(July 2, 2021) — “The recent recommendations made by the California Statewide Commission on Curbside Recycling and Market Development to CalRecycle regarding a Statewide Standardized Acceptance List of Recyclable Materials (CA Statewide Recyclable List) concerns our organizations in its omission of polypropylene (PP #5) bottles, rigid containers, tubs, and cups. We believe the recommendation not to include PP on the list underestimates the recycling access, capture, and marketability of PP in California and could prove detrimental to PP recycling and waste reduction within the state and nationwide. The public and private sectors both have an opportunity to catalyze solutions to further accelerate the system-wide shift already underway for PP, improving the circularity of this material and satisfying an ever-increasing demand for recycled PP in new products and packaging. We stand by polypropylene and our commitment to expanding access, education, recovery, and other necessary actions along its path to maintaining wide recyclability in California and across the U.S.”

Industry Statement: Response to California Commission Omission of Polypropylene from CA Statewide Recyclable List Recommendation to CalRecycle

July 01, 2021

The following is a joint statement attributable to Steve Alexander, President, and CEO, The Association of Plastic Recyclers; Ron Gonen, CEO, Closed Loop Partners; and Keefe Harrison, CEO, The Recycling Partnership:

Circular Economy Infrastructure Will Build Value For All Americans

May 03, 2021

The circular economy is becoming big business in America. For example, just one piece of the circular economy, the recycling industry, generates over $100 billion in economic activity, nearly $13 billion in federal, state and local tax revenue and supports over 500,000 jobs annually.

On a more personal level, as global supply chains began to crack during the COVID-19 pandemic, our domestic recycling infrastructure saved us from major shortages of critical consumer products — like toilet paper. But that is only a fraction of the value the circular economy can provide on both a local and national level.

A policy known as Extended Producer Responsibility (EPR), now being introduced at the state and federal level, would create a massive investment in local recycling and circular economy infrastructure. Through a fee paid by consumer goods companies, thoughtfully-constructed EPR will save billions of dollars spent annually in landfill disposal fees. It would create hundreds of thousands of local jobs and provide consumer goods companies a reliable and cost-effective alternative to their current dependence on limited raw materials, which generate enormous amounts of greenhouse gas (GHG) emissions during extraction.

In the past, advocating that companies take responsibility for the sustainable management of their products was the sole domain of environmentalists. But we are now seeing multiple stakeholders, including CEOs, politicians, customers and shareholders align on the view that when brands invest in local recycling and circular economy infrastructure to protect the environment, it creates value for businesses too. In New York this January, State Sen. Toddy Kaminsky (D) introduced an EPR bill that has gained broad support, and similar legislation has been introduced or is being considered in California, Colorado, Hawaii, Maryland, New Hampshire, New York, Oregon, Vermont and Washington state.

A select group of CEOs of major consumer goods companies have recognized that what happens to a product after its initial use poses a risk — but when managed properly, can be an opportunity to secure long term value. Mark Schneider, the CEO of Nestlé, wrote recently, “[B]old and meaningful action in this space can become a competitive advantage, contributing to improved market share and growth.” Former Unilever CEO, Paul Polman, saw the opportunity to meet consumer demand years ago and trailblazed with sustainable business practices and products. During his decade-long tenure as CEO from 2009-2018, Unilever’s stock price increased by 290 percent. Investors took notice. Alan Jope, Unilever’s current CEO, has continued to expand Unilever’s commitment to sustainable business practices.

Three considerations are key to make EPR successful. First, stakeholders should gain consensus on the goal for EPR and incentivize brands to achieve it. Second, we should update the definition of “recyclable” to ensure that only products that are profitable for municipal recycling programs are designated as recyclable. Third, we must allocate funds from an EPR program directly to municipal recycling programs and empower local leaders to invest the funds in the infrastructure required to achieve their waste reduction goals. Styrofoam is an example of a packaging material that is challenging to recycle and has a limited market, while aluminum is infinitely recyclable and has a strong market.

