First-of-Its-Kind Study by the Composting Consortium Analyzes Contamination Rates Across U.S. Composting Facilities

February 28, 2024

Commonly held assumptions about contamination were put to the test, revealing new data on the realities of contamination at composting facilities.

February 28, 2024, New York, NY — Today, the Composting Consortium, an industry collaboration led by the Center for the Circular Economy at Closed Loop Partners, released an unprecedented report on compost contamination, Don’t Spoil the Soil: The Challenge of Contamination at Composting Sites. The report reveals first-of-its-kind data on the amount of contamination at U.S. composting facilities, and the significant cost to manage it. Working with composters across the U.S., the Consortium’s in-field study quantifies contamination rates in feedstock and finished compost, highlighting a need for policy, innovation and packaging design to help composters improve contamination mitigation and strengthen organics recovery processes.

The report is released at a critical time for the composting industry, as pressure increases around the growing food waste crisis in the U.S. Today, nearly 40% of food is wasted and sent to landfill in the U.S.––at a loss of $430 billion––and only about 4% of all post-consumer food waste generated by Americans is sent to composters. Organics collection and infrastructure is one key solution to the crisis. To meet growing demand, the U.S. composting industry is shifting. While most composting facilities in the U.S. still only process yard trimmings, curbside organics collection has surged by 49% since 2021. Composter feedstock acceptance policies are also slowly shifting to match demand, with approximately 145 full-scale compost facilities in the U.S. now accepting food waste and some forms of food-contact compostable packaging—that packaging can be a key vessel for diverting food waste to compost, if recovered at composting facilities.

There is eagerness among compost manufacturers to be a part of the food waste solution, but concerns about contamination risks in the organics stream continue to be the one of biggest barriers to greater acceptance of food waste and food-contact compostable packaging. Concerns are increasing amidst the growing volume of compostable packaging in the U.S., largely due to look-alike, non-compostable packaging inadvertently entering the composting stream due to unclear labeling and confusion among consumers. This creates operational and financial challenges for haulers and composters, hindering further acceptance of food waste across the country.

Before the Composting Consortium released this report, there was little to no publicly available data on the amount and types of contamination in feedstock or finished compost products, or the time and money spent by composters to manage contamination at their facilities. To support the composting industry in its transition to accept food waste and food-contact compostable packaging, the Composting Consortium set out to address this data gap by conducting a first-of-its-kind study with 10 leading composters of varying sizes across the continental U.S., capturing a geographically and operationally diverse dataset on contamination volumes and decontamination practices.

The study measures and characterizes contamination across different points of the composters’ processes––and analyzes the financial cost to composters to handle contamination. The study examines five commonly held assumptions about contamination and compostable packaging, and breaks down in-field realities in a data-backed and easy-to-follow format. Key findings include:

- Conventional plastic is the most common contaminant received by composters, making up an average of 85% of the contamination that composters receive, by volume;

- Despite diligent efforts to combat contamination, conventional plastic can persist in the finished compost; 4 out of 10 composters in the study had trace amounts of conventional flexible plastic in their finished compost;

- Contamination has a significant impact on the bottom line; on average, 21% of composter operating costs are spent on contamination removal;

- Most composters had contamination, irrespective of whether or not they accept compostable packaging; several factors contribute to the levels of contamination that a facility receives;

- Eight out of nine composters who accept compostable products in the study had no detectable amounts of compostable packaging in their finished compost.

The data confirms the pervasiveness of plastic contamination, and the need to further mitigate this challenge, both upstream and downstream in the composting value chain. It also highlights that more consistent and standardized compostable packaging design and labeling is needed to ensure that certified, food-contact packaging is properly sorted and recovered at end of life. In the same vein, non-compostable packaging should be distinct in its design and labeling to reduce the risk of conventional plastic packaging making its way into the organics stream. Composters must be supported and incentivized to accept food and certified food-contact compostable packaging, to ensure these materials drive value and circular outcomes to the composting industry.

“Addressing contamination is critical to paving the way for broader organics recovery as a key solution to the food waste crisis in the U.S.,” says Kate Daly, Managing Director of the Center for the Circular Economy at Closed Loop Partners. “The Composting Consortium’s findings shed light on the significant opportunities––and challenging realities––of composting in the U.S. today. This study lays the groundwork for future research and investment to scale end-of-life solutions for food and food-contact compostable packaging to drive circular outcomes.”

This study is an important snapshot of a pervasive challenge that affects the compost industry. This work represents the Composting Consortium’s continued efforts to break siloes and bring together the key stakeholders––upstream, midstream and downstream––to remove barriers and advance a circular economy for organics and compostable packaging. Addressing contamination requires enhancing transparency, intensifying educational efforts and championing innovation. Additional research and collaboration across the entire composting and compostable packaging ecosystem can help pave the way for a circular future, turning food waste into a valuable resource and relieving composters from the burden of contamination.

About the Composting Consortium

The Composting Consortium is a multi-year collaboration to pilot industry-wide solutions and build a roadmap for investment in technologies and infrastructure that enable the recovery of compostable food packaging and food scraps. The Composting Consortium is managed by Closed Loop Partners’ Center for the Circular Economy. PepsiCo and the NextGen Consortium are founding partners of the Consortium. Colgate-Palmolive; Community Impact at Danaher; Eastman; The Kraft Heinz Company; Mars, Incorporated; and Target Corporation joined as supporting partners, and the Biodegradable Products Institute, the US Composting Council and the U.S. Plastics Pact joined as industry partners. Our compost partners for the Contamination Pilot include Ag Choice, Atlas Organics, Black Earth Compost, Dirt Hugger, The Food Bank at Dayton, Happy Trash Can Compost, Napa Recycling, Specialized Environmental Technologies (SET), Veteran Compost, and Windham Solid Waste Management District. Our advisory partners include 5 Gyres, Foodservice Packaging Institute (FPI), ReFED, Compost Research and Education Foundation (CREF), the Sustainable Packaging Coalition (SPC), Compost Manufacturers Alliance (CMA), Eco-Cycle, University College London (UCL), Western Michigan University (WMU), University of Wisconsin-Stevens Point and World Wildlife Fund (WWF). Learn more about the Consortium at closedlooppartners.com/composting-consortium/

About the Center for the Circular Economy at Closed Loop Partners

The Center for the Circular Economy (‘the Center’) is the innovation arm of Closed Loop Partners, a leading circular economy-focused investment firm in the U.S. The Center executes research and analytics, unites organizations to tackle complex material challenges and implement systemic change that advances the circular economy. The Center for the Circular Economy’s expertise spans circularity across the full lifecycle of materials, connecting upstream innovation to downstream recovery infrastructure and end markets.

Many Americans Don’t Understand What to Do with Compostable Packaging. Here’s a Solution.

February 20, 2024

As countries and corporations get one year closer to their own deadlines for meeting major climate targets, there are some important pathways to emissions reduction that cannot be ignored. Food waste mitigation is one of them.

