Why We Invested in Capra Biosciences: How Microbes Are Changing Manufacturing

April 29, 2024

Today, we are witness to a rapidly changing manufacturing landscape, driven by demand for low cost, resilient (localized and more distributed) manufacturing and processing, with less reliance on feedstocks from complex global supply chains. In addition to AI, robotics and other advances in manufacturing, we see immense opportunity in the efficiency of the smallest of organisms: the microbe.

Microbes are behind well-known industrial processes: from yeast for leavening bread or producing ethanol to acetic acid bacteria for vinegar production. These processes typically start with some sort of carbohydrate or sugar-rich feedstock, in which the living organisms are added and allowed to eat their way through the feedstock in a process known as fermentation. Closed Loop Partners has long been exploring the prospect of using microbes to advance circularity, such as creating energy from food waste––as seen through the work of one of our earliest portfolio companies, HomeBiogas. Today, we are seeing even more opportunities for microbes to change the way we produce, and this drove our investment in Capra Biosciences.

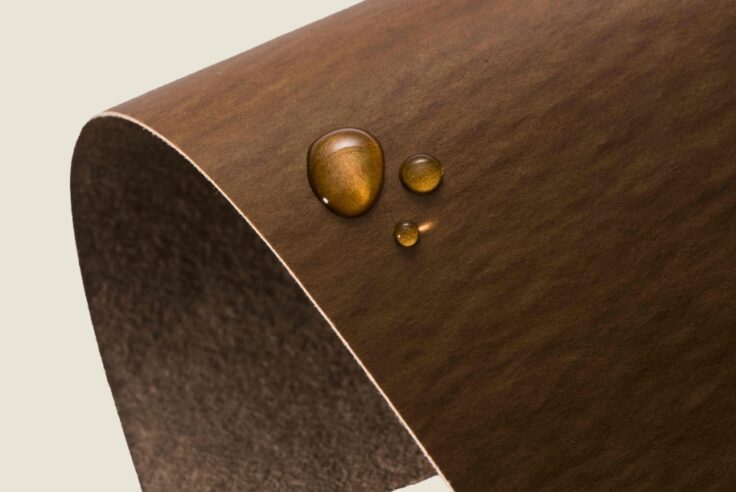

Capra sits at the confluence of synthetic biology, resilient supply chains for national defensive strategies, and sustainable consumption. Capra leverages a unique microbe to consume organic feedstocks (like food waste) and convert those materials into high value molecules that are direct replacements for petrochemical-derived products. This can range from molecules used in cosmetics to high value lubricants.

In taking these waste feedstocks and upcycling them into some of the highest value end products, Capra demonstrates how synthetic biology sits at the heart of the circular economy:

- Reducing reliance on extractive industries: Capra is displacing petroleum-based feedstocks for hydrophobic chemicals. This eliminates the need for extractive mining processes and instead leverages waste feedstock to produce high value commodity products at a price point that is competitive with market incumbents.

- Leveraging waste feedstock: Synthetic biology is often reliant on sugars as feedstock for the microbes, which come from net new agricultural production. Capra is starting with food-waste derivatives that are widely available. By giving these materials another life, Capra diverts food waste from landfill and offers a more sustainable product.

- Process-flow material recovery: An ideal system is one in which the microbes and solvents can be recovered after one pass through the system, leaving a close to zero waste process and positively impacting unit economics.

- Distributed, on-site generation: Capra’s technology design allows for continuous flow and modularity, meaning they can convert waste carbon sources such as food waste into high value chemistries onsite. By keeping production and distribution local and integrated, their process helps reduce emissions associated with transportation.

Given the promise of synthetic biology, we are proud to be backing the expert team of Liz Onderko, PhD and Andrew Magyar, PhD, co-founders of Capra Biosciences. We have compiled a diverse syndicate of support, including SOSV, GS Futures, First Bight, E14 and others to support Capra in their work to make high performance and affordable renewable chemicals for the circular economy. Learn more about Capra Biosciences here or reach out to [email protected].

About Capra

Capra Biosciences is venture-backed startup company focused on sustainable production of petrochemical replacements from waste carbon using their proprietary bioreactor platform. Capra Biosciences is located in Sterling, VA. To learn more about the company, visit www.CapraBiosciences.com

About the Closed Loop Ventures Group at Closed Loop Partners

Closed Loop Partners is at the forefront of building the circular economy. The company is comprised of three key business segments: its investment arm, Closed Loop Capital Management; its innovation center, the Center for the Circular Economy; and its operating group, Circular Services. Closed Loop Capital Management manages venture capital, buyout private equity and catalytic private credit investment strategies. The firm’s venture capital group, the Closed Loop Ventures Group, has been investing early-stage capital into companies developing breakthrough solutions for the circular economy since 2016. The Closed Loop Ventures Group’s portfolio includes companies developing leading innovations in material science, robotics, agritech, sustainable consumer products and advanced technologies that further the circular economy. Closed Loop Partners is based in New York City and is a registered B Corp. Closedlooppartners.com.