For true accountability, all parties should set a goal for the policy and decide how to measure progress. Experience shows us that the best objective would be a recycling rate percentage well above today’s average recycling rate of around 30 percent, and a percentage of post-consumer recycled content used in the manufacturing of a product or packaging. EPR fees charged to consumer goods companies should not be viewed as the goal, but as a means to achieve the goal of a fully circular production system, where reliance on natural resource extraction and landfills is limited. Therefore, incentives for brands — fee waivers, designation to consumers and public recognition — are key for products to achieve a high recycling rate and use of recycled content. Where it’s not possible for producers to currently meet such goals for a particular product due to technical or economic limitations, this system and waiver could help incentivize producers to switch to recyclable or compostable materials or adopt reusable packaging models.

Which brings us to the next: a clear definition of what “recyclable” means. Recyclable has traditionally been defined as the ability of a product or material to be collected and sorted by a recycling facility in the United States. This does not take into account the economics of the recycling industry and the municipal recycling programs that are expected to remain solvent and grow. The result: consumer goods companies claiming that a product is recyclable, while municipal recycling programs struggle to find profitable end markets for it.

“Recyclability” should be defined as “a product whose primary material is sold by a municipal recycling facility for a profit.” Therefore, in order to receive a designation of “recyclable,” a product should have a market value of above the processing cost of materials (paper, metal, glass, plastic) at municipal recycling facilities across the United States. This stipulation would encourage producers to be more rigorous from the outset regarding their packaging design, connecting the diverse pieces of the system, from designer to producer to recycler, so that all stakeholders are in agreement that a product has value in a circular system. The EPR fee structure should be designed to motivate brands to ensure that their product is recyclable (per the definition above), is recycled and uses all or mostly recycled content in manufacturing.

Third, we should allocate funds from an EPR program directly to municipal recycling programs, empowering local leaders to invest the funds in infrastructure and innovation. It is critical that legacy policies, such as bottle bills that conflict with municipal recycling collection programs, be phased out as EPR policy is adopted. There are a number of leaders that have accomplished amazing things with limited funding, showing that investments made directly in local municipal recycling programs and at the direction of local leaders will yield the best results.

While EPR won’t solve all of our waste issues, thoughtfully-constructed EPR will provide the foundation for the development of comprehensive recycling and circular economy infrastructure in the United States. And with thoughtful incentives, companies that strive to be leaders in reducing waste, will be recognized and rewarded.

We are a country that has demonstrated that when the interest of business aligns with the interest of policy makers and local communities, we can develop infrastructure that creates massive long-term value. Thoughtfully-constructed EPR has the potential to do just that.

Ron Gonen is the CEO of Closed Loop Partners, a circular economy-focused investment firm and innovation center and author of “The Waste Free World: How the Circular Economy will Take Less, Make More, and Save the Planet.”

Originally published in The Hill.

North America’s Unique Journey Toward Circularity

October 09, 2020

Last week, I (virtually) joined more than 5,000 business leaders, policymakers and circular economy enthusiasts from across the globe for the digital World Circular Economy Forum (WCEF), convened by the Finnish Innovation Fund Sitra. It’s been four years since WCEF’s first convening, and it was inspiring to see the continued momentum and global interest in advancing circularity. This year was the first time WCEF was to be held in North America, reflecting the growing tide of interest here. I was happy to have the opportunity to join the events and speak to the nuances specific to our region in our journey toward circularity.

Elements of the circular economy have existed within North America for centuries, under different names: indigenous stewardship, industrial ecology, recycling, cradle to cradle, environmental justice, remanufacturing. For the new circular economy to flourish in North America, we must commit to building on this knowledge, in addition to adapting successful international models to our own North American cultures and governing systems.

While here in the U.S and Canada we don’t have the same type of unifying mandates prevalent in the European Union, business and investors are not waiting around for national legislation. They’re deploying capital, and identifying new business models and opportunities for collaboration. Many corporations are setting ambitious goals and doing the difficult work of identifying how circularity can become an integrated part of their bottom line. And in the absence of national legislation or funding, some cities are launching zero waste mandates and circular business accelerators to turn waste into resources and create local jobs. Innovation, investment, policy and above all partnership are the key drivers of the new economic model in the U.S. and Canada, and digitization is a key enabler. And in all of this we must together ensure that the new systems put into place don’t perpetuate the negative outcomes of the old ones, where low-income communities are disproportionately affected by the environmental burdens of pollution and waste.

