Why We Invested in Molg: Supporting the Circular Economy for Critical Minerals Through Electronics Recovery

May 31, 2023

This blog is part of our “Why We Invested” series, which offers a deep dive into our most recent investments and the growing circularity trends in the space.

Over the past few months, the dialogue around sourcing critical minerals for the clean energy transition has reached a fever pitch. In March, we highlighted the three pain points to critical mineral recovery that have been largely absent from discussions: (1) valuable streams of recoverable domestic materials are currently overlooked; (2) existing processing techniques are leaving value on the table; and (3) geographic silos are disadvantaging both suppliers of recovered materials and manufacturers. Today, we’re excited to share how one of the newest portfolio companies of Closed Loop Partners’ Ventures Group, Molg Inc., is moving the needle on critical mineral recovery through advancing design-for-disassembly and deconstruction.

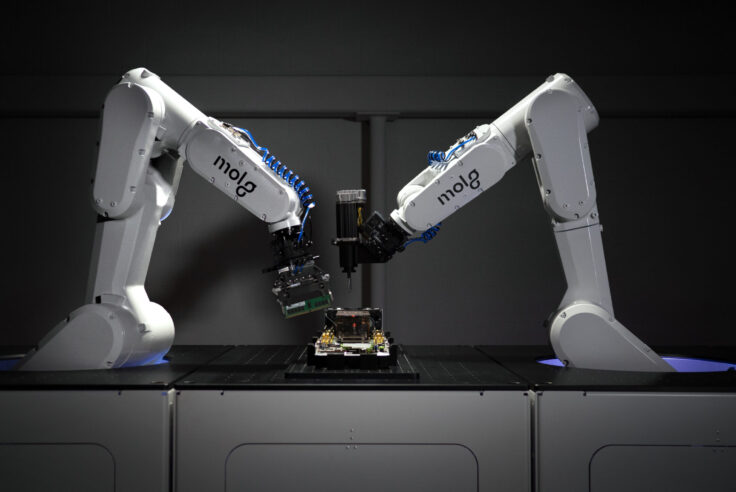

Molg uses robotics and design software to ensure one product’s end is another’s new beginning––enabling a circular manufacturing process. Led by Co-Founders Rob Lawson-Shanks and Mark Lyons, Molg provides a full suite of solutions to improve the disassembly of existing electronic products––from servers to laptops to handheld electronics. We invested in Molg because circularity is at the core of why and how this team operates. They think outside the box of traditional, linear systems, understanding that just because products have always been designed one way, doesn’t mean that process should continue. They are also committed to recapturing as much material as possible––including those previously designed in non-recoverable ways––recognizing that even products lacking optimized designs can be recovered profitably at scale. That’s a circular economy.

- Molg is targeting a historically overlooked source of critical materials in the U.S.: end-of-life electronics. Much of the unused critical materials needed for advancing the clean energy transition are not domestically available at scale in the U.S. and may be sourced from regions challenged with human rights breaches, water scarcity or geopolitics. However, much of the minerals needed already exist in our end-of-life electronics in the U.S.––both in commercial and individual use cases. Molg is committed to capturing and recovering the materials from these sources and, through direct CAD integrations, has a pathway to do so for a diverse variety of products.

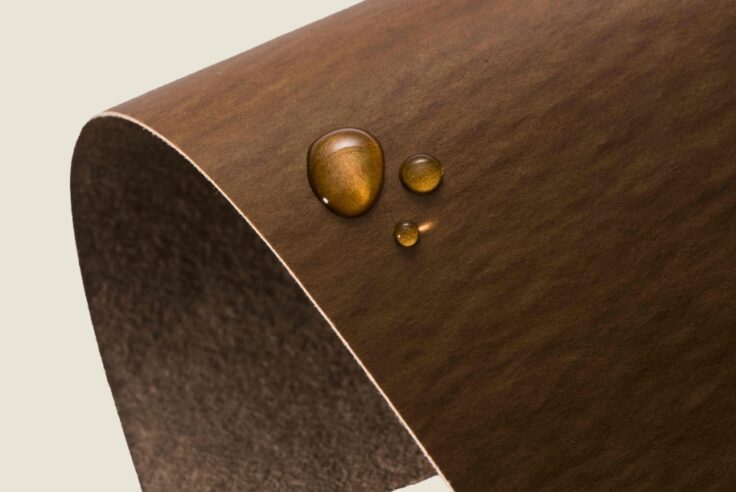

- Molg’s robotic disassembly processes maximize the value from recovered materials. Traditional recovery processes prioritize shredding materials and then using chemicals to deconstruct those materials down to monomers, capturing only those worth the highest value, and losing value in the process. By starting with disassembly, Molg can close a tighter loop––keeping still usable materials in their original form factor––and accelerating reuse while ensuring feedstock that can be recycled.