Roughly one-third of the world’s food is wasted each year––a loss estimated at $230 billion. Nearly 60% of the uncontrolled methane emissions from municipal landfills are caused by discarded food, highlighting its significant impact on the environment. To address the urgent food waste and climate challenge, demand for organics circularity is rising, and with it, the volume of food-contact compostable packaging––a market poised to grow 16% annually in the U.S. until 2032, 4x faster than traditional plastic packaging.

Certified, food-contact compostable packaging can enable the diversion of food waste from landfill and support a circular economy. If food packaging filled with food scraps is properly recovered and sent to composting facilities, then this food wouldn’t end up emitting greenhouse gases in landfills. The food and packaging would also be converted into nutrient-rich compost. But if certified compostable packaging is not appropriately collected and processed into compost after it’s used, more waste is created.

We often hear that there is a lack of recovery infrastructure for compostable materials. The reality is, U.S. composting infrastructure is in the middle of transitioning from processing just yard waste to accepting more types of inputs, including post-consumer food waste and food-contact compostable packaging. Today, 70% of the 200 full-scale composting facilities that process food waste already accept and process some forms of compostable packaging. Plus, 15 million Americans have access to organics collection, a dramatic 49% increase in access since BioCycle’s last survey in 2021.

For food-contact compostable packaging to be successful in the market today, labeling and design need to be aligned so that consumers throw packaging in the right bin, and composters can easily process these materials. Yet, data shows that some labels confuse consumers, who mistake packaging as compostable when it’s not, or misunderstand where to dispose of that packaging at the end of its use.

Without policies that drive clear, standardized labels and instructions on where compostable packaging needs to go after it’s used, a lot of it ends up in landfills or contaminating recycling streams. Conversely, non-compostable look-alike products and packaging can make their way to compost facilities where they end up contaminating the soil. These look-alikes are the primary contamination challenge in the organics stream.

To address this challenge, the Composting Consortium, led by the Center for the Circular Economy at Closed Loop Partners, and the Biodegradable Products Institute (BPI) embarked on a joint study to test different packaging label and design approaches, and how these inform consumers’ assumptions on what to do with compostable packaging after it’s been used. The findings can inform policies that better support labeling practices and standards for both compostable and non-compostable packaging. In the U.S. today, five states have compostable packaging labeling laws, including Washington, California, Colorado, Minnesota and Maryland. Other states, like Virginia and New Jersey, recently introduced laws that would establish recycling labeling requirements.

Until this study, this information on American consumers had not been publicly available. The Composting Consortium and BPI released the findings in a first-of-its-kind industry report. Here’s a snapshot of what the data reveals:

- Nearly 1/3 of respondents say they would place compostable packaging in the recycling bin

Compostable packaging is not designed to be recycled at a material recovery facility (MRF) and can contaminate the recycling stream if intermixed with fossil fuel-based plastics. Compostable packaging that mistakenly ends up in recycling streams loses a significant portion of its value and creates a contamination challenge that impedes the recovery of valuable recyclable materials. Cross-contamination of the recycling and composting streams is an expensive operational challenge and would pose significant risk to both industries. Brands that have set ambitious sustainable packaging goals are also impacted by inadequate collection and processing of these materials.

Our recommendation: Brands and municipalities should work together on educational campaigns and clear, on-pack messaging.

- Up to 50% of respondents say they would place packaging labeled as “made from plants” in the composting bin

“Made from plants” describes the materials used to make the packaging, not where the package should go at the end of its use. In fact, “made from plants” claims are commonly found on plastic packaging that should be recycled (i.e. PET made from ethanol derived from corn). Our study found that American consumers are especially confused by products and packaging that are not actually compostable yet have green or natural coloring, green tinting, or make claims such as “made from plants” without any context or disclaimer language. These plastic, non-compostable materials are virtually indistinguishable from their compostable counterparts.

Our recommendation: Brands and policymakers should support labeling policies that standardize clear, consistent consumer communications, design and labeling.

Source: Alamy

- Adding a trusted certification logo and larger “compostable” call out increases consumers’ ability to identify packaging as compostable by up to 22%

Our study finds that using at least two to three design elements that call out compostability on food-contact compostable packaging, such as the BPI certification mark, the intentional use of tinting and coloring, and a more prominent “compostable” call out, is most effective for consumer understanding.

Our recommendation: Brands and manufacturers should refer to the Composting Consortium’s latest report and BPI’s Industry Labeling Guidelines for specific examples of packaging design strategies that improve consumer identification, increase recovery of compostable materials and mitigate contamination at facilities.

Coming this month: A new report from the Composting Consortium on contamination rates at different composting facilities! Sign up for a webinar to learn about our findings here!

Without standardized labeling, misleading designs and claims will continue to cause consumer confusion. This research provides insights to brands, manufacturers, consumers, policymakers, municipalities, composters and other stakeholders on effective design and labeling techniques that could improve the diversion of food-contact compostable packaging to the right material stream. While these new findings shed light on the issue, this is just the beginning. As the composting space rapidly evolves, complementary studies will be critical to advancing the recovery of compostable packaging––a critical path to reducing food waste and greenhouse gas emissions.

Learn more about these findings in the latest report from the Composting Consortium and BPI here: https://www.closedlooppartners.com/research/us-consumer-perception-of-compostable-packaging/.

Circular Services Acquires Midwest Fiber Recycling, Expanding Services for Communities in the U.S.

December 18, 2023

The acquisition of a leading Midwest recycling company expands Circular Services’ holistic materials management services to support more communities and companies across the U.S.

December 18, 2023, New York, NY – Circular Services, a leading developer and operator of circular economy infrastructure in the U.S., announced its acquisition of Midwest Fiber Recycling, growing the portfolio of materials recovery facilities under Circular Services’ recycling arm, Balcones Recycling. This marks Circular Services’ expansion into the Midwest of the U.S., to support existing recycling infrastructure and services in the region and increase the recovery of valuable materials into domestic supply chains.

Midwest Fiber began in 1990 when founders Ron and Linda Shumaker purchased the Decatur Recycle Paper Company. Since then, with sons Mike and Todd Shumaker, they have grown the company into one of the largest recycling operations in the Midwest, with facilities in Decatur, Normal, Urbana and Peroria, IL and Terre Haute, IN. Today, Midwest Fiber services residential single-stream and commercial properties via a dedicated collection fleet. In addition, Midwest Fiber provides document destruction and recycling services and has a recycled material brokerage arm that helps generators maximize value by marketing directly to end-users. Following the acquisition, Midwest Fiber’s management team will continue to run the company, partnering with the Circular Services team and leveraging its broader platform to continue its growth trajectory.

“Todd and I waited to find the right partner,” said Mike Shumaker, CEO of Midwest Fiber Recycling. “The singular focus of Circular Services and Balcones Recycling on advancing robust circular materials management, as well as their longstanding experience operating recycling infrastructure, made them a great fit. We look forward to working alongside their team, and leading our family business into the next chapter.”

