Putting Recovery at the Center of the Critical Minerals Sourcing Debate

March 22, 2023

Over the past few months, sourcing critical minerals has been at the forefront of conversations about how to support the renewable energy transition.

The chip shortages in 2020-21 increased awareness that, from steel and aluminum to rare earth minerals, the U.S. market has far fewer processed materials available than we need to meet the growing demand for electric vehicles, battery storage and transmission lines needed to maintain a 1.5-degree future. And the push to secure access to a finite, price-competitive global materials supply was only heightened by the Inflation Reduction Act’s domestic sourcing requirements for assets like electric vehicle batteries.

This growing need has prompted efforts to fund new extraction domestically and to secure feedstock from international regions––often with challenging environmental and human rights records but higher volumes of available supply. Onshoring and near-shoring of key aspects of manufacturing––once seen as cost prohibitive––are now seen as cost-of-doing-business to access the U.S. market. Less prevalent is the consideration of how to create more sustainable domestic sourcing channels for the critical minerals needed to support the manufacturing being announced in the U.S.

That is not to say that “recycling” is absent from the conversation. Indeed, a handful of large battery recycling companies have garnered significant attention and capital––the most recent being a $2B conditional loan commitment from the Department of Energy Loan Programs Office to Redwood Materials. However, much of what is being invested in today relies upon energy- or chemical-intensive processes that prioritize recovery of the highest-value-by-dollar-amount materials. The result is that other materials––steel, aluminum, copper––can be left behind in the process. Those materials that are recovered––like lithium, cobalt, nickel––may end up requiring significant re-processing to be re-usable in a new battery.

It is important to advance the “large loop” circularity narrative of recycling materials all the way back to their base, raw material form; however, enabling smaller, cost-competitive loops alongside this can move the needle on material availability in the near-term. These include optimally leveraging used materials and minimizing processing costs to get these materials back to the manufacturing lines where they are needed. This is essential as we redefine our hierarchy of mineral recovery––from one that leads with extraction to one that leads with recovery as the primary source for materials.

At Closed Loop Partners, we see significant opportunity to elevate recovery as a core part of the critical minerals conversation. Namely that (1) valuable streams of recoverable domestic materials are currently overlooked; (2) existing processing techniques are leaving value on the table; and (3) geographic silos are disadvantaging both suppliers of recovered materials and manufacturers.

- Valuable streams of recoverable domestic materials are being overlooked

It is no secret that there are major concerns about the near-term availability of end-of-life batteries to feed existing recycling lines. At the same time, sourcing newly mined materials for electric vehicles has become a challenge for many automakers, and recent announcements demonstrate a push toward net new, domestic extraction for materials like cobalt.

There are diverse used material streams that can serve as the feedstock needed by new battery manufacturers. This includes everything from scrap created during the initial battery manufacturing process to end-of-life electronic waste and, even, recovery from seawater, clay or waste streams from other manufacturing processes.

Innovation that takes the country’s natural endowments into account is better positioned to move the needle on critical minerals access. These include not just minerals under the ground, but also those above it––being scrapped off the line, waiting in line at an end-of-life electronics processor, or even in our junk drawers at home. And there is an investment opportunity in recovery technologies that view those waste streams not as liabilities but as feedstocks for the energy transition.

- Existing processing techniques are leaving value on the table

While current methods for battery recycling, such as pyro and hydrometallurgy, are well suited to recover cathode materials––lithium, cobalt, nickel and manganese––there is still opportunity to innovate and improve recovery mechanisms, ideally that preserve and catalyze reuse of anode materials or casings––graphite, iron, copper, steel, aluminum––many of which may not be fully recaptured in processing.

We know it is possible to extract more value from existing waste streams to loop materials back into supply chains––and de-manufacturing is a core enabler of that. Instead of starting a recovery process by shredding the existing product, we can prioritize deconstruction. This allows for the preservation of materials in a usable form rather than a return to the base elements (for example, direct cathode-to-cathode recovery, versus a reversal to lithium carbonate that needs to be reprocessed to be usable in a battery again). Not only does this require fewer steps for reintegration, but it may also be less energy intensive––and still gets domestic materials back to the manufacturers who need them most.

Similarly, existing operations in traditional industries, such as mining and oil and gas, have room for incremental recovery of materials that are currently viewed as waste products. Mine tailings, for example, are a natural waste product of the mining process and there are thousands of tailing dams––both active and inactive––around the world. There is an opportunity for innovation that focuses on reprocessing and recovering the critical minerals still present in those tailing dams. These “waste” streams from traditional extraction processes can become valuable sources for materials needed in battery manufacturing. They can also have secondary benefits, such as improved water quality, revitalization of biodiversity loss and more.

- Geographic silos are disadvantaging both suppliers of recovered materials and manufacturers

North American electric vehicle battery manufacturing has continued to accelerate, with nearly 1,000 GWh/year of manufacturing capacity expected to be online by 2030. The manufacturing footprint is broad––stretching from California to Eastern Canada, Texas to Florida to Massachusetts. Unfortunately, the planned capacity for critical minerals recovery is less distributed.

As operators of the largest private recycling company in North America, Closed Loop Partners knows well that the most important aspect of profitability in waste recovery is the ability to optimize the full ecosystem processing cost––and transportation is a significant part of that equation especially when an end-of-life product is heavy. There may be opportunities for more proximate, localized or modular processing, as well as more structured recovery infrastructure.