- Molg’s micro-factory approach allows for localized recovery where the materials are most needed––minimizing transport costs that may otherwise challenge recovery economics. End-of-life electronics are heavy and transporting them costs money. By advancing pathways to disassemble electronics on-site through their micro-factories, Molg allows processors to get to single source feedstocks sooner, removing the need for sortation and processing that may have required transport before recycling could take place.

What the Molg team is building is just one part of the broader recovery ecosystem. The involvement of the entire value chain is needed––from aggregators, sorting and recertification infrastructure, metal processors and manufacturers who are prepared to use recycled feedstocks in their processes. This also includes designers prepared to take on the challenge of designing for disassembly, and regulators who view these waste products as a primary source of materials and worthy of being prioritized. There is a promising opportunity ahead for critical minerals, and at Closed Loop Partners, we’ll continue to invest in companies that strive to push circularity for these materials forward.

Interested in learning more about Molg? Tune in to Circularity23 where the team will be pitching for Accelerate for Circularity!

About Closed Loop Partners

Closed Loop Partners is at the forefront of building the circular economy. The company is comprised of three key business segments. Closed Loop Capital Management manages venture capital, growth equity, buyout and catalytic private credit investment strategies on behalf of global corporations, financial institutions and family offices. The Center for the Circular Economy unites competitors and partners to tackle complex material challenges and implement systemic change to advance circularity. Circular Services employs innovative technology within reuse, recycling, remanufacturing and re-commerce solutions to improve regional economic and environmental outcomes, and build resilient systems that keep food & organics, textiles, electronics, packaging and more, in circulation and out of landfill or the natural environment. Closed Loop Partners is based in New York City and is a registered B Corp. For more information, please visit www.closedlooppartners.com.

About Closed Loop Ventures Group

Closed Loop Partners’ venture capital arm launched in 2017 with one of the first venture funds dedicated solely to investing in early-stage companies developing breakthrough solutions for the circular economy. The Closed Loop Ventures Group targets leading innovations in material science, robotics, agritech, sustainable consumer products and advanced technologies that further the circular economy.

The Closed Loop Venture Fund II builds on the venture capital group’s first fund’s strategy, supported by an existing portfolio with strong financial performance, coupled with robust environmental and social impact. HomeBiogas, one of the early investments of the Closed Loop Venture Fund I is a leader in developing biogas systems that transform organic waste into clean energy and bio-fertilizer. They announced their $94 million initial public offering (IPO) in Israel in 2021, accelerating the company’s growth into additional markets, including North America. To date, the company has sold over 10,000 systems in more than 100 countries. Algramo, another investment of Fund I, developed a reuse system powered by vending machines that dispense household products into smart reusable packaging. With the investment and support of Closed Loop Partners, the Chile-based company expanded into North America, now piloting their reuse systems in New York City, while also having piloted with leading brands such as Walmart and Unilever in other geographies.

About Molg Inc.

Molg tackles the growing e-waste problem by making manufacturing circular. The company’s robotic microfactory can autonomously disassemble and reassemble complex electronic products like laptop PCs, servers, and handheld electronics, helping keep more valuable materials within supply chains. Molg partners with leading electronics manufacturers to design the next generation of products with reuse in mind, ensuring that one product’s end is another’s beginning. To learn more, visit molg.ai.

Disclaimer:

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

Related posts

Blog Post

How AI Can Reduce Food Waste at Restaurants

Closed Loop Ventures Group led the seed investment...

Blog Post

Why We Invested in Mycocycle: Nature-Inspired Circular...

Closed Loop Partners’ Ventures Group saw a key opportunity...

Press Release

Closed Loop Partners Leads $4M Seed Round for LAIIER,...

Investment in the innovative liquid leak detection...

Blog Post

Making Circularity Stick: Electronics

A conversation with Rob Lawson-Shanks, CEO of Molg...

Press Release

Closed Loop Partners Doubles Down on Investment in...

Closed Loop Ventures Group joins Earthodic's $4 million...

Blog Post

Why We Invested in Neutreeno: Engineering Circular...

Neutreeno offers a game-changing solution that seamlessly...

Press Release

Molg Raises $5.5 Million in Seed Funding to Tackle...

Closed Loop Partners' Ventures Group leads seed funding...

Blog Post

How the Apparel Industry Is Challenging Us to Think...

The high cost of textile waste has sparked the need...

Blog Post

Why We Invested in Aerflo: Making Reuse an Everyday...

Closed Loop Ventures Group is thrilled to announce...

Blog Post

Why We Invested in Capra Biosciences: How Microbes...

Today, we are witness to a rapidly changing manufacturing...

Blog Post

Why We Invested in VALIS Insights: Bringing Circularity...

Closed Loop Partners invested in VALIS Insights because...

Blog Post

Why We Invested in Found Energy: The Importance of...

Closed Loop Ventures Group invests in Found Energy,...