The acquisition is taking place at a critical time as more cities across the U.S. prioritize zero-waste goals, due to the combined urgency of climate risks and increasing landfill costs. Similarly, many leading corporations in the U.S. are committing to keep more materials in circulation and incorporate more recycled content in their packaging, as part of their larger sustainability and net zero goals. According to the Circularity Gap Reporting Initiative, 70% of all global greenhouse gas (GHG) emissions are related to material handling and use, making circular economy infrastructure a critical part of the solution to the climate crisis. Expanding access to recycling and reuse services will enable cities and businesses to avoid the costs and emissions of landfilling products and packaging and achieve their sustainability goals.

Circular Services operates several companies to offer holistic circular materials management services, helping municipalities and businesses close the loop on valuable materials, including paper, metal, glass, plastics, organics, textiles and electronics. Among these companies is Balcones Recycling, Circular Services’ recycling company. Prior to this acquisiton, Balcones Recycling was already one of the largest independent recycling companies in the country, handling more than 1 million tons of recyclables each year through its operations in New York, New Jersey, Florida, Texas, Arizona and Arkansas. Following this acquisition, Balcones Recycling will operate 18 materials recovery facilities across the U.S., including five from Midwest Fiber.

“The Shumakers have built and led a great company with an excellent reputation as they served their surrounding communities for over 30 years,” said Tom Outerbridge, CEO of Balcones Recycling. “We are proud to join forces with Mike, Todd and their management team and leverage our collective expertise and growing portfolio of facilities to offer custom, effective recycling solutions to more municipalities, counties and small-to-large businesses.”

“We are excited to expand Circular Services and have Midwest Fiber Recycling be a part of our larger portfolio of infrastructure and services keeping materials in circulation—from paper, to plastic, organics, electronics, textiles and more,” said Amy Wagner, CFO & EVP of Business Development & Operations, Circular Services. “We look forward to expanding our services to the Midwest region of the U.S., and into commercial and brokerage services, providing more communities and companies with the infrastructure needed to reduce dependence on extraction and landfill, and advance a circular economy.”

About Balcones Recycling

Balcones Recycling is a Circular Services company. As a pure-play recycling company, Balcones is on a mission to recover all recyclables from the waste stream. As such, we design custom recycling programs focused on keeping resources away from landfills. We are known for building state-of-the-art facilities and fostering great partnerships with small-to-large businesses, counties and municipalities. We don’t stop at processing – we are active in key industry initiatives to increase the circularity of our materials and economy. We prioritize education and outreach initiatives to improve recycling participation. We love what we do and look forward to partnering with you to build a circular economy, one bale at a time. Learn more about Balcones Recycling at https://www.balconesrecycling.com/about/

About Circular Services

Circular Services is the operating group of Closed Loop Partners, a leading investment firm focused on advancing the circular economy. Circular Services provides holistic, circular materials management to close the loop on valuable materials for municipalities and businesses throughout the United States. Employing innovative technology within reuse, recycling, remanufacturing and re-commerce solutions, Circular Services improves regional economic and environmental outcomes by building resilient systems to keep food & organics, textiles, electronics, packaging and more, in circulation and out of landfill or the natural environment. For more information, please visit https://www.closedlooppartners.com/circular-services/

Closed Loop Partners Invests in Circular Manufacturing Company, Minus Works, Accelerating Sustainable Solutions for Cold Chain

December 06, 2023

The loan from Closed Loop Partners’ Infrastructure Group will help the company scale production of sustainable gel packs, reducing waste in the shipping of perishables

December 6, 2023, New York, NY –– Circular economy-focused investment firm Closed Loop Partners announces the closing of its loan to Minus Works, a manufacturing and technology company developing circular solutions for the cold chain. Minus Works builds products to reduce waste in the shipping of perishable products, primarily through sustainable gel packs and freezing process innovations. Financing was deployed through Closed Loop Partners’ catalytic private credit arm, the Closed Loop Infrastructure Group, to support the company’s expansion to meet growing demand for environmentally friendly alternatives to single-use plastic encased gel packs, and create a new end market for recycled paper.

Founded in 2020 and based in Farmingdale, New York, Minus Works is disrupting the cold chain with their BRiQ smarter coolant, a sustainable, high-performance gel pack and freezing process for the shipping of perishables, which aims to reduce single-use plastic waste and avoid greenhouse gas emissions in the supply chain. Made with recycled content paper, as well as a compostable gel interior, BRiQ serves as a non-toxic, circular alternative to single-use plastic wrapped gel packs. With freezing co-located at the gel manufacturing site, Minus Works also reduces required production space by 80%, and reduces costs and emissions associated with transportation.

Today’s standard gel packs are the biggest source of waste in the last mile cold chain, with the vast majority discarded into landfill, or contaminating the recycling stream. Most gel packs are made with single-use, non-curbside recyclable low-density polyethylene (LDPE), and use a petroleum derivative for the gel. Demand for less wasteful alternatives continues to increase as industries that are dependent on the cold chain––such as meal kit delivery services––continue to grow, and perishable packaging materials are expected to shift amidst upcoming Extended Producer Responsibility and “Truth in Labeling” regulations.

The Closed Loop Infrastructure Group has been providing flexible loans to projects that build out circular economy infrastructure and innovation in the United States for nearly 10 years. The loan to Minus Works builds on previous investments in circular economy infrastructure and technologies, including investments in the packaging manufacturing space, such as TemperPack, a leading developer and manufacturer of sustainable packaging materials. The Closed Loop Infrastructure Group aims to advance projects and solutions that keep valuable recyclable materials in circulation for longer, upgrade recycling infrastructure and strengthen end markets for recyclable material.

“Minus Works is accelerating circularity for an industry that has remained largely unchanged for half a century. We are excited about their growth potential, as well as the role that we expect the company to play as a new end market for recycled fiber markets, while reducing waste, emissions and fresh water use in the cold chain industry,” says Jennifer Louie, Managing Director and Head of the Closed Loop Infrastructure Group at Closed Loop Partners. “Closed Loop Partners’ Infrastructure Group is thrilled to partner with Minus Works and to have them as a portfolio company. The company’s values mirror that of other mission-aligned organizations that we have invested in who are committed to advancing innovations and infrastructure to support a circular economy.”

“We at Minus Works see immense opportunity for building new products and introducing new processes that will disrupt the resource-intensive cold chain industry and create more circular supply chains,” says Ben Shore, Founder and CEO of Minus Works. “Since our founding, we have been working on sustainable innovations and have seen demand grow across industries, from the perishable food and meal kit delivery space to life sciences. Our partnership with Closed Loop Partners is a milestone in our continued growth. We look forward to working alongside experts in the circular economy who share our vision for less waste and a positive future for the planet.”

If you are interested in applying for funding from the Closed Loop Infrastructure Group, learn more about Closed Loop Partners’ catalytic capital strategy here.

