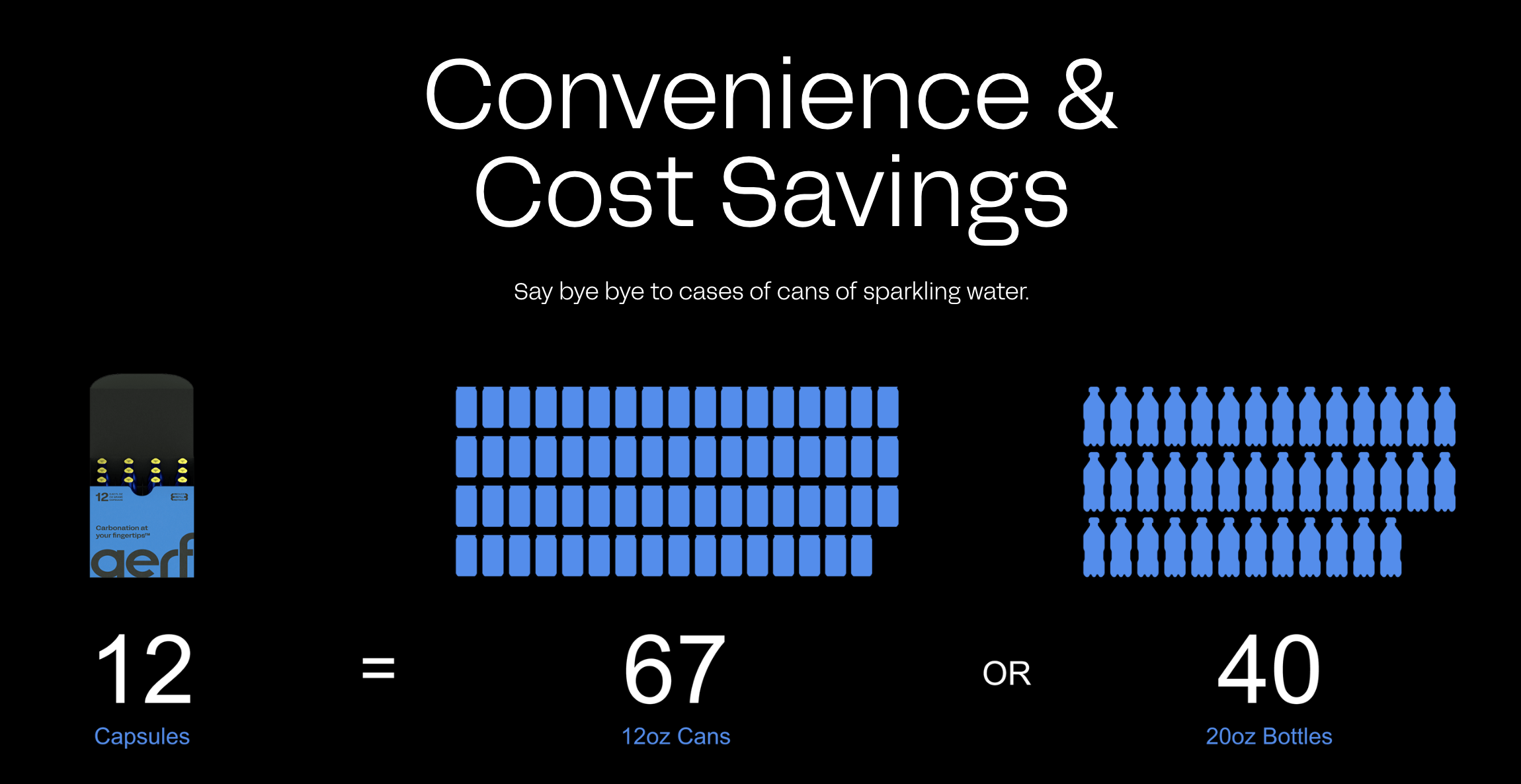

The model is entirely circular. Aside from the clear environmental benefits (each capsule can prevent the need for 330+ cans in its lifetime) this system drives cost savings for customers (60%+ less than single use) and gives the option of still or sparkling at any moment.

Over the past decade, Closed Loop Partners has reviewed hundreds of reuse models through our Closed Loop Ventures Group; we have also tested reuse models in-field and conducted reuse research through our Center for the Circular Economy. And now, Closed Loop Ventures Group is thrilled to announce our investment in Aerflo, a company offering what we believe is a natural choice for on-the-go consumers looking for an elevated experience. Aerflo drinkers don’t need a subscription or commitment and the company offers better value: it is less expensive on a per liter basis than buying carbonated bottled water and offers a more delightful experience to aerate water anywhere, helping make reuse an everyday habit.

About Closed Loop Ventures Group at Closed Loop Partners

Closed Loop Partners has been a leader in the reuse movement for almost a decade. Today, we are actively catalyzing the shift to reuse through our investments and in-market tests––unlocking critical insights and supporting reuse solutions in the field to prepare them for scale. From years of in-field testing and deep research, we have proven that to build successful reuse systems, we need to make reuse a natural choice.

