Industry Case Study

Insights on companies on-the-ground

The Opportunities and Challenges in Developing Distributed Molecular Recycling Systems in a Circular Economy

In November 2021, Closed Loop Partners released its latest report on molecular recycling, Transitioning to a Circular System for Plastics: Assessing Molecular Recycling Technologies in the United States and Canada. As part of this study, our team released a series of case studies meant to highlight best practices and lessons learned from molecular recycling companies advancing these technologies on-the-ground.

Background

Between 2020 and 2021, Closed Loop Partners and its Center for the Circular Economy conducted an 18-month study of molecular recycling technologies and their role in a circular plastics economy. The summary of the financial, supply chain, environmental, and human health impact analyses is detailed in the report, Transitioning to a Circular System for Plastics: Assessing Molecular Recycling Technologies in the United States and Canada.

As part of this study, our team also sought to evaluate the potential of modular and small-scale recycling technologies. Plastic waste is a distributed challenge so we wanted to evaluate the role that distributed, modular solutions could play.

With increasing disruptions and delays experienced across global supply chains, made worse by the pandemic and extreme weather events, our team also sought to explore the important role of local manufacturing networks in building resilience. Our goal was to summarize key financial metrics related to modular, molecular recycling solutions in order to share with investors and plastic recycling stakeholders to help evaluate their role in a circular plastics future.

Overview of the Technologies

For this case study, small-scale molecular recycling is defined as those technology processes whose design allows for annual throughput capacity of less than 12,000 metric tons (1). A modular system is defined as one which allows for “pre-designed” components that can be manufactured to a single design and combined together to make larger units vs projects that must be designed to a specific scale for each effort. These molecular recycling technology processes leverage chemical solvents, thermal heat, or enzymes to purify or break down plastic waste into polymer, oligomers, monomers, or hydrocarbon products that can be sold in the market.

While our main study focused on a broader set of molecular recycling technologies, including purification, depolymerization, and conversion technologies, all the technology companies evaluated for the small-scale modular case study that fit the criteria above are classified as conversion technologies (i.e. pyrolysis, gasification and pyrolysis-to-gas). A primary reason for this is because purification and depolymerization commercial facility sizes typically fall between 15,000 and 40,000 metric tons per year; units smaller than this are typically for demonstration purposes only and/or not economically viable. In contrast, conversion technologies have the capability to operate at a smaller scale, profitably, and usually serve a specific use case for local waste management (i.e. local fuel production, localized energy production, local processing of ocean plastics, private and safe processing of waste for a corporate entity or government, etc.).

About the companies in this case study

Recycling Technologies: Recycling Technologies Ltd, a UK-based company founded in 2011, developed a proprietary, patented technology to recycle mixed plastic waste. The RT7000 is a pyrolysis technology that transforms plastic waste into Plaxx®, a chemical feedstock for plastic production. The RT7000 is a modular technology that can process most types of plastics that are not routinely recycled, such as soft and flexible packaging (e.g., films), multi-layered and laminated plastics (e.g., crisp packets), complex or even contaminated plastic (e.g., food trays). In 2020, Recycling Technologies secured an important investment with two strategic industry investors, Neste and Mirova, leaders in renewable products and sustainable investments––forming valuable collaborations between the recycling industry and financial services to enable strategic and profitable circular solutions for plastic waste.

Renew One (formerly Renewlogy): Founded at MIT, Renew One aims to be a technology leader in developing solutions for landfill-bound waste. The company operates a research & demonstration facility in Salt Lake City, Utah, which converts low-value plastics into petrochemical products, and demonstrates innovative pre-processing for mixed plastic waste. The company’s proprietary molecular recycling process allows the company to reverse plastic back into its basic molecular structure, converting non-recycled plastic waste into new valuable products such as high-value petrochemical feedstocks. Their process is continuous, automated and able to accept contaminated, mixed streams of plastics.