In our most recent report, The Circular Shift: Four Key Drivers of Circularity in North America, we at Closed Loop Partners drew on our experience as researchers, operators and investors in the circular economy to illustrate the momentum and headway made thus far. Both the public and the private sector are responding to changing consumer preferences, increasing demands for better outcomes for local communities, and regulatory pressures. And it’s the cutting edge sustainable innovations and growing investment opportunities that provide a path forward toward circularity.

We’re in an age of experimentation, perfecting reusable and refillable packaging models, renting rather than buying clothing, and transferring ownership of products and packaging back to their producers. There are many reasons to be optimistic, and the time for action, critically, is now. The clock is ticking on our current linear economic system and the circular economy offers a viable and much-needed solution: a robust framework that aligns the interests of shareholders, corporations, local communities and the environment, and is underpinned by core principles of resource efficiency, inclusiveness and resilience.

Together, we all have a role to play to catalyze inclusive approaches to systems change that shift us toward a better, more circular economy that’s business-led and community-led. There is no question that it will require unexpected and unprecedented collaboration, but personally I’m encouraged by the progress made to date and I look forward to what lies ahead of us in North America and beyond.

Closed Loop Partners Launches Report on Unprecedented Shifts in the Circular Economy in North America

September 23, 2020

The report explores the sea change underway as four key drivers – market forces, recent innovations, changing policy and groundbreaking partnerships – push circularity forward

New York, Sept 24 – Today, Closed Loop Partners’ innovation center, the Center for the Circular Economy, announced the release of its timely report, The Circular Shift: Four Key Drivers of Circularity in North America. The report highlights critical trends driving circularity in the region, putting circular economy solutions at the center of business strategy, innovation development, policy changes, and new institutional partnerships.

The tumultuous events of 2020 have shed light on the importance of strong, stable, transparent systems, exposing the risks of overcomplicated, opaque supply chains and the limitations of continually extracting finite resources. In North America and around the world, supply chain disruptions, growing amounts of waste, and health and safety risks have called attention to the flaws of business-as-usual. As these challenges come to the fore, the urgency of rethinking systems that throw $10 billion worth of resources into U.S. landfills has increased. With growing investments and interest in less wasteful systems, the circular economy in North America is in the midst of a sea change.

Since 2014, Closed Loop Partners has been operating and investing in the circular economy, finding opportunities in the space and supporting its rapid growth across the U.S. Drawing from the firm’s investment intelligence and its Center’s research, the report delves into the Four Key Drivers of the Circular Economy in North America, exploring how innovation, investment, policy and partnership act as key enablers of the emerging economic model.

These factors shape and strengthen the landscape for circularity as investable opportunities have noticeably advanced, with momentum and innovation in the space growing rapidly. Capitalizing on the circular economy ultimately promises to recapture business value, offering a $4.5 trillion global opportunity by 2030, according to Accenture. Unexpected partnerships and visionary policy will be essential to accelerate the shift toward an economic model that is enduring, and able to withstand future shocks.

Against the backdrop of this year’s NYC Climate Week, the link between the circular economy––the reduction of both extraction of raw materials and of waste––and the consequences of climate change have never been stronger, or more apparent. The circular economy is not a singular solution, nor a short-term fix. To achieve circularity goals, such as decarbonization and dematerialization, change must be sweeping and collaboration must be far-reaching. Much like environmental solutions must include every stakeholder in the path forward, so must the circular economy.

“The clock is ticking on our current linear economic system and the circular economy offers a path forward: a robust framework that aligns the interests of shareholders, corporations, local communities and the environment,” says Kate Daly, Managing Director of the Center for the Circular Economy at Closed Loop Partners. This report builds on the achievements to date and the necessary actions to move forward, underscoring the urgency of focused investment, innovation opportunities, policy change and unexpected collaborations to achieve system-wide change.

Closed Loop Partners at the United States Senate Environment and Public Works Committee on Recycling

June 19, 2020

Launched in 2014, Closed Loop Partners (CLP) is the first investment firm primarily focused on building the circular economy. Our vision is to help build a new economic model focused on a profitable and sustainable future that aligns the interests of shareholders, brands and local communities and the environment that we all share. Closed Loop Partners provides equity and project finance to scale products, services and infrastructure at the forefront of the development of a circular economy. We have over the past 5 years built a development system that connects entrepreneurs, industry experts, global consumer goods companies, retailers, financial institutions and municipalities.

