Closed Loop Partners Doubles Down on Investment in Earthodic, Advancing Coating Alternatives for Paper Packaging

November 13, 2024

Closed Loop Ventures Group joins Earthodic’s $4 million seed funding round alongside other leading investors, supporting the company’s expansion into the U.S.

November 13, 2024, New York, NY — Closed Loop Partners‘ Ventures Group announces its follow-on investment in Earthodic, a Brisbane-based biotechnology company creating recyclable bio-based coatings for paper packaging. This is Closed Loop Ventures Group’s second investment in Earthodic, supporting the company’s expansion into the U.S. The $4 million seed funding round was led by FTW Ventures, with participation from existing investors Closed Loop Partners’ Ventures Group, Tenacious Ventures and Investible, and new investors Circulate Capital, Queensland Investment Corporation, UniQuest Fund, Significant Capital Ventures, Branch Venture Group and Redstick Ventures.

The investment is taking place as more corporations demand packaging alternatives that reduce waste while maintaining performance. Today, most paper packaging uses petroleum-based plastic liners that help prevent leakage and maintain temperature but are typically discarded as waste. Closed Loop Ventures Group saw an opportunity to advance bio-based coatings that can enable better performance of existing paper packaging or products and unlock opportunities to switch from non-recoverable single-use plastics to recoverable bio-based alternatives.

Earthodic’s Biobarc™ is a water-resistant, repulpable and recyclable coating for paper packaging, offering a solution for brands and packaging manufacturers looking to transition away from wax and polymer film coatings to reduce plastic waste. Earthodic uses lignin––a byproduct of paper manufacturing that is often discarded or burned for energy––and reintegrates it into Biobarc™ to create a recyclable solution for paper packaging. The company is also pursuing third party certifications to ensure Biobarc™’s compostability at industrial composting facilities in the U.S., creating more potential end-of-life pathways for the material.

“This is a key milestone for Earthodic as we expand our reach into new geographic markets, and new paper packaging applications. Advancing a bio-based coating for paperboard can have a significant impact on plastic waste reduction,” says Anthony Musumeci, Co-founder and CEO of Earthodic. “Closed Loop Partners’ Ventures Group has been a key partner in our growth since they first invested in Earthodic. We are thrilled to continue our partnership with their team as we scale our solution and advance the circularity of packaging.”

Closed Loop Ventures Group’s investment in Earthodic advances the group’s mandate to deploy early-stage capital to founders and companies who rethink how products are designed, manufactured, consumed and recovered. Since Closed Loop Partners’ venture capital group launched in 2016, it has invested in over 40 companies advancing solutions that optimize supply chains and reduce reliance on fossil fuel extraction and landfilling. These range from packaging & plastic alternatives to safer chemistry and supply chain transparency to waste reduction solutions for food & agriculture, retail logistics, renewable energy, water reclamation, built environment and distributed manufacturing.

“Packaging waste comprises 30 percent of materials sent to landfill today, creating a significant challenge for brands and packaging manufactures looking to meet zero waste goals. Earthodic’s coating offers a circular solution for paper packaging that can help divert materials from landfill while maintaining the same performance capabilities brands have come to expect from their packaging solutions,” said Aly Bryan, Investor on the Closed Loop Ventures Group team at Closed Loop Partners. “Closed Loop Ventures Group is proud to have been among the first investors in Earthodic and we look forward to supporting their growth as they scale throughout the United States with their solution.”

With capital from its seed funding round, Earthodic will establish a second headquarters at Western Michigan University Homer Stryker M.D. School of Medicine Innovation Center, situated near a pilot coating plant and testing facilities used extensively by the paper industry. Their main research & development hub will stay in Queensland, Australia. The company will deepen existing research & development partnerships with global leaders in paper packaging while continuing to sell Biobarc™ into non-food contact packaging at scale, as a superior solution to traditional wax and petroleum-based coatings.

This will create more opportunities for circularity across the packaging, food and consumer goods industries.

If you are interested in learning more about Closed Loop Partners’ Ventures Group, please visit www.closedlooppartners.com.

If you are interested in learning more about Earthodic, please visit www.earthodic.com.

About Earthodic

Earthodic is on a mission to advance the global transition to a circular economy. We help companies within the paper industry and their customers adopt sustainable packaging solutions, mitigating packaging waste that ends up in landfill. Earthodic has created sustainable function barrier coatings that are certified 100% biobased carbon, to offer liquid water barrier and oil and grease resistance to paper-based packaging. Earthodic coatings utilize lignin, a by-product of the pulp and paper industry, and are a drop-in solution for existing coating infrastructure. Established in 2022, Earthodic has operations across Australia and the USA.

To learn more, visit www.earthodic.com.

About Closed Loop Partners

Closed Loop Partners is at the forefront of building the circular economy. The firm is comprised of three key businesses that create a platform for systems change: an investment group, Closed Loop Capital Management; an innovation center, the Center for the Circular Economy; and an operating group, Closed Loop Builders. Closed Loop Capital Management manages venture capital, buyout private equity and catalytic private credit investment strategies.

The firm’s venture capital strategy, the Closed Loop Ventures Group, has been investing early-stage capital into companies developing breakthrough solutions for the circular economy since 2016. Closed Loop Ventures Group’s portfolio includes companies developing leading innovations in material science, robotics, agritech, sustainable consumer products and advanced technologies that further the circular economy. Closed Loop Partners is based in New York City and is a registered B Corp.

To learn about Closed Loop Ventures Group, visit www.closedlooppartners.com.

Disclosure

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

Why We Invested in Neutreeno: Engineering Circular Supply Chains with the Right Data

October 29, 2024

You can’t manage what you can’t measure.

This has been the mantra around carbon emissions measurement and management for the last decade. Over that time, we have seen several companies attempting to properly measure Scope 1, Scope 2 and Scope 3 carbon emissions––with various levels of (in)accuracy and friction. However, most importantly, none that are actionable across entire value chains.

To properly measure and address emissions across complex value chains, you need (1) primary data from suppliers, (2) deep knowledge of various processes, energy intensity and embodied emissions in materials, (3) scientific models that make this collection and calculation easy, and (4) actionable insights for businesses and asset owners to lower their carbon footprints.

The growth of the carbon measurement and management market is partially driven by regulatory scrutiny, but for Closed Loop Partners’ Ventures Group, we think the biggest opportunity is in helping asset owners reduce costs, risks and waste in their supply chain, made possible through studying resource flows and emissions simultaneously.

Today, up to 70% of greenhouse gas emissions are linked to the extraction, processing and manufacturing of materials within our current linear production and consumption model. Measuring and managing carbon emissions uncovers opportunities for increased circularity within supply chains––a key driver of supply chain resilience and greenhouse gas avoidance. After reviewing hundreds of companies in this space, we believe Neutreeno is best positioned to help address these embedded emissions and move industry towards circular models, given the team’s scientific credentials.

Through collaboration with University of Cambridge researchers, Neutreeno has developed industry-leading emission models that solve the fundamental challenges of data collection, accuracy and actionability across the major industrial sectors.

Dr. Spencer Brennan, CEO and Founder of Neutreeno combined his Physics PhD research in high-resolution measurement systems with his chemical engineering background to build models that require 10x less data to generate precision emissions reports, and provide actionable insights about how a given supplier can decarbonize. Neutreeno’s advanced product material and energy flow analysis builds on University of Cambridge Professor, Jonathan Cullen’s, 15 years of research to decode manufacturing processes, drive efficiency, integrate circularity and decarbonization across multiple tiers of the value chain, and deliver critical emissions insights and visualizations.