Putting Recovery at the Center of the Debate

We have the opportunity today to build the new supply chain for electric vehicle battery manufacturing with circular economy and recovery principles embedded from the beginning. Prioritizing recovery over additional mineral extraction allows us to localize supply chains and feed new capacity for domestic manufacturing of semiconductors and batteries for electric vehicles. It hedges over-exposure to finite supplies of raw materials that have, historically, only been accessible in specific, higher risk geographies around the world and, in doing so, creates a hedge against pricing volatility in those markets. If done well, it does all of that at a lower cost than full lifecycle mineral extraction and with a lower emissions footprint than legacy recycling infrastructure while diverting high value waste from landfill. It builds long-term resilience––all while driving transparency, connectivity and agility into our domestic processing capacity for critical minerals.

Core to our investment approach at Closed Loop Partners is a belief in the power of the ecosystem. The circular economy, by definition, requires collaboration across stakeholders. It requires a shared understanding of fully loaded costs to get something back in circulation and a commitment to make it work in the least emissions-intensive, most cost-efficient way possible––not just for a single entity in the value chain but for all of them. Sourcing critical minerals is no different. Now is the time for a new wave of collaborative innovation that puts novel recovery front and center in our journey toward sustainable, cost competitive, low carbon and low waste materials for the energy transition.

Special thanks to the GreenBiz23 team and my fellow panelists from the Future Proofing Critical Minerals Supply panel, to my Closed Loop Partners team––especially Jessica Long, Danielle Joseph, Andrew McColm, and Anne-Marie Kaluz––and to the countless corporate partners, investors, and start-ups innovating across this ecosystem that have already pushed my thinking here. I look forward to many more discussions on the topic!

Disclaimer:

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

Related posts

Blog Post

How Smart, Scalable Sensors Are Reducing Waste in the...

Why We Invested in LAIIER, a Denver-based startup pioneering...

Blog Post

The Hidden Value of Scrap Metal: Why Local Recovery...

VALIS discusses circularity of metal processing, and...

Blog Post

How AI Can Reduce Food Waste at Restaurants

Closed Loop Ventures Group led the seed investment...

Blog Post

Why We Invested in Mycocycle: Nature-Inspired Circular...

Closed Loop Partners’ Ventures Group saw a key opportunity...

Press Release

Closed Loop Partners Leads $4M Seed Round for LAIIER,...

Investment in the innovative liquid leak detection...

Blog Post

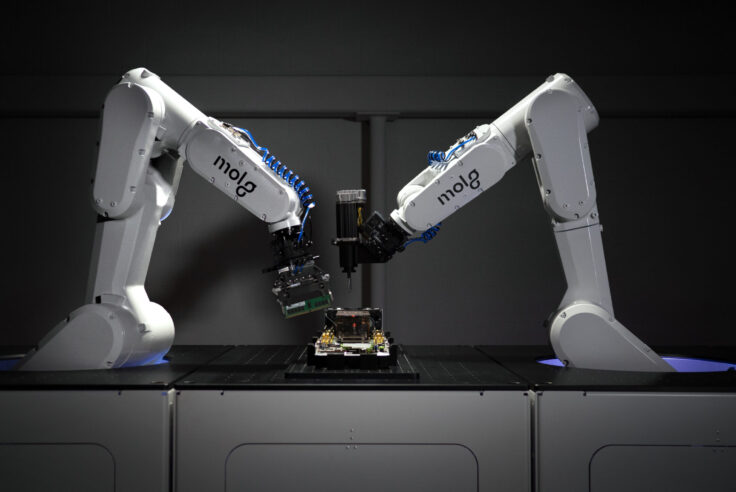

Making Circularity Stick: Electronics

A conversation with Rob Lawson-Shanks, CEO of Molg...

Press Release

Closed Loop Partners Doubles Down on Investment in...

Closed Loop Ventures Group joins Earthodic's $4 million...

Blog Post

Why We Invested in Neutreeno: Engineering Circular...

Neutreeno offers a game-changing solution that seamlessly...

Press Release

Molg Raises $5.5 Million in Seed Funding to Tackle...

Closed Loop Partners' Ventures Group leads seed funding...

Blog Post

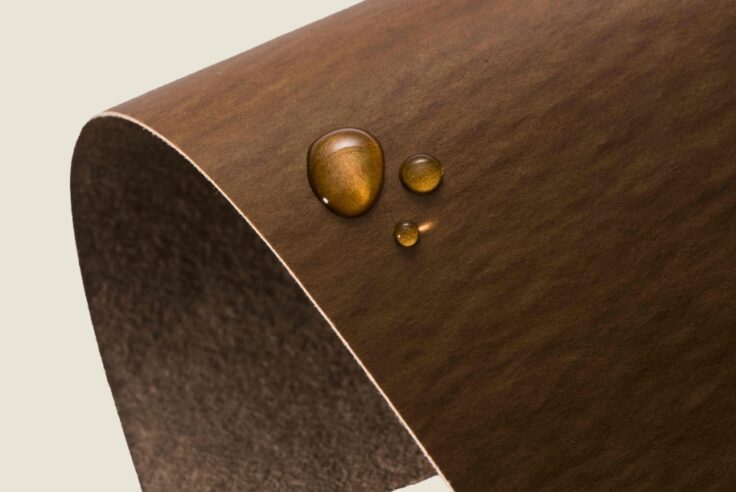

How the Apparel Industry Is Challenging Us to Think...

The high cost of textile waste has sparked the need...

Blog Post

Why We Invested in Aerflo: Making Reuse an Everyday...

Closed Loop Ventures Group is thrilled to announce...

Blog Post

Why We Invested in Capra Biosciences: How Microbes...

Today, we are witness to a rapidly changing manufacturing...