On June 17, 2020, Bridget Croke, Managing Director, at Closed Loop Partners spoke at the United States Senate Environment and Public Works Committee as they held a hearing on “Responding to the Challenges Facing Recycling in the United States.” The following text is drawn from her testimony.

Today, we have over 40 investments in companies and municipal projects in the United States, all focused on helping Americans avoid landfill disposal fees while generating good jobs in the recycling and manufacturing sector. Our investors are a combination of some of the largest American based consumer brands in the world including 3M, Coca-Cola, Colgate Palmolive, Johnson & Johnson, Keurig Dr. Pepper, PepsiCo, Procter & Gamble, Unilever and The Walmart Foundation, as well as the American Beverage Association, institutional investors, family offices and environmental foundations. CLP proves that public–private partnerships are critical to unlocking the capital needed to build robust recycling and circular economy infrastructure needed to create jobs, reduce waste and build the supply chains of the future.

Despite some of the headlines we’ve all seen, recycling is big business in America and should create the manufacturing feedstock for future packaging. In 2019, the recycling industry in America generated over $110 billion in economic activity, $13 billion in federal, state, and local tax revenue and 530,000 jobs. In spite of COVID and market challenges in recent years, 2020 is shaping up to be a year of major innovations in the recycling industry as it becomes central to circular economy business models that major consumer goods companies and cities are deploying. Transitioning US manufacturing to circular supply chains could unlock a $2 trillion opportunity.

Recycling continues to be the most cost-effective option for the vast majority of American cities. The economics are simple. Cities have two choices when it comes to disposal: recycle or landfill. While the value of recycling is generally reported as the amount that a city can be paid for its recyclables, the core economic value of recycling is actually the opportunity for a city to avoid costly landfill disposal fees. Economic analysis conducted has shown that the U.S. scrap recycling industry is a major economic engine powerful enough to create 531,510 jobs and generate $12.9B in tax revenue for governments across the US.

New York City, the largest market in the United States, is an example of how advanced recycling infrastructure and strong local markets create long term profits. New York City has a long-term public-private partnership with Pratt Industries that converts all of its recycled paper locally into new paper products sold back into the NYC market. Via its contract with Pratt, New York City is paid for every ton of paper its residents recycle, as opposed to a cost of over $100 per ton to send paper, plastics and metals to a landfill.

Minneapolis is another good example. Eureka Recycling and the City of Minneapolis invested in local community outreach focused on keeping their recycling stream clean of contamination, defined as non-recyclable material. The result is one of the lowest contamination rates of any municipal recycling program in the country. With a clean stream of valuable recyclables, Eureka consistently shares with Minneapolis the profits earned from the sale of their recyclables. In many other cities, unfortunately, approximately 15% of the material that arrives at the municipal recycling facility is considered contamination. Municipal recycling programs that keep contaminants out of the recycling stream via strong community outreach or enforcement realize lower costs and better revenue opportunities. Municipalities that recognize that recycling is part of the commodities industry, not the waste industry, generate value.

Along with the examples of Pratt Industries in New York City and Eureka Recycling in Minneapolis, Recology in San Francisco and Balcones in Austin, among others, continue to provide their municipal and commercial customers robust recycling service. In addition, municipalities like Pensacola, Florida and Davenport, Iowa that manage their own best in class recycling facilities consistently reduce landfill disposal costs and create local economic value for their constituents.

The value of recyclable commodities continues to have a wide range. The cost to process municipal recyclables at a recycling facility is, on average, $70 per ton. That means that for a recyclable commodity to have value, it must have a market that pays the recycling facility over $70 per ton of that material. A sample of the commodities that are usually profitable to recycle include PET plastic (beverage containers), HPDE plastic (laundry detergent and soap containers), rigid polypropylene (bottle caps, some yogurt containers), cardboard and aluminum.

In 2020, three innovations are driving the increased profit potential of recycling in America and the development of a vibrant and growing Circular Economy.