Closed Loop Partners is at the forefront of building the circular economy. The company is comprised of three key business segments: its investment arm, Closed Loop Capital Management; its innovation center, the Center for the Circular Economy; and its operating group, Closed Loop Builders. Closed Loop Capital Management manages venture capital, buyout private equity and catalytic private credit investment strategies. The firm’s venture capital group, the Closed Loop Ventures Group, has been investing early-stage capital into companies developing breakthrough solutions for the circular economy since 2016. The Closed Loop Ventures Group’s portfolio includes companies developing leading innovations in material science, robotics, agritech, sustainable consumer products and advanced technologies that further the circular economy. Closed Loop Partners is based in New York City and is a registered B Corp.

About Aerflo

To learn more, visit https://aerflo.co/.

Disclaimer

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

Related posts

Blog Post

How AI Can Reduce Food Waste at Restaurants

Closed Loop Ventures Group led the seed investment...

Blog Post

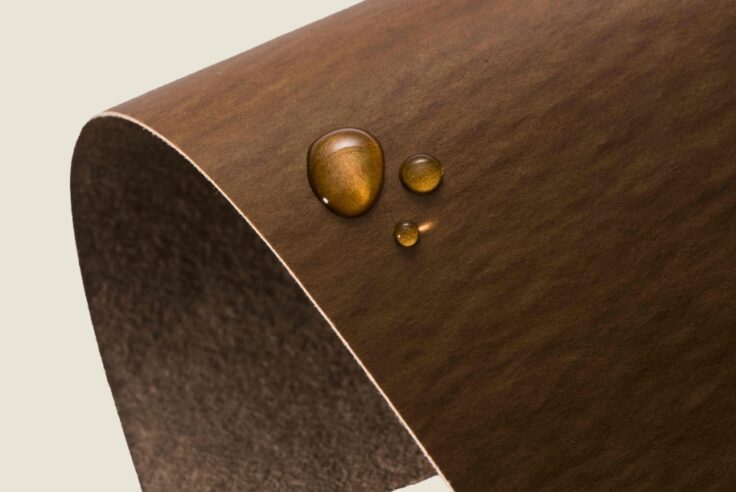

Why We Invested in Mycocycle: Nature-Inspired Circular...

Closed Loop Partners’ Ventures Group saw a key opportunity...

Press Release

Closed Loop Partners Leads $4M Seed Round for LAIIER,...

Investment in the innovative liquid leak detection...

Blog Post

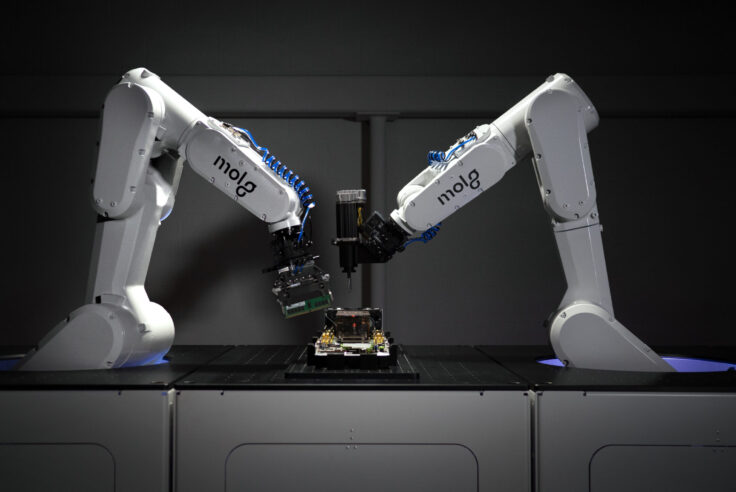

Making Circularity Stick: Electronics

A conversation with Rob Lawson-Shanks, CEO of Molg...

Press Release

Closed Loop Partners Doubles Down on Investment in...

Closed Loop Ventures Group joins Earthodic's $4 million...

Blog Post

Why We Invested in Neutreeno: Engineering Circular...

Neutreeno offers a game-changing solution that seamlessly...

Press Release

Molg Raises $5.5 Million in Seed Funding to Tackle...

Closed Loop Partners' Ventures Group leads seed funding...

Blog Post

How the Apparel Industry Is Challenging Us to Think...

The high cost of textile waste has sparked the need...

Blog Post

Why We Invested in Capra Biosciences: How Microbes...

Today, we are witness to a rapidly changing manufacturing...

Blog Post

Why We Invested in VALIS Insights: Bringing Circularity...

Closed Loop Partners invested in VALIS Insights because...

Blog Post

Why We Invested in Found Energy: The Importance of...

Closed Loop Ventures Group invests in Found Energy,...

Blog Post

Why We Invested in Molg: Supporting the Circular Economy...

Closed Loop Ventures Group shares how Molg Inc. is...