Closed Loop Partners Provides New Funding for Midwest Recycling Program

December 19, 2022

The equipment upgrades will provide more than 1,600 tons of additional capacity and allow for the capture of an additional 900,000 pounds of materials each year

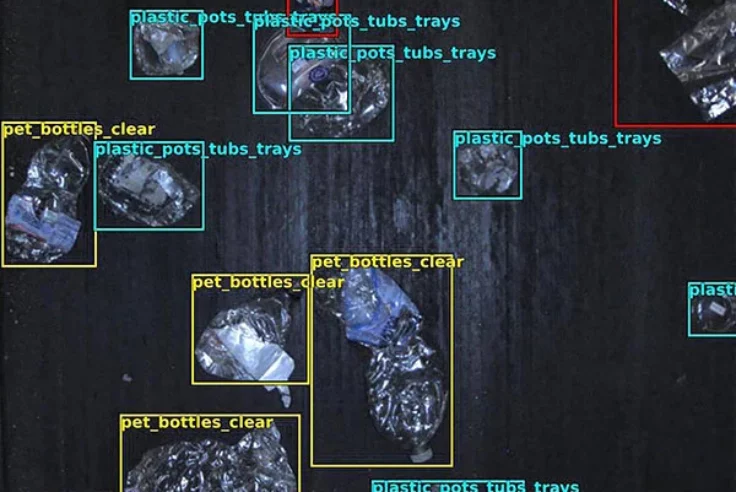

NEW YORK, NY—December 19, 2022—Closed Loop Partners announced Monday that its Closed Loop Infrastructure Fund (CLIF), together with its Circular Plastics Fund (CPF) and Beverage Fund (CLBF), closed a third loan to the Waste Commission of Scott County (WCSC) in Iowa. The $5 million loan will support equipment upgrades at the county’s materials recovery facility. WCSC will purchase three new optical sorters to increase and improve the facility’s sorting capacity.

The Closed Loop Infrastructure Group, which is responsible for managing and deploying capital from four different investment funds, including CLIF, provided financing to Scott County in 2015 and 2018 to support infrastructure improvements and purchase recycling carts now in use by the county’s residents.

“Investing in modernizing recycling infrastructure is critical to ensuring that valuable materials are pulled back into supply chains at end of life, and never go to waste,” said Jennifer Louie, Managing Director at Closed Loop Partners. “Scott County has made significant progress over the years to advance resilient recycling systems. We are proud to continue our support of their work, grow material recovery capabilities and strengthen local circular economy infrastructure.”

The new loan will help grow the processing of valuable recyclable materials throughout the region. When installed the equipment upgrades will provide more than 1,600 tons of additional capacity and allow for the capture of an additional 900,000 pounds of materials each year.

“Scott County is the third largest county in Iowa and WCSC’s service area reaches 75,000 households,” said Kathy Morris, Director of the Waste Commission of Scott County. “The new equipment helps us increase our tonnage and diversion rates so that we’re diverting more waste from the landfill and into efficient recycling systems.”

About Closed Loop Partners

Closed Loop Partners is at the forefront of building the Circular Economy. The company is comprised of three key business segments: an investment firm, innovation center and operating group. The investment firm invests in venture, growth equity, buyout and catalytic private credit strategies on behalf of global institutions, corporations and family offices. The innovation center, the Center for the Circular Economy, unites competitors and partners to tackle complex material challenges and implement systemic change to advance circularity.

The operating group, Circular Services, has twelve recycling facilities in operation today, and provides holistic, circular materials management to close the loop on valuable materials for municipalities and businesses throughout the United States. Employing innovative technology within reuse, recycling, remanufacturing and re-commerce solutions, Circular Services improves regional economic and environmental outcomes by building resilient systems to keep food & organics, textiles, electronics, packaging and more, in circulation and out of landfill or the natural environment.

Closed Loop Partners is based in New York City and is a registered B Corp. For more information, please visit www.closedlooppartners.com.

About the Closed Loop Infrastructure Fund at Closed Loop Partners

Established in 2014 and funded by some of the world’s largest retailers, corporate foundations, technology and consumer goods companies. The Closed Loop Infrastructure Fund provides below-market rate loans to finance projects that build out circular economy infrastructure in the United States. Investors include 3M, Amazon, Coca-Cola, Colgate-Palmolive, Johnson & Johnson, BlueTriton, Keurig Dr Pepper, Procter & Gamble, PepsiCo, Danone North America, Danone Waters, Starbucks, Unilever and Walmart Foundation. Learn more about the Fund’s investment criteria and apply for funding here.

About the Closed Loop Circular Plastics Fund at Closed Loop Partners

The Closed Loop Circular Plastics Fund provides catalytic financing to build circular economy infrastructure and improve the recovery of polypropylene and polyethylene plastic in the U.S. & Canada, returning plastics to more sustainable manufacturing supply chains for use as feedstock for future products and packaging. Investors include Dow, LyondellBasell, NOVA Chemicals, Sealed Air and SK Geo Centric Co. Ltd. Learn more about the Fund’s investment criteria and apply for funding here.

About Closed Loop Beverage Fund at Closed Loop Partners

In partnership with the American Beverage Association, the Closed Loop Beverage Fund seeks to improve the collection of the industry’s valuable plastic bottles so they can be made into new bottles through investments in recycling and circular economy infrastructure in the United States. Learn more about the Closed Loop Beverage Fund here.

Disclaimer:

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

Related posts

Press Release

Closed Loop Partners’ Portfolio Company, Sage Sustainable...

The bolt-on acquisition scales Sage’s end-to-end...

Press Release

Closed Loop Partners Unveils Groundbreaking Findings...

Closed Loop Partners’ Center for the Circular Economy...

Blog Post

8 Tips to Navigate Life Cycle Assessments for Circular...

Closed Loop Partners’ Center for the Circular Economy...

Blog Post

Scaling Circular Solutions: Why Access to the Right...

A case study on the growth of Minus Works, a company...

Press Release

Paper Cup Recycling Hits New Milestone in the U.S....

The NextGen Consortium and Foodservice Packaging Institute...

Press Release

Closed Loop Partners Provides Financing to Olyns, a...

The catalytic loan will help scale production of Olyns’...

Press Release

Circular Services Acquires Midwest Fiber Recycling,...

The acquisition of a leading Midwest recycling company...

Press Release

Closed Loop Partners Invests in Circular Manufacturing...

The loan from Closed Loop Partners’ Infrastructure...

Press Release

New Report from the NextGen Consortium Shares Path...

Insights include solutions for paper mills, material...

Reuse

Blog Post

When Reusable Cups Reach End-of-Life: 5 Tips to Ensure...

The NextGen Consortium shares 5 tips to ensure reusable...

Press Release

How AI Could Change the Way We Think About Recycling

Closed Loop Partners’ Center for the Circular Economy...

Blog Post

How Closed Loop Partners’ Multi-Million Dollar Investment...

This is Closed Loop Partners’ third loan to LRS,...