- The introduction of robotics and artificial intelligence. The future of the industry will be led by the recycling facilities that produce the highest quality commodity bales of materials. Companies like AMP Robotics have introduced robotics (robots) with artificial intelligence systems that enable the sorting and production of high-quality commodity bales, supply chain tracking and safeguards against contamination that were never before imagined in the industry.

- Packaging innovation. We are seeing the emergence and growth of smart refillable packaging systems like Algramo that makes it cheaper and more convenient for consumers to use packaging more than one time. We are also seeing a growth in packaging that is designed to be recycled for value. Temperpack, for example, is a packaging technology that uses recycled cardboard to keep packaged food cold, replacing a significant amount of low value plastics like Styrofoam peanuts, which are both not recyclable and a common contaminant in the recycling system.

- Advanced plastics recycling technologies, including purification technologies and chemical recycling technologies. Purification is an enzymatic process that improves the quality of recycled plastics so they can more easily be used again in packaging. P&G invented a technology and helped launch a company, PureCycle Technologies, that will significantly increase the value of recycled plastic by removing color and smells. Chemical recycling is a process whereby plastic is depolymerized back to the base monomer, intermediary or carbon state in order to remanufacture a new plastic. Some plastics, like PET, HDPE and rigid polypropylene have significant value and are very profitable for the recycling industry, but they can degrade after a number of recycling cycles while some other plastics currently have limited value or are challenging to recycle. Chemical recycling has the potential to create an infinite circular economy value loop for all plastics. Some of the leading innovators are backed by major consumer goods companies. In 2020, we expect a number of emerging companies to move from pilot to commercialization phase.

These and other circular advancements are attracting significant private capital from leading investors. The industry saw investments from leading investors across asset classes. Google and Sequoia invested in AMP Robotics, Goldman Sachs is now the largest shareholder in Lakeshore Recycling Systems, Citi is largest investor in rPlanet Earth, a bottle-to-bottle plastics recycling facility in California and SJF Ventures invested in TemperPack.

The emerging leadership demonstrated by a number of retailers and consumer brands is driving the growth of the circular economy and improvements in recycling. Leadership means designing products and packaging that are free of any non-recyclable material and profitable for recycling. These packages are manufactured with recycled content, while reducing raw material inputs. Brands are telling their consumers that their commitment is to use recycled content in their packaging. Leaders are transparent in their progress, reporting in their annual reports the use of different recycled feedstocks. They know that any product or package that is not recyclable is destined for a landfill (or even worse, a river or ocean), and that cost is passed to the taxpayer.

Walmart has developed design for recycling guidelines for their suppliers to ensure the products sold in their stores are recyclable and piloting refillable packaging models. Unilever’s Seventh Generation Brand uses mostly recycled HDPE plastic in its packaging and recycled paper in its paper products. And over 10 global companies have invested over $150m in CLP’s investment funds so together we can help spur more innovation and create more tons of recycled feedstock coming through systems in the US.

We are also seeing a major trend amongst consumer goods companies looking to increase their use of recyclable material in the packaging and products they sell. It makes sense. At scale, along with the considerable environmental benefits, it should be less expensive for companies to manufacture using recycled material. That is why most major beverage companies including Coca-Cola, Keurig Dr. Pepper, PepsiCo, Nestle and Danone as well as the world’s largest consumer goods companies such as P&G, Unilever and Colgate Palmolive are publicly communicating aggressive goals for the use of recycled materials in their products and packaging.

For Americans, recycling is a matter of economic self-interest. Recycling our cardboard, paper, beverage bottles, rigid plastics containers, and aluminum cans has three important outcomes. First, it reduces the cost to manufacture the products we buy. Second, it reduces the amount of our taxpayer dollars used every year to pay landfills. Third, it generates revenue for our communities via the sale of recyclable commodities. A recent analysis reported the average cost to dispose of a ton of municipal waste in the US in 2019 was $55 per ton, and disposal fees in some states average more than $100 per ton.