Neutreeno offers a game-changing solution that seamlessly integrates into existing workflows. Built on rigorous, science-based foundations for calculating emissions, their model delivers precise, actionable insights for immediate decarbonization across the value chain. Plus, with ROI analysis, businesses can confidently prioritize the most impactful levers, driving faster and smarter decisions to advance more circular, decarbonized supply chains.

About Closed Loop Partners

Closed Loop Partners is at the forefront of building the circular economy. The company is comprised of three key business segments: its investment arm, Closed Loop Capital Management; its innovation center, the Center for the Circular Economy; and its operating group, Closed Loop Builders. Closed Loop Capital Management manages venture capital, buyout private equity and catalytic private credit investment strategies. The firm’s venture capital group, the Closed Loop Ventures Group, has been investing early-stage capital into companies developing breakthrough solutions for the circular economy since 2016. The Closed Loop Ventures Group’s portfolio includes companies developing leading innovations in material science, robotics, agritech, sustainable consumer products and advanced technologies that further the circular economy. Closed Loop Partners is based in New York City and is a registered B Corp. To learn more, visit closedlooppartners.com

About Neutreeno

Utilizing proprietary process networks and engineering models, Neutreeno identifies and eliminates emissions at source. Neutreeno partners with leading businesses wanting to move beyond carbon accounting and take decisive action to decarbonize Scope 3 emissions. Learn more here.

Disclosure

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

Molg Raises $5.5 Million in Seed Funding to Tackle Electronics Waste Through Circular Manufacturing

October 09, 2024

STERLING, Va., Oct. 9, 2024 — Molg Inc. (“Molg”) announces the closing of $5.5 million in seed funding to scale the company’s circular manufacturing processes for electronics and electrical components. Closed Loop Partners’ Ventures Group led the round, with participation from Amazon Climate Pledge Fund, ABB Robotics & Automation Ventures, Overture, Elemental Impact and Techstars. The company plans to use funding to scale production capacity and meet growing customer demand for circularity and automation.

The funding round is closing at a pivotal time, amidst growing urgency to keep electronics in circulation and recover the critical minerals needed to support the clean energy transition. Today, tens of millions of tonnes of electronic devices are discarded or become obsolete each year. In 2022, only 22.3 percent of e-waste was recycled, according to data from the UN Global E-waste Monitor, resulting in the vast majority of electronics being sent to landfill, where they release greenhouse gasses and chemical substances into the environment. Over $62 billion worth of critical minerals and precious metals are also left unrecovered within electronics waste, missing the opportunity for reuse and remanufacturing for clean energy supply chains. As these materials grow increasingly scarce, expensive and geopolitically sensitive, more solutions are needed to ensure they are kept in circulation.

“After a decade in consumer electronics manufacturing, we founded Molg because we saw firsthand how current design, production and recovery processes—or the absence thereof—contribute to the massive problem of e-waste,” said Molg cofounder and CEO Rob Lawson-Shanks. “Achieving true circularity requires a fundamental shift in the underlying systems that support demanufacturing. It starts with better design and is enabled by dynamic automation. This funding allows us to accelerate our work at both ends of a product’s life, designing for circularity from the start and recovering valuable devices, components and materials through automated disassembly.”

Molg is tackling the e-waste challenge through a comprehensive circular manufacturing process powered by robotics and design. Its robotic microfactories can autonomously disassemble complex electronic products to recover valuable components for reuse, remanufacturing or recycling. The team also partners with leading manufacturers to design electronics with circularity in mind—ensuring one product’s end is another’s new beginning.

“We invested in Molg because they are rethinking how critical materials can be recovered from electronics, addressing a historically overlooked source of valuable resources. Their process maximizes the value of recovered materials and allows for local recovery where materials are most needed––important parts of advancing the circular economy,” said Aly Bryan, Investor on the Ventures Group team of Closed Loop Partners, a firm focused on building the circular economy. “They are helping to unlock a scalable solution that not only reduces environmental impact but also strengthens supply chains by recovering materials domestically.”

Molg has its headquarters and manufacturing facility in the heart of the data center industry in Northern Virginia. The company’s seed round of funding will be used primarily to scale production to meet customer demand for circular supply chains.

“Amazon remains committed to our decarbonization efforts and supporting technologies that aim to improve the circularity of our supply chains,” said Sam LaPierre, Investor at Amazon’s Climate Pledge Fund. “Efforts to improve hardware demanufacturing and material recovery, such as those developed by Molg, are promising technologies that can help advance the recycling and material recovery industries at scale. We are excited to support the growth of Molg, a company at the forefront of unlocking circular supply chains for electronics.”

Molg has already installed robotic disassembly Microfactories at Sims Lifecycle Services and is rolling out to ITAD facilities of leading hyperscalers. The team also works on circular design with leading companies like HP, Dell and ABB Robotics & Automation Ventures to redesign products for the automated recovery of valuable components, remanufacturing and recycling.

“Our investment in Molg will open new possibilities for using industrial robots in the recovery and recycling of data center equipment,” said ABB Robotics Managing Director Business Line Industries, Craig McDonnell. “By helping to enable the automated disassembly and responsible disposal of disused electronics, we are excited to be playing our role in transforming the circularity and sustainability of the data center sector.”

“We invested in Molg to help solve two critical challenges: dealing with mountains of toxic waste that are growing every year, and meeting the rapidly increasing demand for critical minerals in batteries, data centers, and electronics,” said Elemental Impact CEO Dawn Lippert. “Molg is an example of how innovation in AI and robotics can be good for the planet and consumers: why would we landfill precious metals when we can recover them domestically and reuse them?”

“The AI boom and rapid expansion of data centers is coinciding with an energy transition that demands an immense supply of critical minerals. Molg helps hyperscalers and electronics manufacturers tap into the supply of retired servers and other e-waste that still contain immense material value,” said Overture Climate VC Managing Partner, Shomik Dutta. “Molg’s robotic solution not only moves the industry towards circularity; it presents a supply that is cheaper and more domestically secure.”

About Molg

Molg tackles the growing e-waste problem by making manufacturing circular. The company’s robotic microfactory can autonomously disassemble complex electronic products like laptops and servers, helping keep valuable components and materials within supply chains and out of landfills. Molg partners with leading electronics manufacturers to design the next generation of products with reuse in mind, ensuring that one product’s end is another’s beginning. To learn more, visit molg.ai.