—

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Partners or any company in which Closed Loop Partners or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Information provided reflects Closed Loop Partners’ views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision.

Related posts

Press Release

Closed Loop Partners Doubles Down on Investment in...

Closed Loop Ventures Group joins Earthodic's $4 million...

Blog Post

Why We Invested in Neutreeno: Engineering Circular...

Neutreeno offers a game-changing solution that seamlessly...

Press Release

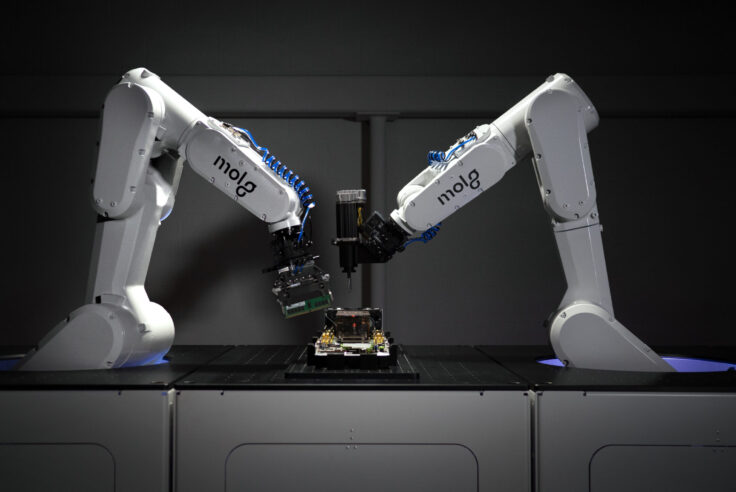

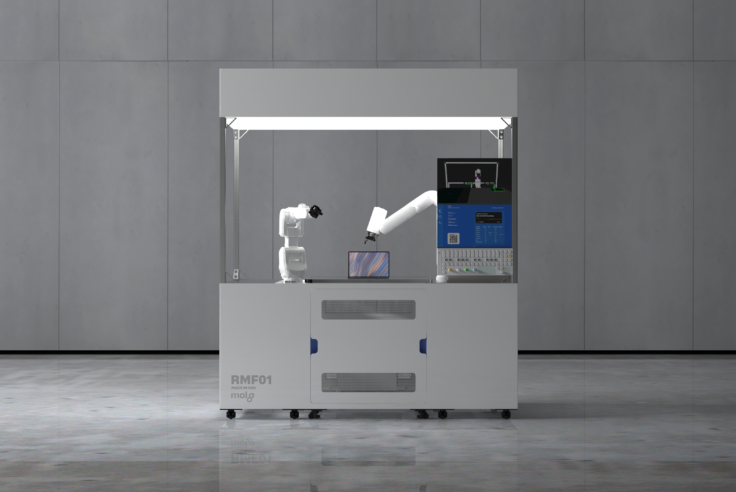

Molg Raises $5.5 Million in Seed Funding to Tackle...

Closed Loop Partners' Ventures Group leads seed funding...

Blog Post

How the Apparel Industry Is Challenging Us to Think...

The high cost of textile waste has sparked the need...

Blog Post

Why We Invested in Aerflo: Making Reuse an Everyday...

Closed Loop Ventures Group is thrilled to announce...

Blog Post

Why We Invested in VALIS Insights: Bringing Circularity...

Closed Loop Partners invested in VALIS Insights because...

Blog Post

Why We Invested in Found Energy: The Importance of...

Closed Loop Ventures Group invests in Found Energy,...

Blog Post

Why We Invested in Molg: Supporting the Circular Economy...

Closed Loop Ventures Group shares how Molg Inc. is...

Blog Post

Putting Recovery at the Center of the Critical Minerals...

At Closed Loop Partners, we see significant opportunity...

Press Release

With Investment from Closed Loop Partners, Hyran Technologies...

Hyran Technologies (Hyran), a collaborative, AI-driven...

Blog Post

That’s the Circular Economy: How A Logistics Company...

A full logistics center inside a shopping mall––this...

Blog Post

How the Inflation Reduction Act Will Accelerate the...

Earlier this week, the United States Congress passed...