What Brands Need to Know to Increase the Recovery of Compostable Packaging

November 28, 2023

Permitting for composting facilities is complex, but critical. The Composting Consortium breaks it down.

Over the last few years, demand for compostable packaging has grown quickly, as more brands explore alternatives to single-use conventional plastic. Whether in the form of a bowl, fork or a chip bag, compostable packaging is becoming more prevalent each year. At its best, compostable packaging could play an important role in reducing food and packaging waste by helping deliver food scraps within packaging to composting infrastructure, avoiding the greenhouse gases emitted if food were to end up in landfill.

But the reality is that the U.S. composting infrastructure in existence today was predominantly designed to process only yard trimmings––leaves, grass clippings and woody debris––because of a policy trend in the late 80s and early 90s that banned yard waste from landfill in dozens of states. As climate change mitigation and zero-waste goals have emerged, the composting industry is modernizing, diversifying feedstock inputs to include post-consumer food waste and certified compostable packaging. But it is only at the beginning stages of that transition.

The Composting Consortium, a multi-year collaboration across the entire compostable packaging value chain, has been studying composting infrastructure for several years. In the U.S., about 70% of the 200 full-scale composting facilities that process food waste also process some form of compostable packaging. Most of these facilities are located in urban areas. The rest of the over 2,500 composting facilities in the U.S. only process yard waste, meaning most Americans lack convenient options to compost food waste, including food-contact compostable packaging. Creating circular outcomes for compostable packaging hinges on scaling the recovery of food scraps, and brands, packaging manufacturers, industry groups, composters and investors all need to be involved.

What needs to happen so that compostable packaging doesn’t end up as waste?

Several things need to be in place for compostable packaging to operate within a truly circular, waste-free system. Consumer education, supportive policy, and clear and consistent packaging design and labeling all play important roles––and recovery infrastructure is a critical piece to the puzzle.

When envisioning a future system where composting facilities accept not just yard waste, but also food scraps, and the compostable food packaging those scraps often arrive with, the first step is to consider what must be true for facilities to upgrade from yard waste-only composting infrastructure to also recover food.

Only when more food waste is recoverable at composting facilities will it be possible to also see more recovery of food-contact compostable packaging. This infrastructure upgrade is a key steppingstone to reducing packaging waste.

Why do permitting requirements matter?

While there is opportunity to upgrade existing yard trimmings composting facilities to recover food waste––and potentially, also food-contact compostable packaging––it is often difficult to get the necessary permits to do so. In many cases, yard trimmings-only composting facilities are permitted to compost only yard trimmings. To obtain a permit to also compost food waste and make all the necessary upgrades, these facilities would need to go through a lengthy and expensive permitting process.

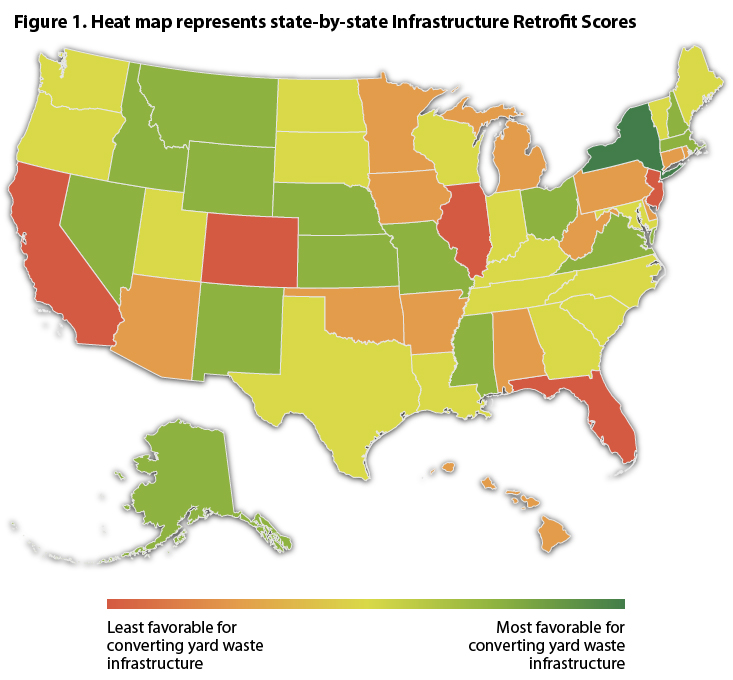

The Composting Consortium, BioCycle and Craig Croker evaluated each of the 50 states’ permitting requirements across five factors to produce a “Composting Infrastructure Retrofit Score” that measures how easy or difficult upgrading existing yard trimmings-only composting facilities would be across different states.

The final Composting Infrastructure Retrofit Score looked across five factors:

- Ease of permitting process: The difficulty of obtaining a permit to compost food waste in a particular state.

