That’s the Circular Economy: How A Logistics Company Uses Empty Retail Spaces to Fix Supply Chains and Reduce Waste

December 20, 2022

A full logistics center inside a shopping mall––this is how Fillogic infuses agility into supply chains.

The company is at the center of one of today’s most pressing opportunities, as supply chain bottlenecks and logistics challenges elevate the need for streamlined, efficient movement of goods into and out of our homes and businesses. Today’s complex logistics system is coupled with a manufacturing system weighed down by overproduction, opacity and waste. The fashion industry alone has an average 40%[1] overproduction rate. This overloads production facilities and raises costs for brands as they hold unsold inventory for long periods. Eventually, most surplus products are landfilled or destroyed, wasting valuable resources. While legacy supply chains went unquestioned for many decades, their inefficiency has been apparent amidst the bottlenecks of the last two years.

The COVID pandemic accelerated the growth of e-commerce, and in its wake, return rates soared to over 20%[2]. Brittle retail supply chains bogged down by overproduction were unable to handle the spike. Today, if a garment is returned at all, it takes weeks or months until it is available for sale again––if it ever makes it back on shelf at all. This means that unsold and returned inventory can sit in a box for half of the apparel markdown cycle, and when it finally goes back to the retailer for sale, it is often already shopworn and damaged. This says nothing for the excess carbon emissions associated with the transport of that good through the network as returns make their way back to central distribution hubs.

The retail system operates as an omni-channel network and its weakness lies in its silos. If 100 pairs of jeans are shipped, they travel in one direction before branching into different sales channels: wholesale, retailer and e-commerce. These silos are often disconnected and managed by different parties. When items across these three channels are unsold or returned, they end up in consolidation centers mixed with different products. Brands have little to no data on that inventory. Without the backend infrastructure to connect these three channels and consolidate information, a holistic view of managed inventory is impossible––making it similarly challenging to reallocate products into the optimal sales channels. Inventory ends up in holding patterns instead of getting where it needs to go.

Networks, technology and infrastructure need to change quickly, but it’s never been more expensive to do so. Industry is looking for ways to use existing infrastructure more efficiently. That’s where Fillogic comes in.

Breaking Down Silos

Fillogic recognizes that if the same product (for example, a pair of jeans) is allocated across a brand’s wholesale, retail and e-commerce channels, then the three channels should be connected on the backend. That way, outbound, unsold, returned or lightly worn inventory can be reallocated to a channel where it will most likely sell, helping brands reach business goals and meet customers where they are while minimizing inventory idling in warehouses or backed up in transit.

Their technology intercepts unsold garments at the middle mile and redirects them across the appropriate channel. This reduces the need for retailers to markdown in stores to move inventory. Instead, they can resell these products––which are often part of the nearly 40% of inventory that’s sold at discount––at full price or at a slight markup, through a different channel or in a different store, and more quickly than should these items have languished in the existing logistics infrastructure.

To add speed and efficiency, Fillogic operates within existing spaces close to retailers and customers. They repurpose shopping malls and under-utilized retail spaces into local market logistics hubs that connect the retail network. They see opportunity in forgotten spaces: the truck tunnels and elbow joints––bringing value back into overlooked assets rather than building more infrastructure. They optimize existing inventory, both outgoing and returning, to unlock new revenue streams for brands, enable better margins on the sale of unsold items and the resale of returned goods, advancing reuse and meeting customer demand in the process. Ultimately, this keeps valuable products that otherwise could have gone to landfill in the hands of consumers.

Paving the Path for Growth

Closed Loop Partners’ Ventures Group invested in Fillogic in early 2022, recognizing the need for supply chain transparency to increase utilization of goods and keep those materials in circulation. According to the Circularity Gap report, 70% of greenhouse gas emissions are related to material production and use, bringing the circular economy, and increasing utilization rates of manufactured products to the center of climate conversations. Advancing more circular supply chains plays a key role in increasing resource efficiency and resiliency to bring products to market while limiting waste.

As more retailers cross geographic boundaries, Fillogic faces growth opportunities in North America and beyond. Bill Thayer, Founder and CEO of Fillogic, is developing retail partnerships alongside a close-knit team, many of whom have had long careers in logistics, store operations, ecommerce and technology. In Bill’s words, “[Other players have] spent hundreds of billions of dollars building logistic networks. At Fillogic, we feel that network already exists. By connecting [those sites] with technology, operations and infrastructure, we can use under-utilized infrastructure more efficiently…operating as nodes on existing supply chains and making that middle mile more efficient.” Fillogic’s technology platform connects these heavily siloed, disparate systems, a hub network that uses underutilized spaces, and a delivery marketplace that connects those two assets. Together, all three assets create an affordable, efficient, cost-effective and sustainable network using existing infrastructure where people live, buy new clothes and make returns.

Ultimately, Fillogic is helping to increase the resale and recapture of consumer goods. By doing this, Fillogic is optimizing existing processes––reducing costs, timelines and the percentage of excess or unsold inventory. This is a win for both financial officers and sustainability managers––and that’s the circular economy.

[1] https://www.voguebusiness.com/sustainability/fashion-waste-problem-fabrics-deadstock-pashko-burberry-reformation

[2] https://www.cnbc.com/2022/01/25/retailers-average-return-rate-jumps-to-16point6percent-as-online-sales-grow-.html

Disclaimer:

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

Related posts

Press Release

Closed Loop Partners Doubles Down on Investment in...