About Minus Works

Minus Works is an American manufacturing and technology company focused on bringing innovative products to the cold chain industry, including sustainable, high-performance coolant for the shipping of perishables. Learn more about Minus Works here https://minusworks.com/

About Closed Loop Partners

Closed Loop Partners is a leading investment firm advancing the circular economy. The company is comprised of three key business segments: its investment arm, Closed Loop Capital Management; its innovation center, the Center for the Circular Economy; and its operating group, Circular Services. Closed Loop Capital Management manages venture capital, buyout private equity and catalytic private credit investment strategies. Closed Loop Partners’ catalytic private credit arm, the Closed Loop Infrastructure Group, provides a flexible mix of financing solutions to support a range of circular economy projects, companies, infrastructure and enabling technologies. The Closed Loop Infrastructure Group deploys catalytic capital, which seeks to accelerate and de-risk the development of high-impact projects and companies. Areas of strategic investment include: providing below-market rate loans to finance circular infrastructure, providing catalytic financing to increase recovery of hard-to-recycle plastics and PET bottles, and financing and deploying small-scale, modular materials recovery facilities (MRFs) to increase recycling in communities with no or limited access to recycling. Closed Loop Partners is based in New York City and is a registered B Corp. closedlooppartners.com.

Disclaimer:

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

What Brands Need to Know to Increase the Recovery of Compostable Packaging

November 28, 2023

Permitting for composting facilities is complex, but critical. The Composting Consortium breaks it down.

Over the last few years, demand for compostable packaging has grown quickly, as more brands explore alternatives to single-use conventional plastic. Whether in the form of a bowl, fork or a chip bag, compostable packaging is becoming more prevalent each year. At its best, compostable packaging could play an important role in reducing food and packaging waste by helping deliver food scraps within packaging to composting infrastructure, avoiding the greenhouse gases emitted if food were to end up in landfill.

But the reality is that the U.S. composting infrastructure in existence today was predominantly designed to process only yard trimmings––leaves, grass clippings and woody debris––because of a policy trend in the late 80s and early 90s that banned yard waste from landfill in dozens of states. As climate change mitigation and zero-waste goals have emerged, the composting industry is modernizing, diversifying feedstock inputs to include post-consumer food waste and certified compostable packaging. But it is only at the beginning stages of that transition.

The Composting Consortium, a multi-year collaboration across the entire compostable packaging value chain, has been studying composting infrastructure for several years. In the U.S., about 70% of the 200 full-scale composting facilities that process food waste also process some form of compostable packaging. Most of these facilities are located in urban areas. The rest of the over 2,500 composting facilities in the U.S. only process yard waste, meaning most Americans lack convenient options to compost food waste, including food-contact compostable packaging. Creating circular outcomes for compostable packaging hinges on scaling the recovery of food scraps, and brands, packaging manufacturers, industry groups, composters and investors all need to be involved.

What needs to happen so that compostable packaging doesn’t end up as waste?

Several things need to be in place for compostable packaging to operate within a truly circular, waste-free system. Consumer education, supportive policy, and clear and consistent packaging design and labeling all play important roles––and recovery infrastructure is a critical piece to the puzzle.

When envisioning a future system where composting facilities accept not just yard waste, but also food scraps, and the compostable food packaging those scraps often arrive with, the first step is to consider what must be true for facilities to upgrade from yard waste-only composting infrastructure to also recover food.

Only when more food waste is recoverable at composting facilities will it be possible to also see more recovery of food-contact compostable packaging. This infrastructure upgrade is a key steppingstone to reducing packaging waste.

Why do permitting requirements matter?

While there is opportunity to upgrade existing yard trimmings composting facilities to recover food waste––and potentially, also food-contact compostable packaging––it is often difficult to get the necessary permits to do so. In many cases, yard trimmings-only composting facilities are permitted to compost only yard trimmings. To obtain a permit to also compost food waste and make all the necessary upgrades, these facilities would need to go through a lengthy and expensive permitting process.

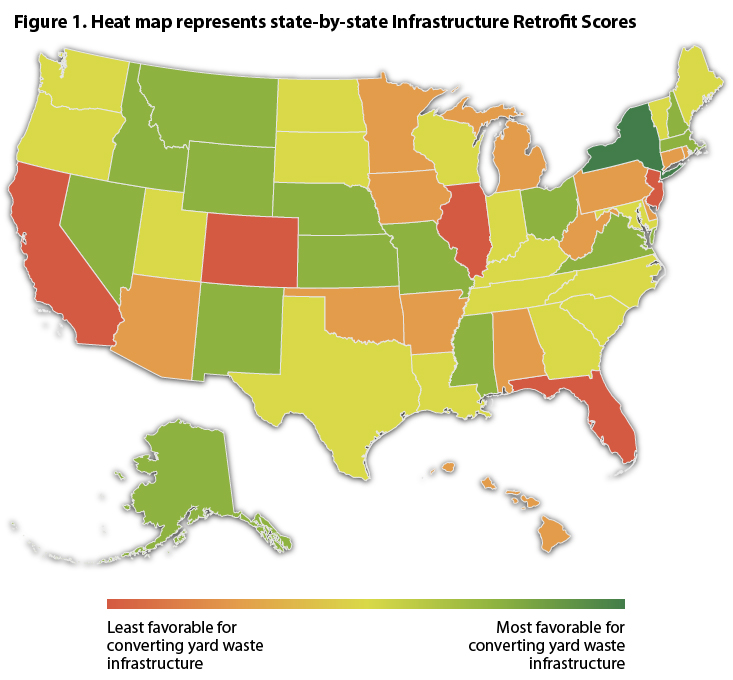

The Composting Consortium, BioCycle and Craig Croker evaluated each of the 50 states’ permitting requirements across five factors to produce a “Composting Infrastructure Retrofit Score” that measures how easy or difficult upgrading existing yard trimmings-only composting facilities would be across different states.

The final Composting Infrastructure Retrofit Score looked across five factors:

- Ease of permitting process: The difficulty of obtaining a permit to compost food waste in a particular state.

- Presence of permitting tier: Whether a state has rules for composting facilities depending on how much and what types of food waste they accept. Some states have stricter rules for facilities that accept large amounts of food waste or food waste that may be contaminated with pathogens.

- Cost to upgrade: The cost of upgrading a yard trimmings-only composting facility to process food waste.

- Time needed to upgrade: The amount of time it takes to upgrade a yard trimmings-only composting facility to process food waste.

- State food waste disposal ban: Whether a state has a ban or mandate that restricts disposal of food waste.

The findings uncovered a patchwork landscape of permitting conditions across the county as shown in BioCycle’s heatmap below. New York state stood out among the 50 states as having a comparatively straightforward process to obtain permits required for infrastructure retrofit, while most states including South Carolina, Rhode Island and California make navigating permitting requirements significantly more costly and time-intensive.

Original Source: BioCycle

In many states, permitting requirements for food waste composting are one of the major factors standing between compostable packaging and the recovery pathways needed to ensure they are a circular alternative to single-use plastic packaging.

What role do brands play in navigating permitting requirements?

CPG brands have a unique opportunity to play a leading role in scaling up a more circular system for food-contact compostable packaging in the U.S.––by investing in recovery solutions for food-contact compostable packaging, advancing consumer education, designing packaging that is compatible with food waste composting infrastructure, and advocating for policies––like extended producer responsibility––that can support the development of food waste composting infrastructure.