About Closed Loop Partners

Closed Loop Partners is at the forefront of building the circular economy. The company is comprised of three key business segments: its investment arm, Closed Loop Capital Management; its innovation center, the Center for the Circular Economy; and its operating group, Closed Loop Builders. Closed Loop Capital Management manages venture capital, buyout private equity and catalytic private credit investment strategies. The firm’s venture capital group, the Closed Loop Ventures Group, has been investing early-stage capital into companies developing breakthrough solutions for the circular economy since 2016. The Closed Loop Ventures Group’s portfolio includes companies developing leading innovations in material science, robotics, agritech, sustainable consumer products and advanced technologies that further the circular economy. Closed Loop Partners is based in New York City and is a registered B Corp. To learn more, visit closedlooppartners.com

About ABB Robotics & Automation Ventures

ABB Robotics & Automation Ventures (ABB RA Ventures) is the business-led strategic venture capital unit of ABB Robotics & Discrete Automation, part of ABB’s corporate venture capital framework: ABB Ventures. Since its formation in 2009, ABB Ventures, formerly known as ABB Technology Ventures (ATV), has invested around $500 million into startups having a close fit to its electrification, robotics, automation, and motion portfolio. For more information, visit www.abb.com/ventures

About Elemental Impact

Elemental Impact is a non-profit investing platform that invests in climate companies and projects with deep local impact. Elemental has a 15-year history of investing in real world solutions that make neighborhoods and homes cleaner, healthier, safer, and more affordable. The investing platform scales climate technologies through a three-tiered approach: deploying catalytic capital, providing project expertise, and prioritizing community partnership. Elemental’s portfolio is active nationwide as well as in more than 100 countries and has raised over $10B in follow-on funding.

About Overture

Overture Climate VC is an early-stage climate tech fund with a focus on helping founders win government support and navigate regulatory complexity. For more information, visit https://www.overture.vc/

Disclaimer:

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

How the Apparel Industry Is Challenging Us to Think Again on Circularity

September 17, 2024

In crowded retail stores, it’s easy to believe that all products on shelves eventually find their forever home in someone’s closet, or at least get re-sold at an off-price retailer at some point. But today’s retail experience––as convenient and on-trend as it is––does not indicate the complexities of operations behind the scenes.

Behind the rapid and improbably simple exchange of products in stores, from cashier to customer (and back, as clothes are often returned), are legacy supply chains struggling to keep up with the speed required of retail today.

The rapid pace of trends and increasing volume of returns are up against slow supply chain timelines and complex logistics. This translates to a lot of excess clothing––most of it ending up in landfill. Textile recycling and recovery systems are also not yet scaled to recover all these items; often, the best case scenario is items like jeans turning into home insulation. They don’t become new jeans again.

The high cost of waste, to both retailers and consumers, has sparked the need for change, but the apparel industry has ebbed and flowed in its transition to circularity. Yet, in the past six months, the tides have been turning. What makes the next decade the time for the industry to rise to the challenge of an urgent waste crisis?

Retailers are hurting––and change is the only option.

The proliferation of style requirements, and long timelines between a brand placing their order and receiving it, have made it increasingly difficult for retailers to purchase only what they need––and to design in ways that minimize overstock and oversupply. The result is anywhere from 12-40% of clothing is unsold at the end of the season[1]. These are clothes that the brands have already paid their manufacturers for and are now taking losses on through liquidation channels. Even when a product does make it to a consumer, it will likely be worn fewer than seven to 10 times before being discarded,[2] a result of increasing consumer demand for the new and novel and manufacturers’ decisions to prioritize lower cost, lower quality construction to bring products to market quicker.

In parallel, return rates are soaring––up to 20-30% of all products purchased.[3] This costs retailers up to $30 per returned item––or even 2/3 the cost of an item––regardless of whether they’re going to be able to sell that product again.[4] This is made more challenging because a large percentage of returns are damaged on their way back to shelves[5]. Those never make it back on shelf to begin with, even if they were efficiently processed and listed for resale. Every year, more than 9 billion pounds of material end up in landfill from consumer returns.[6] It’s no surprise that historically lenient policies for returns are beginning to fade away[7] as retailers wrestle with finding a balance between top quality customer service and operating a profitable business.

As retailers struggle to right the wrongs of legacy business models, circularity could create opportunities to reduce cost and waste together.

Consumers are aware––and want to see change.

The average consumer purchases 53 new items per person per year––U.S. consumers throw away more than 80 pounds of clothes in the same timeframe.[8] Consumers are increasingly engaging with “returnless refund” models, where retailers offer to refund a consumer a purchase and allow them to keep the product to save shipping and processing costs on returns[9] (which make very clear that the ultimate destination should they have returned the product is landfill), and are asked to engage directly with the disposal themselves. Legacy donation-led systems have also come under increased scrutiny, and it’s become clear just how much business-as-usual results in products being shipped overseas or ultimately landfilled.

In parallel, large retailers are promoting resale and takeback channels at unprecedented levels (see Trashie’s recent announcement with Steve Madden for their takeback recycling program), not to mention the mainstreaming of resale through models like ThredUp, The RealReal and others. Rental is also on the rise again, and it’s creating a sense of community, as our portfolio company, By Rotation, has demonstrated.

In other words, consumers want to be a part of the solution.

High profile “failures” are encouraging all of us to think again

Earlier this year, early innovator in textile recycling, Renew:cell, declared bankruptcy[10]––a sobering moment for all of us who work in this industry. The reality is that less than 1% of textiles are recycled into new fibers annually,[11] and while the necessity of textile recovery is widely recognized, it’s been seen as a Sisyphean task by the industry.

The cost to purchase end-of-life materials is often high. This is driven up by competition with cheaper downcycling options that do not require the same level of stringent sorting as more complex molecular processing technologies. Most of those technologies are currently operating sub-scale, with significant upfront capital requirements to grow to a point where they can produce at parity to virgin fibers.

Where is the opportunity? Necessity is the mother of invention and we’ve seen a remarkable evolution in the willingness of brands and institutional investors to support first-of-a-kind facilities supporting next life textile collection, sorting, processing and recycling in the past twelve months. An evolving capital stack is positioning us to help emerging technologies achieve scale more quickly, as more innovators come into the market to focus on lower cost solutions.

More sophisticated capital partners, and a new crop of innovators––let’s do this!

We’re (finally) all in this together.

In short, if you’ve been an innovator working to advance textile circularity, or a brand responsible for reducing waste in your supply chain, the past decade has been challenging. But in the past two years, the narrative has shifted, and we believe the momentum has returned. Brands, consumers and innovators are coming together with urgency––because the problem of textile waste is not just one for the planet. It is an existential threat––and opportunity––for the industry itself.

At Closed Loop Partners, we’re excited to be on the front lines of this transition. We hope you’ll join us.

If you are interested in continuing to engage on this topic, Closed Loop Ventures will be co-hosting a session during New York Climate Week with the Los Angeles Cleantech Incubator. Please reach out if interested in attending at [email protected].

Note from the Author:

I am lucky to have gotten to evolve my thinking on the apparel industry in real time with a host of industry experts over the past few months. Many thanks to the Circularity24 team from Trellis––and my co-panelists from Eileen Fisher, Fillogic, Debrand and Loop, the team at Home Delivery World, innovators in textile design, reverse logistics, and recycling––including CLVG portfolio companies Browzwear, Hyran, Fillogic and so many others for helping to push my thinking.