Closed Loop Ventures Group joins Earthodic's $4 million...

Blog Post

Why We Invested in Neutreeno: Engineering Circular...

Neutreeno offers a game-changing solution that seamlessly...

Press Release

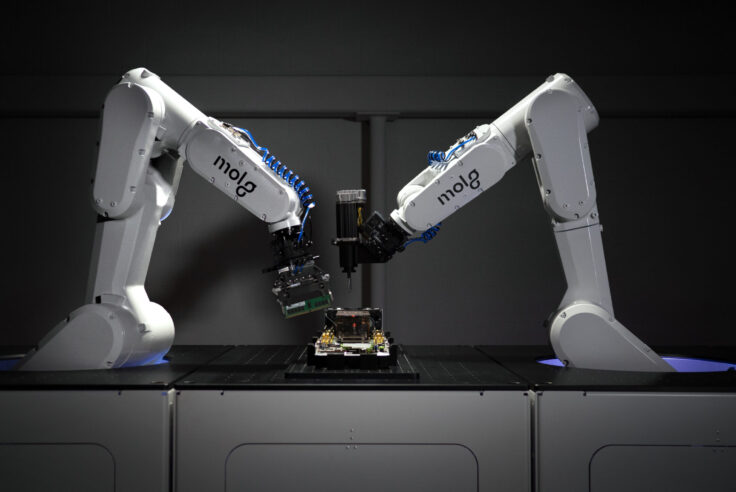

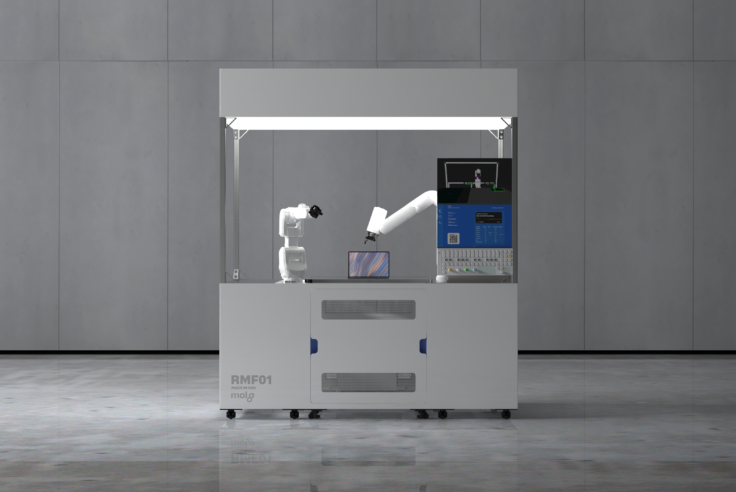

Molg Raises $5.5 Million in Seed Funding to Tackle...

Closed Loop Partners' Ventures Group leads seed funding...

Blog Post

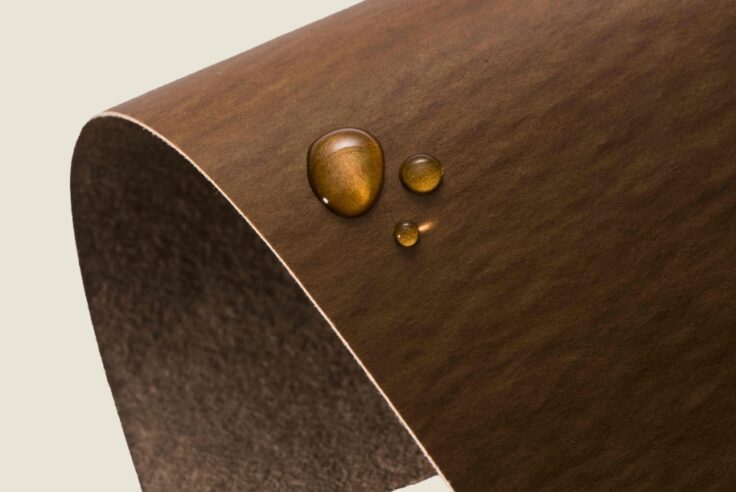

How the Apparel Industry Is Challenging Us to Think...

The high cost of textile waste has sparked the need...

Blog Post

Why We Invested in Aerflo: Making Reuse an Everyday...

Closed Loop Ventures Group is thrilled to announce...

Blog Post

Why We Invested in Capra Biosciences: How Microbes...

Today, we are witness to a rapidly changing manufacturing...

Blog Post

Why We Invested in VALIS Insights: Bringing Circularity...

Closed Loop Partners invested in VALIS Insights because...

Blog Post

Why We Invested in Found Energy: The Importance of...

Closed Loop Ventures Group invests in Found Energy,...

Blog Post

Why We Invested in Molg: Supporting the Circular Economy...

Closed Loop Ventures Group shares how Molg Inc. is...

Blog Post

Putting Recovery at the Center of the Critical Minerals...

At Closed Loop Partners, we see significant opportunity...

Press Release

With Investment from Closed Loop Partners, Hyran Technologies...

Hyran Technologies (Hyran), a collaborative, AI-driven...

Climate

Blog Post

Why Water Needs To Be Part of Circular Economy Investments

Amidst a climate crisis and high water treatment costs,...