Despite these economic incentives, large parts of the United States still have little or no recycling collection or processing infrastructure. Much of the economic activity generated by recycling is accomplished by long standing recycling programs on the West and East Coast as well as the upper Mid-West of America. For those who live in parts of the country with limited or no recycling infrastructure, their tax dollars are wasted on the cost of sending valuable commodities to landfill that could otherwise be sold. While the 90m tons currently recycled in the United States saves American taxpayers and businesses over $3 billion annually in landfill disposal fees, over 180 million tons of recyclable materials are landfilled, costing American taxpayers and businesses over $5 billion annually in landfills fees. We are literally throwing money in the garbage.

It is also important to recognize how China, which has received much press as of late for their role in the American recycling ecosystem, impacts the industry. For much of the past 20 years, the U.S. recycling industry was dependent on China as the leading export market. As consumption and waste has increased in China, the Chinese government has decided to develop their own domestic recycling infrastructure. This may cause some short-term pain in some parts of the United States’ recycling industry, but leading companies in the recycling industry, consumer goods and packaging industry, as well as a number of investors, see this as an opportunity to further develop and profit from domestic recycling and manufacturing infrastructure.

These are exciting times in the recycling industry as the development of the circular economy continues to expand. Major innovations are entering the industry ranging from robotics to supply chain mapping to advanced technologies that recycle plastics. Like any major industry analysis in the U.S., there is no one or two cities that should be extrapolated to define the industry. There are cities where recycling is profitable and a major economic engine and there are cities where the recycling program is struggling. What is clear is that the cities that focus on limiting contamination in their recycling program, build efficient and effective material recovery facilities and who contract with best in class recycling companies benefit from recycling programs that are both profitable and produce good local jobs.

Leading municipalities, recyclers, manufactures and brands are starting to partner together to establish, and profit from, a circular economy in the United States where goods are continually manufactured using recycled material from local recycling programs. This partnership in developing a circular economy will result in one of the largest investment opportunities in the United States over the next decade, major reduction in landfill disposal fee paid by municipalities, and become a primary driver of job creation in local economies.

We encourage policy makers to build incentives and develop policy to spur the market for recycled content and product and system innovation that reduces waste, creates jobs and makes recycled content competitive with the raw material market.

The Latest Insights and Analysis from Chris Cui, Director of Asia Programs

November 18, 2019

Chris shares her latest thoughts and takeaways from a recent trip to China where she attended the 14th China International Plastics Recycling Conference & Exhibition and visited a local MRF.

China’s Material Recovery Facilities Are Fast Adapting To A Post National Sword World

We gained valuable market insights from policy makers and market practitioners at the 14th China International Plastics Recycling Conference & Exhibition in September in Shanghai. The discussion focused on how stakeholders across the recycling system should work together to develop a domestic closed-loop ecosystem. This means doubling down on collection, transportation, and reprocessing efforts to enable brands to reach their circularity goals. It became clear that the Chinese government is determined and committed to supporting the development of the circular economy in the coming years by carrying out the following policies:

- Implementing a tax to support the recycling industry

- Creating green standards for recycled plastic and for the production of recycled plastic

We saw firsthand the rationale behind these policies that are being considered. Mr. Wang, the Secretary of CRRA, was also quick to note the number of new faces in the room, including brand owners and capital providers, like Closed Loop Partners and the Alliance to End Plastic Waste. This helped to send a strong signal to the recycling industry around the business case for the circular economy.

Chris promoting the circular economy to brand owners & the recycling industry in China, Shanghai.

Witnessing The Transformation Of A Traditional MRF Into A Tech Enhanced One

It’s been three months since mandatory trash sorting was enforced in Shanghai and other big cities across China. We visited a local MRF to see how the new laws have impacted business. Tianqiang, led by CEO Mrs. Hu, has transformed its business model from a MRF to an all encompassing solutions provider, adding collection, reprocessing and production capacity.