Disclaimer:

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

[1] Source: https://www.theguardian.com/fashion/2024/jan/18/its-the-industrys-dirty-secret-why-fashions-oversupply-problem-is-an-environmental-disaster

[2] https://stateofmatterapparel.com/blogs/som-blog/10-scary-statistics-about-fast-fashion-the-environment

[3] Source: https://3dlook.ai/content-hub/apparel-return-rates-the-stats-retailers-cannot-ignore/; https://coresight.com/research/the-true-cost-of-apparel-returns-alarming-return-rates-require-loss-minimization-solutions/; https://medium.com/@shaku.tech/the-challenge-of-high-return-rates-in-the-fashion-industry-ab51878d0073

[4] Source: https://www.modernretail.co/operations/the-case-for-and-against-return-fees/; Source: https://www.modernretail.co/operations/the-case-for-and-against-return-fees/; https://www.letsbloom.com/blog/true-cost-of-ecommerce-returns/

[5] Source: https://www.cnn.com/2021/01/30/business/online-shopping-returns-liquidators/index.html; https://www.newyorker.com/magazine/2023/08/21/the-hidden-cost-of-free-returns

[6] Source: https://www.fastcompany.com/90756025/product-returns-are-wasteful-for-companies-and-the-planet-heres-how-to-change-that; https://earth911.com/business-policy/rescuing-product-returns/

[7] Source: https://www.cbsnews.com/sacramento/news/more-retailers-doing-away-with-free-returns/; https://retailwire.com/free-returns-are-starting-to-disappear/

[8] Source: https://fashionunited.com/global-fashion-industry-statistics

[9] Source: https://www.cbsnews.com/news/returnless-refunds-retailers/; https://www.gotrg.com/company/news-events/news/this-is-everything-to-know-about-returnless-refunds-and-keep-it-options

[10] Source: https://www.renewcell.com/en/renewcell-decides-to-file-for-bankruptcy/

[11] Source: https://www.mckinsey.com/industries/retail/our-insights/closing-the-loop-increasing-fashion-circularity-in-california

Why We Invested in Aerflo: Making Reuse an Everyday Norm

September 12, 2024

Photo Credit: Fast Company

At this point, we know that reuse is a critical part of the circular economy. It keeps valuable materials in circulation longer, and is part of an essential suite of solutions that also includes upstream material reduction and downstream recovery solutions.

Over the last decade, the use of reusable water bottles in particular has grown––many of us are familiar with the ubiquitous airport water fountains––but broader options for refill remain somewhat underwhelming. It’s, in a word, still.

Many circular reuse models today are appealing to environmentally driven consumers. While this is a growing demographic, it is still not scaled. The question remains: how do we get reuse into the mainstream? How do we get it to, in a word, sparkle?

To gain mainstream traction and drive a shift, solutions need to be better without compromise. Along with environmental benefits, they need to be more delightful and cost less to the end consumer.

Enter Aerflo. John Thorp and Buzz Wiggins, co-founders of Aerflo, started on this journey as outdoor adventurers frustrated that the beverages they wanted to drink only came in single-use, disposable packaging. Together, they embarked on building a solution that would make it possible to enjoy these beverages without waste and create a user experience that catered to the on-the-go lifestyle––all driven by a circular model.

Demand for sparkling water is on the rise in the U.S., with the market anticipated to grow at a compound annual growth rate of over 12% from 2023 to 2032. Today, we are not only seeing a diversity of options on retail shelves, but also a wave of innovations making it possible for consumers to make their own sparkling water. We have seen the growth of at-home countertop devices, such as Soda Stream and Aarke, and in-office spaces with Bevi, introducing a shift away from single-use packaging. But for consumers who want sparkling water on the go, single use has been the only option.

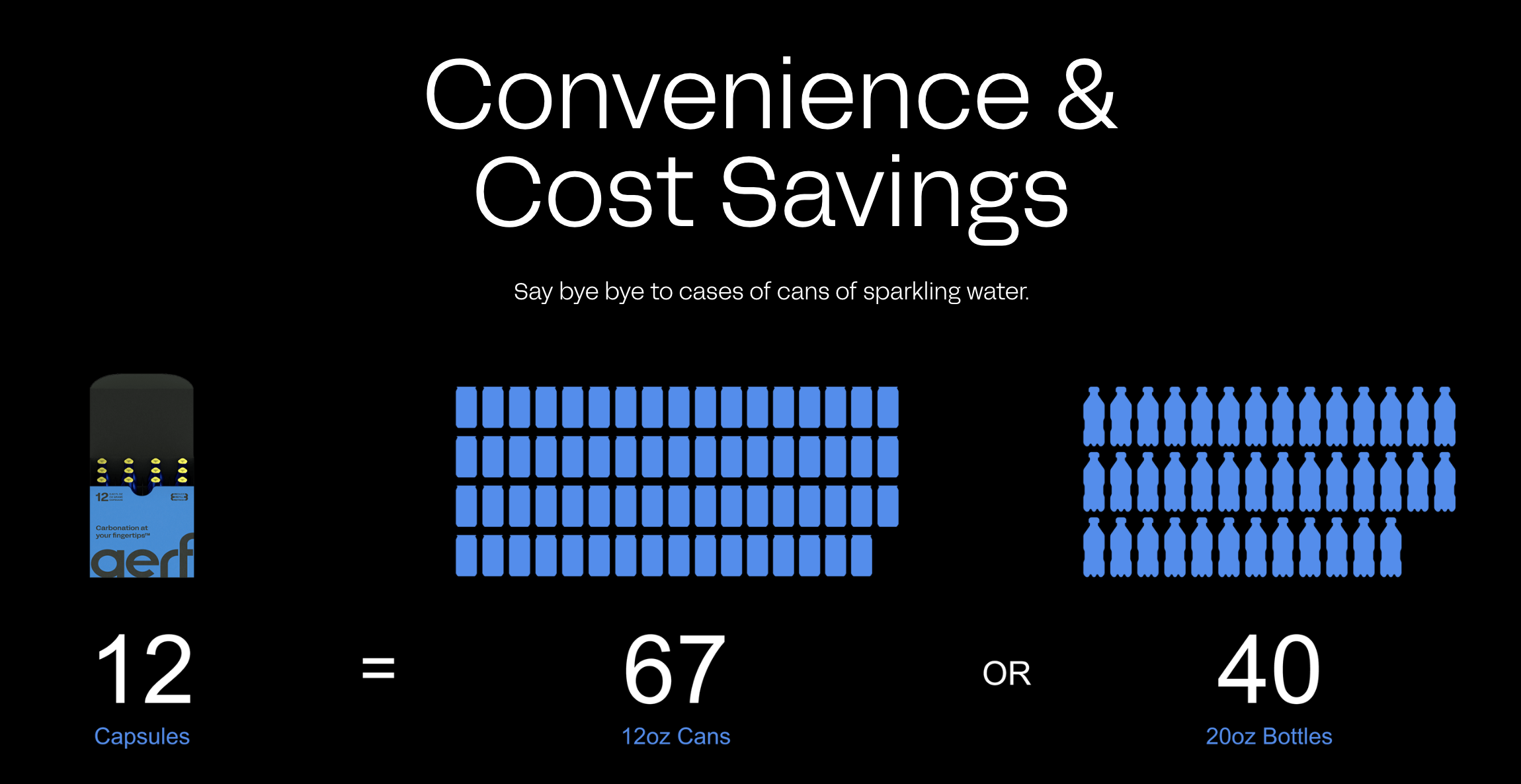

After years of building, John and Buzz launched Aerflo with the first-of-its-kind portable Aerflo Aer1 System that can turn any drinkable water source into refreshing sparkling water with the press of a button. The bottle houses a carbon capsule that can carbonate four full bottles of water. It is designed so that users can see carbonation happen, to gauge how much sparkle to add. The small bubbles mimic those in sparkling water sold in stores, bringing sparkling water to consumers without the need to ship glass bottles or cans filled with water thousands of miles. By inspiring and enabling reuse, Aerflo helps reduce waste and greenhouse gas emissions.

John and Buzz started with the concept of bubbles-on-the-go. How delightful would it be to add bubbles to beverages anywhere in the world, elevating the experience of drinking water, whether someone was on top of a mountain or running through New York City?