To advance the necessary upgrades to composting facilities, brands can be supportive of efforts of composting industry groups like the US Composting Council, who advocates for standardized state regulations for composting. Permitting requirements are a determining factor in creating more opportunities for compostable packaging circularity and navigating them requires the engagement of stakeholders across the value chain.

In 2024 and 2025, the Composting Consortium will continue to connect the dots and work with the compost industry, policymakers, and packaging manufacturers and brands to lower the barriers to scaling food-waste composting infrastructure and unlock value to all stakeholders across the composting value chain. Through this unprecedented collaborative work, the Composting Consortium aims to build a more circular composting system, one that drives values to all stakeholders.

Learn more about the work the Consortium is doing to scale circular outcomes for compostable packaging.

About the Composting Consortium

The Composting Consortium is a multi-year collaboration to pilot industry-wide solutions and build a roadmap for investment in technologies and infrastructure that enable the recovery of compostable food packaging and food scraps. The Composting Consortium is managed by Closed Loop Partners’ Center for the Circular Economy. PepsiCo and the NextGen Consortium are founding partners of the Consortium. Hill’s Pet Nutrition parent company Colgate-Palmolive, Danaher Foundation, Eastman, The Kraft Heinz Company, Mars, Incorporated, and Target Corporation joined as supporting partners, and the Biodegradable Products Institute, the US Composting Council and the U.S. Plastics Pact joined as industry partners. Our advisory partners include 5 Gyres, Foodservice Packaging Institute (FPI), Google, ReFED, Compost Research and Education Foundation (CREF), the Sustainable Packaging Coalition (SPC), TIPA, University College London (UCL), Western Michigan University (WMU), University of Wisconsin-Stevens Point, and World Wildlife Fund (WWF). Learn more about the Consortium at closedlooppartners.com/composting-consortium/

Reuse

Debunking Durability: How Durable Does Reusable Packaging Need to Be?

October 24, 2023

When reuse started regaining popularity in the United States, it was hard to imagine how any version of reuse could be worse for the environment than single-use equivalents. Today, there’s growing awareness of potential unintended consequences of reuse if return rates, and associated packaging use cycles, are not high enough to justify the added durability (and material) that comes with reusable packaging.

With the newest wave of reuse policy discussions and renewed efforts to integrate reuse models into reduction requirements of Extended Producer Responsibility (EPR) bills, there is growing confusion on what defines a “good” reuse system. Although many metrics are cited, use cycles or return rates paint the most robust picture of how well a reuse system is operating in practice. As we build the reuse systems of tomorrow, a universal understanding of such metrics is essential. So, what is a high enough return rate?

The reality of today’s reuse rates

Across different sources, the number of reuses required to offset the added durability and materials needed for reusable packaging (also known as the breakeven point) is said to range from about five to 800 uses. But in today’s reality, reusable packaging is often reused less than five times, based on the results of past and ongoing open-system reuse pilots. For containers to have five uses on average in their lifetime, return rates need to be 80%. For a 90% return rate––which we have yet to see in open systems at scale––containers are used only 10 times on average.

Achieving five to 10 uses is still a dream state for most open-environment reuse systems, yet we see packaging designers choosing and testing packaging materials to withstand dozens, and sometimes hundreds, of uses. Brands and manufacturers designing reusable containers are often reacting to regulations that set up unreasonably high use targets for open-system models. CalRecycle suggests washable as something that lasts 780 cycles. The Choose2Reuse drafted regulation cited a requirement of about 1,000 cycles. These types of requirements force the industry to design packaging for aspirational return rates, making breakeven points even higher.

Why designing for current state matters

To mitigate the environmental impact of reuse, reusable packaging needs to be designed for current return rates. Otherwise, you limit the environmental benefits by potentially generating a higher volume of materials, that are less likely to be recovered.

Additionally, durability will naturally be a function of usage environment; reusables must be appropriately designed for their expected use case. Items made for more closed environments, such as dine-in at a restaurant or for a drink at a venue, may have higher use cycles than open environments, such as takeaway or delivery.

The bottom line: as we transition toward more widespread reuse, we need to design with actual return rates and uses cases in mind. We must also ensure that containers that are not returned for reuse are recycled at their end-of-life (learn more about designing for end-of-life here).

While we work towards building the convenience and incentives needed to increase return rates, we must ask: what’s the least amount of material that we can put in a returnable packaging solution today to make it durable enough to survive five to 10 uses? Will it look sufficiently like a durable reusable to signal returnability? And ultimately, how many cycles does a container need to survive to beat its single-use equivalent? For open reuse systems today, when the answer is less than five or so cycles, the packaging design is going in the right direction.

Reusable packaging is at an important inflection point. New innovations are expanding what is possible, but to ensure that reuse does not generate unintended environmental consequences, reusable packaging needs to be thoughtfully designed with today’s reality in mind. Designing reusable packaging with current return rates, use cases and eventual end-of-life in mind are all critical steps to building a reuse system that truly advances a circular economy and a waste-free future.

How a South Carolina Paper Mill Started Recycling Your Paper Coffee Cups

September 26, 2023

A spotlight on Sonoco and its recycling tests with the NextGen Consortium

In July 2022, Sonoco announced it would accept paper cups in bales of mixed paper at its paper mill in Hartsville, South Carolina. The NextGen Consortium supported cup trials with Sonoco. Below, we discuss with Scott Byrne, Director, Global Sustainability Services at Sonoco how the organization made this decision and what considerations companies might want to take when exploring the recyclability of different types of packaging.

This work represents part of a forthcoming report on paper cup recovery in the United States intended for release in late fall.

Scott Byrne, Director, Global Sustainability Services at Sonoco

1. Who is Sonoco and what are you focused on?

Sonoco is a South Carolina-based global packaging company with more than 20 mills worldwide. Among our packaging products, we manufacture rigid paper cans, steel cans, thermoformed plastics and other packaging formats. Sonoco is uniquely positioned as a leading recycler, paper mill operator and paper packaging converter, in addition to other formats, to help push the industry to look towards future innovations and grow end-of-life solutions across the entire paper value chain.

2. How do you typically approach recycling of new products at your mills?

After validating that our mills could recycle rigid paper cans in residential mixed paper, we decided to further demonstrate the ability to recycle other similar polycoated fiber-based containers through the post-consumer mixed paper stream.

3. Where do you currently accept paper cups?

Hartsville, South Carolina. and we are exploring other Sonoco mills as well that use residential mixed paper.

4. What are some of the steps you took to determine that accepting cups wouldn’t create new challenges for your mill?

With support from the NextGen Consortium, we conducted two main activities to assess how cups might behave. First, we conducted lab-based testing of both single- and double-sided poly-coated fiber cups. Second, and after we were confident that the cups would not pose any issues to our equipment, we ran a large-scale trial whereby we dosed in nearly 20 tons of cupstock and cups into our pulper alongside other mixed paper, increasing the volume relative to other materials to test the system and upper bounds of materials we’d anticipate receiving if we accepted cups. Based on those results we felt confident that cups could be included in our accepted materials list and we were thrilled to have the mill listed alongside others on Foodservice Packaging Institute’s end market map of mills that accept cups.