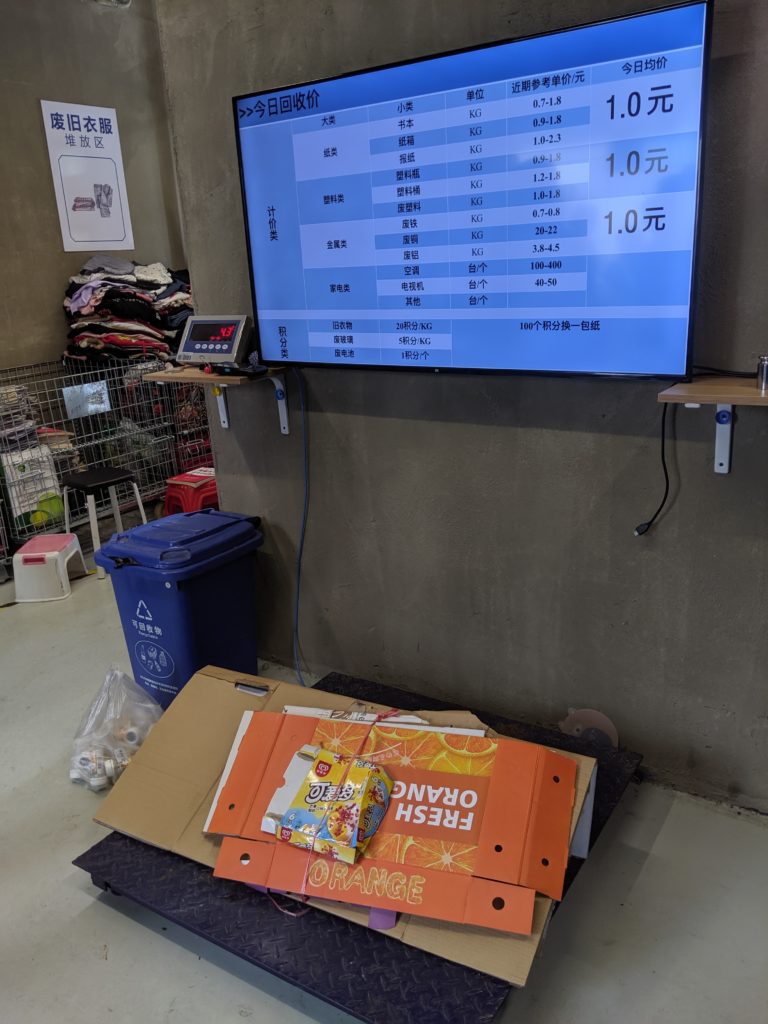

- Tianqiang has implemented technology enabled collection services. They have set up café style smart collection centers with digital scales that are linked to real time commodity prices. Residents get paid immediately by cash or credit according to the commodity price on a given day. Also, operators of the MRF are able to see the exact amount of recyclables collected from each transaction and accumulated at each center on a dashboard. This data helps inform the local government’s waste reduction targets for different communities.

Weighing paper recyclables at Tianqiang.

- Tianqiang is embracing vertical integration. Although their recycled plastic is sold mainly to car and furniture manufacturers, they are also producing their own products such as clothes hangers to sell to retailers. Their recycled paper is being sold directly to the no. 1 and no. 2 paper products manufacturers in China.

- Tianqiang’s collection centers are rent free, strengthening an earlier point that the Chinese government is supporting the development of local recycling infrastructure, for example by providing free land to encourage private sector growth.

Locals separating and sorting recyclables at Tianqiang.

The Latest Insights and Analysis from Chris Cui, Director of Asia Programs

The revision of China’s Solid Waste Management and Pollution Prevention Law could have far reaching impact on brands and recyclers.

A proposed revision to the Solid Waste Management and Pollution Prevention Law in China could affect the operations of brands and recyclers. The revised law entered the review phase at the 13th National Congress on June 25, 2019 and is now seeking public opinion. Below are some key implications of the clauses:

Impact on the packaging industry

Clause 2.13: Companies that produce, use, and store solid waste (SW) should publish their waste management information. Publicly listed companies must also publish their preventive measures against SW pollution.

This represents a significant departure from current protocol. Increased transparency and mandatory reporting requirements for public companies will incentivize companies to invest in SW prevention, potentially providing reputational rewards to those best-in-class. This kind of impact oriented investment fits nicely with the growing interest in ESG investing in China.

Clause 3.20: Producers of SW must pay Environmental Protection Tax.

This would add a new expense for manufacturers that could be passed onto consumers too. The commercial real estate sector in China recently had to adjust to the introduction of this, where previously they did not have to worry about their waste management expenses.