Every detail was carefully considered and crafted, ensuring that convenience and taste were not compromised for circularity––a critical factor to the success of reuse.

When capsules are empty, customers ship them back to Aerflo (in the same packaging, and with a return label pre-affixed). This immediately triggers the customer’s next order to be sent––so no subscription is needed. In the company’s fully automated, circular refill facility in New Jersey, the returned Aerflo capsules are cleaned, inspected and refilled before being shipped out to the next customer.

The model is entirely circular. Aside from the clear environmental benefits (each capsule can prevent the need for 330+ cans in its lifetime) this system drives cost savings for customers (60%+ less than single use) and gives the option of still or sparkling at any moment.

Over the past decade, Closed Loop Partners has reviewed hundreds of reuse models through our Closed Loop Ventures Group; we have also tested reuse models in-field and conducted reuse research through our Center for the Circular Economy. And now, Closed Loop Ventures Group is thrilled to announce our investment in Aerflo, a company offering what we believe is a natural choice for on-the-go consumers looking for an elevated experience. Aerflo drinkers don’t need a subscription or commitment and the company offers better value: it is less expensive on a per liter basis than buying carbonated bottled water and offers a more delightful experience to aerate water anywhere, helping make reuse an everyday habit.

About Closed Loop Ventures Group at Closed Loop Partners

Closed Loop Partners has been a leader in the reuse movement for almost a decade. Today, we are actively catalyzing the shift to reuse through our investments and in-market tests––unlocking critical insights and supporting reuse solutions in the field to prepare them for scale. From years of in-field testing and deep research, we have proven that to build successful reuse systems, we need to make reuse a natural choice.

Closed Loop Partners is at the forefront of building the circular economy. The company is comprised of three key business segments: its investment arm, Closed Loop Capital Management; its innovation center, the Center for the Circular Economy; and its operating group, Closed Loop Builders. Closed Loop Capital Management manages venture capital, buyout private equity and catalytic private credit investment strategies. The firm’s venture capital group, the Closed Loop Ventures Group, has been investing early-stage capital into companies developing breakthrough solutions for the circular economy since 2016. The Closed Loop Ventures Group’s portfolio includes companies developing leading innovations in material science, robotics, agritech, sustainable consumer products and advanced technologies that further the circular economy. Closed Loop Partners is based in New York City and is a registered B Corp.

About Aerflo

To learn more, visit https://aerflo.co/.

Disclaimer

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

That’s the Circular Economy: How A Logistics Company Uses Empty Retail Spaces to Fix Supply Chains and Reduce Waste

December 20, 2022

A full logistics center inside a shopping mall––this is how Fillogic infuses agility into supply chains.

The company is at the center of one of today’s most pressing opportunities, as supply chain bottlenecks and logistics challenges elevate the need for streamlined, efficient movement of goods into and out of our homes and businesses. Today’s complex logistics system is coupled with a manufacturing system weighed down by overproduction, opacity and waste. The fashion industry alone has an average 40%[1] overproduction rate. This overloads production facilities and raises costs for brands as they hold unsold inventory for long periods. Eventually, most surplus products are landfilled or destroyed, wasting valuable resources. While legacy supply chains went unquestioned for many decades, their inefficiency has been apparent amidst the bottlenecks of the last two years.

The COVID pandemic accelerated the growth of e-commerce, and in its wake, return rates soared to over 20%[2]. Brittle retail supply chains bogged down by overproduction were unable to handle the spike. Today, if a garment is returned at all, it takes weeks or months until it is available for sale again––if it ever makes it back on shelf at all. This means that unsold and returned inventory can sit in a box for half of the apparel markdown cycle, and when it finally goes back to the retailer for sale, it is often already shopworn and damaged. This says nothing for the excess carbon emissions associated with the transport of that good through the network as returns make their way back to central distribution hubs.

The retail system operates as an omni-channel network and its weakness lies in its silos. If 100 pairs of jeans are shipped, they travel in one direction before branching into different sales channels: wholesale, retailer and e-commerce. These silos are often disconnected and managed by different parties. When items across these three channels are unsold or returned, they end up in consolidation centers mixed with different products. Brands have little to no data on that inventory. Without the backend infrastructure to connect these three channels and consolidate information, a holistic view of managed inventory is impossible––making it similarly challenging to reallocate products into the optimal sales channels. Inventory ends up in holding patterns instead of getting where it needs to go.

Networks, technology and infrastructure need to change quickly, but it’s never been more expensive to do so. Industry is looking for ways to use existing infrastructure more efficiently. That’s where Fillogic comes in.

Breaking Down Silos

Fillogic recognizes that if the same product (for example, a pair of jeans) is allocated across a brand’s wholesale, retail and e-commerce channels, then the three channels should be connected on the backend. That way, outbound, unsold, returned or lightly worn inventory can be reallocated to a channel where it will most likely sell, helping brands reach business goals and meet customers where they are while minimizing inventory idling in warehouses or backed up in transit.

Their technology intercepts unsold garments at the middle mile and redirects them across the appropriate channel. This reduces the need for retailers to markdown in stores to move inventory. Instead, they can resell these products––which are often part of the nearly 40% of inventory that’s sold at discount––at full price or at a slight markup, through a different channel or in a different store, and more quickly than should these items have languished in the existing logistics infrastructure.

To add speed and efficiency, Fillogic operates within existing spaces close to retailers and customers. They repurpose shopping malls and under-utilized retail spaces into local market logistics hubs that connect the retail network. They see opportunity in forgotten spaces: the truck tunnels and elbow joints––bringing value back into overlooked assets rather than building more infrastructure. They optimize existing inventory, both outgoing and returning, to unlock new revenue streams for brands, enable better margins on the sale of unsold items and the resale of returned goods, advancing reuse and meeting customer demand in the process. Ultimately, this keeps valuable products that otherwise could have gone to landfill in the hands of consumers.

Paving the Path for Growth

Closed Loop Partners’ Ventures Group invested in Fillogic in early 2022, recognizing the need for supply chain transparency to increase utilization of goods and keep those materials in circulation. According to the Circularity Gap report, 70% of greenhouse gas emissions are related to material production and use, bringing the circular economy, and increasing utilization rates of manufactured products to the center of climate conversations. Advancing more circular supply chains plays a key role in increasing resource efficiency and resiliency to bring products to market while limiting waste.

As more retailers cross geographic boundaries, Fillogic faces growth opportunities in North America and beyond. Bill Thayer, Founder and CEO of Fillogic, is developing retail partnerships alongside a close-knit team, many of whom have had long careers in logistics, store operations, ecommerce and technology. In Bill’s words, “[Other players have] spent hundreds of billions of dollars building logistic networks. At Fillogic, we feel that network already exists. By connecting [those sites] with technology, operations and infrastructure, we can use under-utilized infrastructure more efficiently…operating as nodes on existing supply chains and making that middle mile more efficient.” Fillogic’s technology platform connects these heavily siloed, disparate systems, a hub network that uses underutilized spaces, and a delivery marketplace that connects those two assets. Together, all three assets create an affordable, efficient, cost-effective and sustainable network using existing infrastructure where people live, buy new clothes and make returns.

Ultimately, Fillogic is helping to increase the resale and recapture of consumer goods. By doing this, Fillogic is optimizing existing processes––reducing costs, timelines and the percentage of excess or unsold inventory. This is a win for both financial officers and sustainability managers––and that’s the circular economy.