- Presence of permitting tier: Whether a state has rules for composting facilities depending on how much and what types of food waste they accept. Some states have stricter rules for facilities that accept large amounts of food waste or food waste that may be contaminated with pathogens.

- Cost to upgrade: The cost of upgrading a yard trimmings-only composting facility to process food waste.

- Time needed to upgrade: The amount of time it takes to upgrade a yard trimmings-only composting facility to process food waste.

- State food waste disposal ban: Whether a state has a ban or mandate that restricts disposal of food waste.

The findings uncovered a patchwork landscape of permitting conditions across the county as shown in BioCycle’s heatmap below. New York state stood out among the 50 states as having a comparatively straightforward process to obtain permits required for infrastructure retrofit, while most states including South Carolina, Rhode Island and California make navigating permitting requirements significantly more costly and time-intensive.

Original Source: BioCycle

In many states, permitting requirements for food waste composting are one of the major factors standing between compostable packaging and the recovery pathways needed to ensure they are a circular alternative to single-use plastic packaging.

What role do brands play in navigating permitting requirements?

CPG brands have a unique opportunity to play a leading role in scaling up a more circular system for food-contact compostable packaging in the U.S.––by investing in recovery solutions for food-contact compostable packaging, advancing consumer education, designing packaging that is compatible with food waste composting infrastructure, and advocating for policies––like extended producer responsibility––that can support the development of food waste composting infrastructure.

To advance the necessary upgrades to composting facilities, brands can be supportive of efforts of composting industry groups like the US Composting Council, who advocates for standardized state regulations for composting. Permitting requirements are a determining factor in creating more opportunities for compostable packaging circularity and navigating them requires the engagement of stakeholders across the value chain.

In 2024 and 2025, the Composting Consortium will continue to connect the dots and work with the compost industry, policymakers, and packaging manufacturers and brands to lower the barriers to scaling food-waste composting infrastructure and unlock value to all stakeholders across the composting value chain. Through this unprecedented collaborative work, the Composting Consortium aims to build a more circular composting system, one that drives values to all stakeholders.

Learn more about the work the Consortium is doing to scale circular outcomes for compostable packaging.

About the Composting Consortium

The Composting Consortium is a multi-year collaboration to pilot industry-wide solutions and build a roadmap for investment in technologies and infrastructure that enable the recovery of compostable food packaging and food scraps. The Composting Consortium is managed by Closed Loop Partners’ Center for the Circular Economy. PepsiCo and the NextGen Consortium are founding partners of the Consortium. Hill’s Pet Nutrition parent company Colgate-Palmolive, Danaher Foundation, Eastman, The Kraft Heinz Company, Mars, Incorporated, and Target Corporation joined as supporting partners, and the Biodegradable Products Institute, the US Composting Council and the U.S. Plastics Pact joined as industry partners. Our advisory partners include 5 Gyres, Foodservice Packaging Institute (FPI), Google, ReFED, Compost Research and Education Foundation (CREF), the Sustainable Packaging Coalition (SPC), TIPA, University College London (UCL), Western Michigan University (WMU), University of Wisconsin-Stevens Point, and World Wildlife Fund (WWF). Learn more about the Consortium at closedlooppartners.com/composting-consortium/

Related posts

Blog Post

Materials Matter: Designing Reuse for the Real World

One of the most important design decisions for reuse...

Press Release

Closed Loop Partners Advances Major Progress for the...

The circular economy-focused firm releases 2024 impact...

Press Release

Beyond the Bag Initiative Unites Major and Local Retailers...

Headlined by Target, CVS Health, Ralphs and Food 4...

Blog Post

Reuse Is Coming to U.S. Cities. Here’s How Businesses...

Reuse is growing across sectors — but it’s still...

Press Release

Beyond the Bag Initiative Releases Its Largest Study...

The Consortium to Reinvent the Retail Bag unveils insights...

Blog Post

For Reuse to Work, Language Matters

A quick guide to messaging for reuse programs and getting...

Press Release

Closed Loop Partners Adds New Private Equity Managing...

Daniel Phan joins the circular economy-focused firm...

Blog Post

The Hidden Value of Scrap Metal: Why Local Recovery...

VALIS discusses circularity of metal processing, and...

Press Release

Closed Loop Partners’ Composting Consortium Launches...

The grant program for composters and communities comes...

Blog Post

How AI Can Reduce Food Waste at Restaurants

Closed Loop Ventures Group led the seed investment...

Press Release

New Data Reveals High Quantities of Food-Grade Polypropylene...

Closed Loop Partners’ Center for the Circular Economy...

Blog Post

Keeping Compost Clean: Tools to Help Reduce Contamination...

The Composting Consortium interviews EcoProducts to...