Clause 3.21: The design and production of packaging must follow green production standards that will be set up by the State Market Regulation to reduce waste generation. Producers of materials that fall under mandatory recycling categories must be responsible for the recycling of their materials. The list of mandatory recycling materials will be produced by NDRC (National Development and Reform Committee).

Clause 3.22: The government will encourage R&D institutes and producers to develop and use materials that can be easily recycled, safely stored, and that can decompose in a natural environment. Packaging materials that can’t be easily composted will be banned.

Clause 3.21 and 3.22: It’s encouraging to see that the government is not only promoting recycling, but also the reduction of waste through circular design and materials innovation. This will force brands to adopt circular packaging principles, so there will be a lot of room for innovation in eco-friendly packaging.

Clause 3.42: There will be EPR for electric appliances and other products.

Since 2018, this kind of EPR has been in effect for electric vehicle manufacturers, requiring better lifecycle management across the value chain – from product design and consumption to the recycling and waste management related to electronic vehicles at end-of-use.

Impact on the recycling industry:

Clause 3.28: Permits must be required for the transportation of SW across cities.

Demand for distributed, modular recycling units will grow so that waste can be processed more locally. The need for smart logistics will grow in tandem to optimize for more efficient transportation routes, among other things.

Clause 3.29: There should be a complete solid waste import ban by 2020.

While there has been a lot of speculation in the U.S. regarding whether or not China will implement a total waste import ban by late 2020, as declared in 2017, it is clear that the Chinese government plans to move ahead with this.

Clause 3.57: There will be differential charging schemes for residential waste.

The mandatory sorting of residential waste was introduced in certain pilot cities in China on July 1, 2019. In a district in Shanghai, it now costs $17 USD to dispose of 120 liters of food waste. You can read more about this on our blog on Recycling Rises to Power in China.

Although we do not know how likely it is that all of the proposed revisions will pass or when, the fact that there are so many proposed changes to the current law, which came into force in 1995, and that they’ve gone all the way to the desk of the National Congress, is a signal that waste management is a high priority for the central government. By reviewing the proposed changes, companies in China and abroad can better prepare for what’s coming down the line.

Unlike Europe, where the circular economy is championed by investors, the government, and consumers, in China it’s the government taking the driver’s seat. The proposed revisions to the law illustrate the steps the government is willing to take to develop the circular economy in China. In turn, industries are taking note and are seizing the subsequent business opportunities.

I would encourage brands that consider China as one of their key markets to give serious thought on how they can create a circular advantage to meet the growing demand for sustainable products in China before their competitors do. This will be critical in a context where a country is implementing increasingly strict solid waste management laws.

The reform on plastic pollution in China, the next big thing after National Sword?

At the 10th meeting of the Central Committee for Deepening Overall Reform on September 9th, chaired by the Chinese President, plastic waste reform was listed as a key issue. The following was cited:

“Actively responding to plastic pollution by restricting the production, sale, and use of some plastic products, actively promoting recyclable and biodegradable substitute products, and regulating plastic waste.”

We are still waiting for a detailed reform plan, but this is another huge boost for the development of a circular economy in China, supported by the government. Brands and recyclers in China and overseas should start to prepare for the changes brought by a reform like this.

The Key Takeaways from Fortune’s First Global Sustainability Forum:

This September, in Yunnan, China, I attended Fortune’s first Global Sustainability Forum, speaking on a panel on Waste Not. The Forum dived deep into the business opportunities and challenges that arise from the transition from a linear to circular economy, highlighting the following key points:

- There are three key driving forces behind circularity: increasing shareholder activism and interest in public companies’ ESG commitments; public awareness among consumers on the environmental footprint of products and services; and growing regulation in Europe and Asia to tackle waste issues, especially plastic pollution.

- Finance is slowly but surely reckoning with the economic risks posed by climate change and other environmental threats. ICBC, the world’s largest bank by assets, ran a stress test in 2015 and, we learned, issues higher interest loans to firms that are over-exposed to environmental hazards. The stress tests began in 2015, and have changed the way Chinese banks look at the businesses they fund, now reducing their exposure to coal projects and increasing their exposure to renewable energy.

- Building sustainable supply chains is challenging due to limited transparency around data, a lack of focused financing, and water and waste management typically being too cheap to account for negative externalities. Labor specific issues also often take precedence.