[1] https://www.voguebusiness.com/sustainability/fashion-waste-problem-fabrics-deadstock-pashko-burberry-reformation

[2] https://www.cnbc.com/2022/01/25/retailers-average-return-rate-jumps-to-16point6percent-as-online-sales-grow-.html

Disclaimer:

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

Climate

Why Water Needs To Be Part of Circular Economy Investments

October 13, 2022

Amidst a climate crisis and high wastewater treatment costs, water reuse technologies are key to keeping one of the most valuable commodities in circulation

The circular economy is the most significant restructuring of global commerce and supply chains since the industrial revolution. The goal? To produce, consume and manage resources so that valuable materials do not go to waste, and damage communities and ecosystems. Since its founding, Closed Loop Partners has made progress to reach this goal across plastics & packaging, organics, textiles and electronics. However, driven by a range of compounding factors, we are at a point where we need to go deeper, and expand this list of materials to include one that is arguably one of the most valuable: water.

Water is fundamental not only in terms of consumption––human beings cannot survive more than three days without drinking water––but clean water is also essential to production. Most of the groundwater we pump is used by farmers to irrigate agricultural land and industries to manufacture the goods we consume. But with the rates of production and consumption fueling today’s linear economy, wastewater treatment is more important than ever. Groundwater is pumped out of aquifers faster than it can be naturally replenished. Increasing frequency and severity of extreme weather events also mean that long periods of drought are exacerbating already diminishing amounts of water, while periods of excessive rainfall are overwhelming the absorption capacity of soil and water treatment infrastructure, causing overflows in sewage and stormwater systems and massive amounts of consequent damage to ecosystems and infrastructure.

Insufficient supplies of water could reduce production capacity for businesses by 44%, disrupting the availability of essential resources like energy, clothing and food and resulting in millions of dollars’ worth of stranded assets. Earlier this year, droughts in Mexico drove a shortage of chili peppers, threatening the production of Sriracha around the world. Sriracha could just be the tip of the iceberg. Droughts are also exacerbating shortages of staple crops like cotton, wheat and corn, which could drive price increases. On the other hand, increasingly frequent deluges of water threaten the systems our societies run on. For example, the recent floods in Pakistan have already resulted in damages reportedly worth over US$10 billion, affecting millions of people and breaking and overwhelming key infrastructure. Overall, according to a CDP report, 69% of publicly listed companies around the world stated that they are exposed to water risks that could generate a substantive change in their business, with the potential value at risk topping out at US$225 billion.

Consumption patterns coupled with climate change are stressing our water sources and systems, threatening the continuity of those very consumption patterns. Amidst this, the diamond-water paradox is glaring––the availability of water directly affects the longevity and quality of our life yet has been one of the most mispriced assets. While water’s historical undervaluation has made investing in it notoriously difficult, we are now seeing market signals that water pricing and value are changing, and this is creating an opportunity for investors.

A sea change in water investing

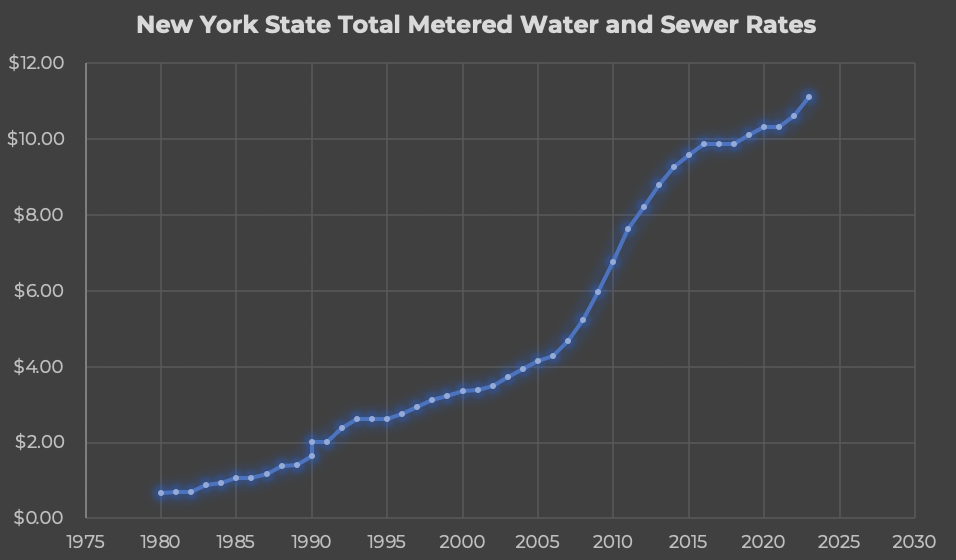

Wastewater treatment has largely improved over the years, driving up water-associated costs in much of the U.S. and Europe. In New York, alone, the price of water and sewer have both increased nearly 5% YoY, and increased over 26% over the last 10 years (over 2x the rate of inflation).

Source: New York City Water Board Rate History Data

The cost to transport heavy wastewater to water treatment facilities, and then transport the leftover sludge to landfill, ensures that operational costs stay high. Sending wastewater sludge to landfills also opens up new environmental and social risks––unleashing a slew of hormones and chemicals from agricultural and industrial waste into the soil. More capacity is needed at treatment plants, but building new water infrastructure requires significant costs: land, new pipes and labor. As it stands, it is more expensive for customers to get rid of water than to buy it. In fact, for anyone hooked up to a municipal water treatment plant, that is often the case. Water disposal in New York City is 159% more expensive than supply (and has been for the last 30 years).

Despite rising costs to treat water, businesses are faced with numerous pressures to keep used water in circulation. Growing policy––including the EPA’s new regulation that holds polluters accountable for cleaning up PFAS contamination, as well as a new plan that reduces water releases from Lake Powell––is raising accountability standards. Industry collaborations––such as Ceres’ Valuing Water Finance Initiative (VWFI), which engages 72 companies with a high water footprint to value and act on water as a financial risk and drive the necessary large-scale change to better protect water systems, and the UN Water Resilience Coalition, a CEO-led initiative committed to reducing water stress by 2050––are driving broader market attention. Water-related public health crises around the U.S.––in Jackson, Las Vegas, Baltimore, Flint and New York––are pushing additional attention onto expanding potable water sources and addressing outdated water infrastructure. With all these forces at play for industries that output water, investing in water management can reduce waste management costs, and provide a consistent and reliable water input stream. If companies can recycle water back into the system and reuse it as an input, they can reduce costs and relieve municipalities of capacity challenges.

A groundswell of new innovations

Across the board, alternative water sources are increasingly interesting––and importantly, increasingly viable from an investment perspective. This includes on-site generation of water, such as SOURCE Water’s technology to produce potable water from sunlight and surrounding air. This also includes on-site filtration technologies that could create potable, grey or functional water, depending on the end user.

Most recently, Closed Loop Partners’ Ventures Group invested in Accelerated Filtration, a water filtration company based in Midland, Michigan that develops industrial water filtration technologies. The company’s technology helps address the pain point of industrial customers, delivering packaged turn-key filtration solutions for the consistent removal of fine suspended solids in variable water streams.