5. What about your other paper mills?

Before we broadly accept cups at more of our mills, we’d want to distill our findings from the Hartsville location and consider any additional steps those mills would need to take to feel confident in accepting cups. This might include additional lab-and mill-based trials.

6. Any advice you’d give to other mills considering including cups?

Every mill is slightly different, from their equipment to operating conditions to inbound material mix. Testing to those conditions is a key proof point in determining what might work best in that location.

7. What’s next for Sonoco in its efforts to improve polycoated paper recycling?

Sonoco is a founding member of the Polycoated Paper Alliance that kicked-off in March 2023, which aims to increase widespread end-market acceptance of polycoated paper packaging products. We are collaborating with like-minded member brands and industry leaders on developing improved and harmonized data, updated design guidelines, expanded end market acceptance and upgraded mill specifications, among other initiatives.

How AI Could Change the Way We Think About Recycling

September 11, 2023

Closed Loop Partners’ Center for the Circular Economy and the NextGen Consortium launch a new study with AI technology company Greyparrot to analyze the composition of polypropylene in recycling streams

Behind the walls of recycling facilities across the U.S., a sea of materials moves through hands and machines working hard to get them to the end of the line––and the beginning of their next life. A critical balance of manual labor and automation enables the sorting and recovery of these materials in a closed loop system. Yet despite a multi-step sortation process, it is difficult to track what flows through the system at all times. It’s a challenge that results in many recycled materials losing potential value, in addition to millions of dollars worth of valuable material being sent to landfill unintentionally.

Among the diverse materials flowing through the recycling system are the yogurt containers, and iced coffee and fountain beverage cups many of us use on a regular basis. These are just a few examples of products made of one of the most commonly used resins in foodservice packaging today: polypropylene (PP). PP is a valuable material that should be kept in circulation to reduce waste and meet corporate commitments to use more recycled content in foodservice packaging. With that said, very little mechanically recycled food-grade PP actually cycles back into food-grade applications. Most end up in nonfood-grade applications that limit their value and the number of times they can be reused. To create a more circular path for food-grade PP, we must first answer the question: what is in the PP stream today, and how much of it is food-grade or clear food-grade PP?

The NextGen Consortium is a multi-year industry collaboration addressing single-use foodservice packaging waste by advancing solutions across material innovation, reuse and recovery infrastructure––and it’s working to answer that question. In the fall of 2022, the Consortium partnered with Resource Recycling Systems to examine PP bales in two materials recovery facilities (MRFs) to learn what was inside. While only a snapshot in time, the results were enlightening.

On average, nearly half of the PP bales (48%) were presumed food-grade, and more than a quarter of the bales were clear food-grade (26%). Clear beverage cups represented 14% of the bale on average. The high percentage of food-grade PP suggested that there is untapped value in the PP stream. A better system is required to ensure food-grade and/or clear food-grade PP is properly sorted into a separate bale at some point in the value chain if we are to retain its highest potential value.

This year, the NextGen Consortium is diving even deeper, launching a first-of-its-kind study leveraging artificial intelligence (AI) to analyze the composition of the PP material stream well before it ends up in a bale. Together with its managing partner––Closed Loop Partners’ Center for the Circular Economy––the NextGen Consortium is working with Greyparrot, a leading AI waste analytics platform for the circular economy. The collaboration aims to track and categorize objects in the PP stream, and determine the volume of valuable food-grade material passing through the system. AI is on the rise as one potential means of increasing visibility into the recycling process. Today, more technologies are needed to handle an increasingly mixed stream of collected materials, including plastics, electronics, textiles and food scraps––and to enable the recovery of clean, high-quality materials.

“Ensuring that recovery infrastructure can keep pace with a rapidly growing and diverse material stream is critical to advancing the circular economy, alongside solutions such as material innovation, reduction and reuse,” said Kate Daly, Managing Director and Head of the Center for the Circular Economy at Closed Loop Partners. “An important part of our work in the NextGen Consortium is identifying opportunities for data collection and analysis that can advance the circularity of foodservice packaging, and drive greater value for stakeholders across the system, including brands, innovators, infrastructure operators and consumers.”

As part of this project, the Greyparrot Analyser units will be installed above the PP recovery conveyor belts at four leading U.S. MRFs: Balcones Recycling, TX; Cougles Recycling, PA; Rumpke Recycling, OH; and Eureka Recycling, MN. Greyparrot’s AI-powered computer vision system uses cameras to capture images of objects in the PP stream, aiming to quantify and qualify the materials flowing through the MRFs. Their AI model will look to categorize each object based on material, format, financial value and brand, as well as distinguish food- and nonfood-grade material, using those images. Their units will then send that data to an analytics dashboard in real-time. Through machine learning, the flexible vision systems can help improve their package recognition and classification over time.

“We use artificial intelligence to gain continuous and reliable visibility into recycling streams,” said Ambarish Mitra, Co-founder and CPO of Greyparrot. “This helps us improve recycling operations by placing waste intelligence into the hands of the people who are recovering, redesigning and remanufacturing the objects we throw away. We are thrilled to work with our U.S. partners towards our vision of a future where every piece of waste is valued as a resource.”

The collaborative project––a first of its kind in North America––will run for more than six months. During that period, it will gather data on the composition of PP bales over time, while accounting for seasonality. That insight can help determine the potential untapped value in these streams, and identify other materials that might be coming through unintentionally. This data can also help shed light on the presumed volume of food-grade material being captured in the system, along with opportunities for recovery and separation into distinct value chains. More broadly, this can advance a circular economy for valuable materials, improve material quality delivered to recycling facilities, and enhance the value of recyclable commodities shipped to U.S. end markets.

“A lot is unknown about the curbside polypropylene stream today. Filling these knowledge gaps can increase the pace of development for material recovery. Understanding the composition of the stream in a large-scale study highlights potential, reduces risk for pioneers and accelerates better design implementation. This study will be the catalyst to developing much larger-scale recycling of polypropylene,” said Curt Cozart, President of Common Sense Solutions and Technical Advisor to the project.

PP cup recovery––alongside material innovation, reuse and fiber cup recovery––is a critical focus for the NextGen Consortium. According to The Recycling Partnership, more than 2 billion pounds of PP are generated every year by single-family households in the U.S. If just 30% of this material were recovered, it would reduce greenhouse gas emissions by over 300,000 metric tons, providing over 600 million pounds of valuable raw material to companies with recycled content commitments for their foodservice packaging, both voluntary and mandated.

The NextGen Consortium has been actively involved in PP recovery since 2021, when it joined The Recycling Partnership’s Polypropylene Recycling Coalition as a Steering Committee member. Through this initiative, the group helps to fund equipment grants for MRFs so that they can effectively capture PP packaging, and improve community recycling access rates. In addition to improving recycling access, the NextGen Consortium is committed to driving recycling rates by supporting the recovery of post-consumer recycled content (PCR) that can be re-incorporated into packaging.