As investable opportunities in the water space continue to grow, Closed Loop Partners’ Ventures Group continues to watch investment opportunities in water filtration technologies that could provide a strong return on investment to commercial and industrial customers, and allow for water reuse. As water becomes increasingly scarce and increasingly valuable, we look forward to seeing the evolution of the space, and championing the integration of water as one of the most important materials to keep within a circular economy.

Interested in learning more about work to keep key materials in circulation? Visit Closed Loop Partners’ website here.

Closed Loop Partners’ Venture Capital Group Raises $50+ Million Fund II to Scale Breakthrough Circular Economy Solutions

December 13, 2021

Fund II surpasses fundraising targets & extends Closed Loop Partners’ first venture fund strategy across sectors to build circular supply chains

NEW YORK, Dec. 13, 2021 — Closed Loop Partners’ venture capital group––the Closed Loop Ventures Group––announced the successful close of its second fund, surpassing its $50 million target to scale breakthrough circular economy solutions across plastics & packaging, fashion, food & agriculture, and supply chain technology. The firm continues its pioneering position as a dedicated circular economy-focused capital provider, investing in sustainable and profitable solutions that reduce waste, increase operational and material efficiency, and protect the planet.

Closed Loop Partners’ second venture capital fund, Closed Loop Venture Fund II, is driven by the success of its Fund I. The strategy of both funds capitalizes on the growing need to shift away from inefficient, linear and extractive supply chains and toward healthier, waste-free circular systems. The Closed Loop Venture Fund II is strategically positioned within the firm’s broader ecosystem that includes growth equity, private equity and project-based finance, as well as the Center for the Circular Economy. The Ventures Group benefits from a broad range of investors including multinational corporations like Microsoft and GS Group, foundations like the Autodesk Foundation, and single and multi-family offices from across the United States, Asia and Israel.

“At Microsoft, we’re advancing a more sustainable and resilient way of producing and consuming products and services. The breakthrough solutions that the Closed Loop Ventures Group invests in help pave the way toward a more circular future, one that aligns with our vision of a zero waste world,” says Brandon Middaugh of Microsoft’s Climate Innovation Fund, an investor in Closed Loop Partners’ funds. “Our investment in the Ventures Group’s Fund II is a key part of our efforts toward our 2030 zero waste goals, driven by the innovators and emerging companies that help make this possible.”

“Venture capital plays a key role in accelerating the circular economy, seeding the next generation of solutions to overcome legacy take-make-waste systems, encourage innovation and help transformative companies scale,” says Taehong Huh, Managing Director of GS Futures, corporate venture arm of GS Group of Korea. “The Closed Loop Ventures Group is blazing a trail for some of the most innovative circular solutions in the market today, and we are proud to be investors in the Closed Loop Venture Fund II––supporting companies that advance the circular shift of our economic system.”

“The need for solutions that advance the circular economy is coming into focus, and investment is key to scaling their impact. Closed Loop Partners’ venture capital team continues to be at the forefront of this work, supporting founders and businesses that are transforming our systems and supply chains for the better,” says Jennifer Kenning, CEO and Co-founder of Align Impact. “Our partnership with the Closed Loop Ventures Group is mission-critical to our work, advancing investments that have massive positive outcomes for people and our planet.”

“Our support of Closed Loop Partners’ venture funds has been a key part of our work to transition our markets to a full circular economy model by investing in the technologies and solutions that overcome barriers to change,” says Joe Speicher, Executive Director of the Autodesk Foundation and Head of Sustainability at Autodesk. As the philanthropic arm of Autodesk Inc., the Autodesk Foundation was an investor in Closed Loop Partners’ first and second venture funds. “We are proud to have been an early investor of the Closed Loop Ventures Group and are doubling down on our commitment to help scale the emerging design and manufacturing approaches that make end to end circularity possible.”

Led by Danielle Joseph, Managing Director at Closed Loop Partners, Closed Loop Ventures Group demonstrates that builder capital with a hands-on, active approach to building the Circular Economy is what many of the most ambitious entrepreneurs are seeking. The dedicated team brings a combined skill set of entrepreneurial, operating and investing expertise. “Closed Loop Ventures Group enables Closed Loop Partners to activate the most innovative solutions emerging in the circular economy and provide those solutions the full support of the Closed Loop Partners network,” says Ron Gonen, Founder and CEO of Closed Loop Partners.

“The Closed Loop Partners team is unique in the venture capital space, proactively bringing to the table their extensive operating experience, network, and strategic expertise on the circular economy,” says Rich Mokuolu, Co-founder & CEO of Partsimony. “We are proud to be among the first portfolio companies of Closed Loop Venture Fund II and we look forward to the continued growth spurred by their investment, as we expand Partsimony’s reach to build more intelligent, resilient, and local supply chains.”

To date, the Closed Loop Venture Fund II has invested in solutions including Partsimony, ucrop.it and dimpora––investments that span supply chain technology, food & agriculture and fashion. Partsimony‘s SaaS network unifies disparate data to help product designers manufacture more locally and with more sustainable materials. ucrop.it operates a collaborative traceability platform that connects farmers to stakeholders across the agriculture value chain, incentivizing supply chain transparency, best agricultural practices and greater value sharing to advance sustainable agriculture on a global scale. dimpora develops sustainable and PFC-free non-harmful membranes to waterproof clothing, to reduce waste and chemicals from apparel production.

“The successful raise of Closed Loop Partners’ second venture fund signals the increasing understanding that circular supply chains represent the future of industry and materials. We are seeing more founders building businesses in the circular economy, and a growing need for early-stage capital,” says Danielle Joseph, Managing Director of the Closed Loop Ventures Group at Closed Loop Partners. “We look forward to collaborating with the broader venture capital community, fostering transparency and open insight sharing to advance breakthrough innovations.”

Across its investments, the Closed Loop Ventures Group sees transparency and digitization as critical tools in building the supply chains of the future, and will continue to support cutting-edge innovations that reimagine and redesign current systems, driven by data and scientific input. They are focused on furthering localized and distributed manufacturing to build resiliency, and accelerating recovery & reuse to reduce a reliance on volatile commodity prices tied to limited virgin resources. Building on its robust thought leadership, the venture capital team at Closed Loop Partners continues to develop its theses on where they want to see additional investment activity and other smart investors participating in the space, including around markets that are misunderstood in traditional venture capital investing––such as biopolymers as plastic alternatives and evolving molecular recycling technologies.

About the Closed Loop Ventures Group at Closed Loop Partners

Closed Loop Partners’ venture capital arm launched in 2017 with one of the first venture funds dedicated solely to investing in early-stage companies developing breakthrough solutions for the circular economy. The Closed Loop Ventures Group targets leading innovations in material science, robotics, agritech, sustainable consumer products and advanced technologies that further the circular economy.

The Closed Loop Venture Fund II builds on the venture capital group’s first fund’s strategy, supported by an existing portfolio with strong financial performance, coupled with robust environmental and social impact. HomeBiogas, one of the early investments of the Closed Loop Venture Fund I is a leader in developing biogas systems that transform organic waste into clean energy and bio-fertilizer. They announced their $94 million initial public offering (IPO) in Israel in 2021, accelerating the company’s growth into additional markets, including North America. To date, the company has sold over 10,000 systems in more than 100 countries. Algramo, another investment of Fund I, developed a reuse system powered by vending machines that dispense household products into smart reusable packaging. With the investment and support of Closed Loop Partners, the Chile-based company expanded into North America, now piloting their reuse systems in New York City, while also having piloted with leading brands such as Walmart and Unilever in other geographies. Learn more about the Closed Loop Ventures Group here.

About Closed Loop Partners

Closed Loop Partners is a New York-based investment firm comprised of venture capital, growth equity, private equity, project-based finance, and an innovation center focused on building the circular economy. Investors include many of the world’s largest consumer goods companies and family offices interested in investments that provide strong financial returns and tangible impact. Learn more at www.closedlooppartners.com.

Autodesk, the Autodesk logo, and Autodesk Foundation are registered trademarks or trademarks of Autodesk, Inc., and/or its subsidiaries and/or affiliates in the USA and/or other countries. Autodesk reserves the right to alter product and services offerings, and specifications and pricing at any time without notice, and is not responsible for typographical or graphical errors that may appear in this document.

Circular Supply Chains Need Intelligent and Distributed Manufacturer Networks

November 22, 2021

Gone are the fleeting days of component parts showing up just in time for production from an unknown combination of suppliers. After pioneering the just-in-time supply chain, Toyota responded to the Fukushima disaster by stockpiling critical components — such as semiconductor chips — with enough supply for months at a time. That was a decade ago.

Now, Toyota may be doing better than its competitors while a global chip shortage costs the automotive industry upwards of $110 billion in car sales. However, more industries are recognizing the limitations of a just-in-time strategy applied broadly to every component part and raw material across globalized supply chains.

As unforeseen disruptions increase — whether the COVID-19 pandemic or climate-related natural disasters — and as more products demand critical, limited resources, intense fluctuations in demand, labor shortages, inadequate equipment and physically damaged facilities contribute to an instability of manufacturing capacity. Underdeveloped manufacturing capacity leaves industries exposed to risk, price volatility, market dislocations and lost value.

Unfortunately, first-mile stakeholders in the supply chain are often most at risk of losing value in the face of disruptions. For example, demand for lumber sharply increased when homeowners sought to remodel and build new houses during the COVID-19 pandemic. Meanwhile, U.S. sawmills (largely Canadian-owned) had to shut down over 40 percent of their capacity during this same time period. Yet forestry growers — producing timber that becomes lumber — suffered in a buyer’s market and saw prices for timber remain low: When adjusted for inflation, timber prices are at their lowest over the past 50 years.

While the market has since recalibrated and the lumber bubble may be just one instance in which supply was ill-prepared to manage demand, the whole of today’s U.S. manufacturing is just 11 percent of GDP — near its lowest in over 70 years. Underdeveloped manufacturing capabilities from generations of regional specialization pose significant risk to meeting demand and climate goals. U.S. Secretary of Energy, Jennifer Granholm recently wrote: “We have weak domestic supply chains for technologies critical to our economic and national security… China is the only country with control over every tier of the supply chain for critical materials like the lithium we need for vehicle batteries, including 80 percent of raw material refining capacity… Other countries, especially China, produced 85 percent of transformers for our electric grid — while America still produces almost none.”

The automotive, energy and tech industries must contend with critical rare earth metal supply chains needed for everything from batteries to solar panels. These products are reliant on limited resources, often harmfully extracted from biodiverse regions fraught with social inequities. The ability to (re)manufacture and recycle these raw materials efficiently and locally is critical to business continuity in an increasingly resource-constrained world.

The time is now: Advances in automation and machine learning, rising pay globally and increasing risk from supply chain disruptions suggest that onshoring manufacturing is increasingly attractive to many product producers. Against this backdrop, what do resilient and circular supply chains look like? Supply chain managers are finding the right instances to:

- Create visibility into manufacturing supply chains to better prepare for and manage risk

- Produce with distributed, more regionally resilient supply networks

- Source feedstocks locally and from more available recycled content

Smart entrepreneurs are seizing the moment to build more resilient, circular supply chains. Partsimony, a company dedicated to building cognitive supply chains and increasing efficiencies, closed a $2 million seed round led by Closed Loop Partners’ Ventures Group with participation from Contour Ventures, Urban Us and other top institutional and angel investors. Partsimony applies machine learning to build a predictive and dynamic manufacturing market network, helping solve for the manufacturer discovery and price quoting process for complex hardware companies — which can be an opaque, manual and excel-based process today for both the hardware company and the manufacturer. Partsimony provides hardware companies with a better, real-time understanding of their manufacturers’ capabilities and pricing, helping them iterate and commercialize products faster and with increasingly distributed supply chains. Partsimony also supports the manufacturer by serving as a qualified lead generation platform to acquire customers whose products match technical capacity (production methods and volumes) and help manufacturers maximize margin.

Partsimony’s platform demonstrates how increased transparency and intelligence across supply chains can ultimately benefit business, people and the planet through three core activities:

Digitizing supplier relationships creates transparency

When supply chain disruptions happen, hardware companies need better control over their production and transparency into their suppliers to adapt quickly. Case in point: Toyota knew to safeguard its chip supply because of the company’s “no black box” approach, only adopting technologies it truly understands, down to the gases and the metals of each component. This supply chain visibility — down to the material level — is a critical driver of resiliency, and we invested in Partsimony because its platform helps enable this kind of visibility.

Distributed manufacturing supply chains shorten lead times

Adopting a distributed manufacturer network of on-shore manufacturing within existing off-shore manufacturing supply chain networks is increasingly becoming a competitive advantage. This is not about an America-first dogma; on-shoring of manufacturing helps regionalize the production for any supply chain. Doing so shortens lead times and helps diversify the supplier base. Distributed manufacturer networks are primarily about developing resilient and sustainable business practices, with the added benefit of reducing emissions associated with the international transportation of raw materials and finished component parts. Working with customers such as Stanley Black & Decker, Partsimony has demonstrated 96 percent cost reductions and 83 percent lead time reductions.

Data-driven recommendations can leverage engineering insights and incentivize use of recycled content

Design and material selection have an outsized impact on the circular impact of products. A poorly designed product may choose hard-to-recycle and fossil fuel-based materials in formats where the materials are intermingled and difficult to separate for recovery — a product William McDonough would call a “monstrous hybrid.” Now, Partsimony’s AI supports hardware companies in testing novel, more sustainable materials and alternative manufacturing methods in products from the very first point of design. Engineers upload their digital designs or CAD files to the platform, and Partsimony is building its AI to read the structural requirements of the component part and potentially recommend materials from recycled content, as well as alternative manufacturing solutions.

Digital visibility, distributed manufacturer networks and data-driven infrastructures are the circular antidotes to today’s analog and fragile supply chains. The COVID-19 pandemic is not the first black-swan event within this century, and it most certainly will not be the last. Climate-related disasters will continue to upset business-as-usual, just-in-time production and manufacturing. If we want to design more circular products with more socially equitable access, we must also capitalize on the supply chain disruptions in front of us to redesign our supply chain to be more resilient and more circular.

Originally published in GreenBiz

Partsimony Closes $2M Seed Round to Help Organizations Build Intelligent Manufacturing Supply Chains

October 28, 2021

Closed Loop Partners, a circular economy-focused investment firm, leads the round

New York, NY – 8:00 AM EST, October 28, 2021 – Partsimony is pleased to announce the successful close of a $2M Seed round, led by Closed Loop Partners’ Ventures Group with participation from Contour Ventures, Urban Us, and other top institutional and angel investors. Partsimony is a SaaS network that unifies disparate data from multiple sources to more efficiently manage hardware from prototype through production, bringing superior intelligence to manufacturing supply chains.