This collaboration with Greyparrot and MRFs across the U.S. is one critical step toward achieving the NextGen Consortium’s goals. As more data about the PP material stream is captured over the next six months, the Consortium will analyze the new data, identifying opportunities to improve PP sortation and recovery into higher value, new food-grade applications and areas where more research is needed. The NextGen Consortium continues to invite additional MRFs to participate in the project, to gain a better understanding into what is flowing through their material streams and identify ways to drive more value to the system.

About the NextGen Consortium

The NextGen Consortium is a multi-year consortium that addresses single-use food packaging waste globally by advancing the design, commercialization, and recovery of food packaging alternatives. The NextGen Consortium is managed by Closed Loop Partners’ Center for the Circular Economy. Starbucks and McDonald’s are the founding partners of the Consortium, with The Coca-Cola Company and PepsiCo as sector lead partners. JDE Peet’s, Wendy’s and Yum! Brands are supporting partners. The World Wildlife Fund (WWF) is the environmental advisory partner. Learn more at www.nextgenconsortium.com.

About the Center for the Circular Economy at Closed Loop Partners

Closed Loop Partners is at the forefront of building the circular economy. The company is comprised of three key business segments: Closed Loop Capital Management, the Center for the Circular Economy and Circular Services. In 2018, Closed Loop Partners launched its innovation center, the Center for the Circular Economy, which unites competitors to tackle complex material challenges and to implement systemic change that advances the circular economy. Closed Loop Partners brings together designers, manufacturers, recovery systems operators, trade organizations, municipalities, policymakers and NGOs to create, invest in, and support scalable innovations that target big system problems. Learn more about the Center’s work here.

Reuse

Making Reuse an Everyday Reality: 3 Things We Must Consider Before Scale

September 06, 2023

Reuse is now at a critical stage of development. A plethora of innovation has expanded the realm of possibilities, but what will it take to get to the point of industry-scale disruption?

Earlier this year, seven winners of the highly anticipated 2023 Reusies were announced on stage at GreenBiz’s Circularity23 Conference in Seattle. The winners encompassed corporate and community initiatives, and B2B and B2C reuse innovations across food & beverage, consumer packaged goods and fashion & apparel. Together, they provided a window into the best and brightest developments in the reuse space. Indeed, hundreds of start-ups and large corporates are working on making reuse an everyday reality for consumers, with applications as far-ranging as closed system solutions for corporate campuses and events, to software companies supporting reuse-as-a-service, and refill applications in retail or in commercial, industrial and event spaces. The potential for reuse to reduce waste has catalyzed much innovation and brought conversations to a fever pitch.

Reuse is now at a critical stage of development. A plethora of innovation has expanded the realm of possibilities, but what will it take to get to the point of industry-scale disruption? Making reuse a far-reaching and everyday reality––where reusable items are consistently and efficiently reused to make a significant difference and reduce environmental impact––requires continued testing, collaboration across the value chain, investment and supportive policy.

At Closed Loop Partners, reuse systems are an integral part of our vision of a transition away from the take-make-waste economy and toward a circular economy. When products that have historically been single-use are able to be used two, five, ten or one hundred times, and the proper recovery infrastructure is in place for their eventual end-of-life, that can make a meaningful difference on reducing valuable materials sent to landfill––and on the embodied carbon, water and materials required to produce the item in the first place.

But to get to this next horizon, a number of factors must be considered to ensure that reuse does not result in unintended consequences and instead serves a truly circular economy:

1. Closed or semi-closed reuse systems are a key starting point, especially at early stages of adoption. On-premise reuse unlocks higher return rates which can make reuse systems profitable––or at least breakeven. In open systems, as consumers use and dispose products away from point of adoption, more complex collection networks and communication strategies are needed to drive returns. For this reason, closed systems can operate with lower upfront capital expenditures and lower recurring operating expenditures until the time at which consumer behavior has shifted to be more amenable to open systems (see #3!).

2. Reuse is a hardware-first business, and requires capital and collaborations to build localized infrastructure––including collection, sorting and washing. There continues to be a shortage of washing infrastructure needed for reuse solutions, and traditional waste management players are not currently set up for the type of collection and sorting needed for reusable products that are intended to stay in circulation for more than one use. Many software-only solutions still require partnerships with washers and logistics providers. There is an opportunity for founders, corporates and municipal governments to build out these partnerships to enable reuse and share in the funding that will be required to build this new infrastructure.

3. Broad consumer adoption starts with meeting customers where they are today. There are still many customers that have yet to be onboarded into the reuse culture. As we’ve seen in our work through the Beyond the Bag Consortium and the NextGen Consortium, we need to design solutions with current behaviors in mind and support customers as they build new habits. Advancing reuse won’t happen overnight; cross-industry and cross-company collaboration, a range of solutions, clear messaging and consistent regulatory frameworks are required to effectively support consumers in adopting reuse within their communities, as the industry addresses complex waste challenges. Importantly, in-market testing plays a key role in unlocking what works effectively in the market and meets customer needs. Today’s market is complex, with diverse customer demographics and shopping habits, different operations across retailers, a range of reuse packaging materials and more that need to be considered.

We see experimentation as a critical precedent to scale. Reuse is no simple feat, and testing market fit and operation alignment is an important step to expand reuse responsibly and mitigate unintended consequences that can happen without a measured examination of new systems. But isolated, small-scale experiments will not get us there. Closed Loop Partners runs multi-brand reuse tests through its Center for the Circular Economy to identify tactics that are proven and ready to scale, as well as models that require further tweaking and iteration to deliver the expected environmental and financial outcomes. While we work to scale proven solutions, we continue to de-risk systems that need refinement. Our in-field deployments intentionally mimic large-scale, cross-brand implementation, but in a controlled manner. The insights and data gleaned from these tests are key stepping stones to new rounds of implementation and scale. Most recently, the Beyond the Bag Consortium’s largest multi-brand reusable bag pilots tested a range of reuse solutions to understand what it will take to effectively drive reduction of single-use plastic bags. Next year, the NextGen Consortium will go back into market to test the viability of reusable cup systems across multiple brands. These tests unlock important insights on what it will take to build a culture of reuse and will serve as the foundation for identifying scalable initiatives.

With all these developments, we believe we’ll get there. There are tremendous tailwinds supporting the development of reuse and a multitude of communities, innovators and corporations committed to seeing the shift through. To do so, the next five years are critical to pivot from bespoke solutions to shared frameworks, from ad hoc consumer engagement to a consistent drumbeat, and from in market tests to truly scaled solutions. We are excited to be working to advance the transition from innovation to scaled solutions that can replace single-use. Join us!

This article represents perspectives from across Closed Loop Partners, including the Center for the Circular Economy and Closed Loop Capital Management. Special thanks to Kate Daly, Carol Lobel, Danielle Joseph, Aly Bryan and Anne-Marie Kaluz for sharing their thoughts for this piece.

How Closed Loop Partners’ Multi-Million Dollar Investment in LRS Is Expanding Recycling Infrastructure and Access in Chicago

August 16, 2023

This is Closed Loop Partners’ third loan to LRS, which will support the Exchange, its newly constructed materials recovery facility, accelerating materials circularity in the third largest city in the U.S.

When Closed Loop Partners provided its first loan to LRS almost 10 years ago, the leading recycling company was already making waves to advance materials circularity in the Chicagoland area. Operating in the third largest city in the U.S., home to 2.7 million people, LRS has faced significant opportunity to recover valuable materials and expand recycling access at scale, and has been at the forefront of this work, strengthening the recycling infrastructure needed to advance the circular economy. Over the last several years, LRS made critical advancements in its growth, supported by catalytic capital from circular economy investment firm, Closed Loop Partners. Today, LRS, the largest recycling company in the Chicagoland area, has reached another pivotal moment of growth: a newly constructed materials recovery facility (MRF) in the heart of Chicago, the Exchange. Supporting the newly constructed MRF, and the innovative technology housed within it, is a multi-million dollar loan from Closed Loop Partners’ Infrastructure Group.

The Closed Loop Partners team at LRS’s ribbon cutting ceremony; photo credit: Closed Loop Partners

Pictured left to right: Jennifer Louie (CLP), Kate Krebs (CLP), Ray Hugel (CLP)

The state-of-the art MRF is now operational and expected to divert 224 million pounds of recycled material per year. It will house cutting-edge system components, including new artificial intelligence (AI)-powered equipment and other technologies to advance efficient materials sortation and recovery in the Chicagoland area. The loan is closing at a critical time, as infrastructure upgrades and innovative technologies are needed to handle an increasingly mixed stream of collected materials, including plastics & packaging, textiles and food scraps. AI and automation play an important role in improving material sortation and reducing contamination across different material streams, enabling the recovery of clean, high-quality materials. The AI-powered sortation technology to be integrated at the Exchange will enable LRS to sort polypropylene (PP) plastic for the first time in the Chicagoland area, including cold to go cups and yogurt containers. The new automated technology is also expected to mitigate labor risks at the facility, as well as add new jobs to manage the new equipment––increasing job quality and safety.

LRS Exchange Facility – LRS employees celebrate the grand opening of The Exchange materials recovery facility, which created 50 new full-time jobs in the city; photo credit: Sean Kennedy/LRS

This is Closed Loop Partners’ third loan to LRS, building on a robust track record between the two entities. The investment firm’s first and second loans to the recycling company contributed to the growth of their operations at a critical moment, helping enable them to win the collection rights of recyclable materials in three additional Chicago Blue Cart recycling zones. This new loan, provided by three catalytic funds within Closed Loop Partners’ Infrastructure Group––the Closed Loop Infrastructure Fund, Closed Loop Circular Plastics Fund and Closed Loop Beverage Fund––helps expand LRS’s capacity, as the Exchange will process recyclable material collected from all six of Chicago’s Blue Cart zones, sorting material for approximately 430,000 households, encompassing over one million people. The Exchange’s expanded capacity will also enable LRS to collect material from other areas surrounding the city, reducing landfilling and providing recycling access for more communities.

“This is a key moment of our expansion, as we extend our reach and impact across the Chicagoland area,” says John Larsen, chief operating officer, LRS. “This loan to support our new facility helps us serve even more households in the area, and sort and process more valuable materials––including polypropylene, for the first time in the region. Closed Loop Partners has been a key part of LRS’s meaningful growth over the years and we are proud to work with their team again in this work to recycle even more valuable materials and reduce waste.”

Ribbon cutting ceremony for LRS’ new $50 million materials recovery facility (MRF) in Chicago, IL; photo credit: Sean Kennedy/LRS

Pictured left to right: Emily Olsen-Torch (LRS), David Fass (Macquarie), Department of Streets and Sanitation Commissioner Cole Stallard, Rich Golf (LRS), Chief Operating Officer John Larsen (LRS), Cook County Commissioner John Daley, Executive Vice President John Silwicki (LRS)

Over the last nearly 10 years, Closed Loop Partners’ Infrastructure Group––the investment firm’s catalytic capital group––has played a key role in identifying and advancing novel technologies and infrastructure development to help private companies and municipalities keep more materials in circulation and out of landfills. Funded by many of the largest consumer goods, technology and material science companies, the catalytic strategy aims to accelerate further investment into materials circularity and drive net positive environmental and social outcomes. To date, the Closed Loop Infrastructure Group has helped keep approximately three million tons of material in circulation across 30 private loans and 15 municipal loans.

The loan to LRS is a milestone for Closed Loop Partners’ catalytic capital funds participating in the financing:

Aligned with the Closed Loop Infrastructure Fund’s goal to improve efficiencies in circular economy infrastructure, the loan to LRS will significantly expand processing capacity in the Chicagoland area;

Further aligned with the Closed Loop Circular Plastics Fund’s goal to advance the recovery and recycling of plastics, the new equipment at the Exchange will capture and separate PP from the stream, with an expected rate of 650 tons of PP collected per year;

Finally, as the Closed Loop Beverage Fund, in partnership with the American Beverage Association, aims to improve the circularity of PET, a critical plastic to the beverage industry, the loan will help reduce LRS’s residue rate in the Chicagoland area, which will enable an increase in other salable commodities annually, including PET for bottle-to-bottle applications. This investment is part of the beverage industry’s Every Bottle Back initiatve, an integrated and comprehensive partnership between America’s leading beverage companies––The Coca-Cola Company, Keurig Dr Pepper and PepsiCo––to reduce the industry’s use of new plastic. The loan is expected to unlock at minimum an additional 150 tons of PET per year.

“One of our industry’s highest priorities is to create a circular economy for our bottles and cans. We are taking action at every step to make sure they are remade as intended,” said Kevin Keane, interim president and chief executive officer of American Beverage. “Chicago is a great and innovative American city. It is exciting to partner on a significant project that will serve to enhance its beauty, environment and quality of life. America’s leading beverage companies are carefully designing our bottles to be 100% recyclable and investing in modern recycling systems to reduce our plastic footprint and keep plastic out of nature. We are excited to continue that work here in Chicago and thank everyone who made this investment a reality.”

“As the circular economy grows across North America, companies that are vital to its development require access to financing to upgrade technology and expand capacity. Closed Loop Partners’ Infrastructure Group is proud to support leading private and public organizations advancing material circularity through upgraded infrastructure and innovative technologies,” says Jennifer Louie, Managing Director of the Closed Loop Infrastructure Group at Closed Loop Partners. “LRS has been a leader in developing the infrastructure needed to accelerate materials circularity in the Chicagoland region. We are thrilled to be working with their team to advance circularity in one of the largest cities in the U.S., keeping more materials in circulation and serving more communities.”

As LRS enters its next phase of growth, Closed Loop Partners will work closely with the LRS team to integrate new technologies into the facility and bolster potential end markets for materials recycled by the facility, helping establish more robust circular systems in the region.

Learn more about Closed Loop Partners’ catalytic capital strategy here.

Disclaimer:

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

The testimonials provided are from current clients and Limited Partners of Closed Loop Partners. No compensation was provided for the statements, and the statements do not present any material conflicts of interests.