Synova: Founded in California in 2012, Synova is headquartered in the Netherlands with teams in the USA and Bangkok. Synova’s technology is a spin-out and partnership with the Netherlands Organization for Applied Scientific Research (TNO). Synova’s patented process converts plastics and biomass in a single step, into a gas rich in plastic feedstocks (i.e. ethylene, propylene, benzene, C4 olefins.). At ~750°C, the process has wide feedstock tolerance, accepting mixed and multi-material plastics with contaminants (i.e. paper, cloth, food, moisture, wood, sand, cardboard, rubber) in commercially available refuse-derived fuel (RDF) which is plentiful and cheap. Modular design allows scaling from (150+ tons per day) to smaller prefabricated units (~30 tons per day). Synova is engaged with petro-chemical leaders to produce “green” plastics feedstocks and fuels, including its recent strategic partnership with Technip energies, a leader in building plastic production infrastructure.

3 Key Takeaways

Small-scale molecular recycling technologies have lower CapEx setup costs on an absolute and normalized basis compared to larger-scale molecular recycling facilities. However, an absence of subsidies and policy mandates to encourage plastics recycling, in markets like the United States, creates variable rates of return among the technologies we evaluated.

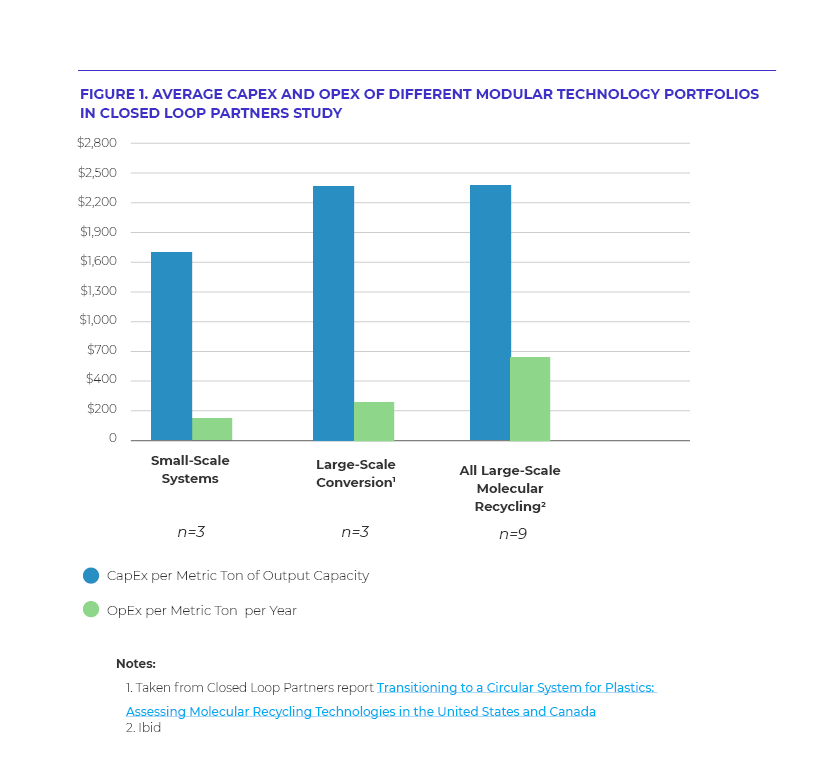

The average throughput capacity of all three small-scale conversion processes is 6,300 metric tons per year; the average CapEx set up costs is $11.1 million dollars (USD). Compared to the larger scale conversion processes in our main study, which had an average annual throughput of approximately 150,000 metric tons per year and required, on average, $275 million dollars to be built (i.e. total CapEx average in Year 0), small-scale molecular recycling units are a fraction of the cost. These smaller units also appear to be more capital efficient on a normalized basis. The CapEx needed per metric ton of feedstock processed is only $1,700 for small-scale units compared to an average CapEx per metric ton of $2,400 for larger-scale conversion technology processes, possibly due to feedstock constraints and additional processing costs that are passed downstream. Figure 1 shows the average CapEx costs for small-scale molecular recycling units compared to the cost of a conversion facility on a normalized basis.

The key of these small-scale units is the speed at which they can be set up and the size of real-estate required which can be a benefit in many densely populated locations where plastics waste concentration is high. In our interviews, most of the molecular recycling companies commented that their technology could be pre-fabricated and shipped around the world in shipping containers. Contrast that to the often multi-year process spent raising capital to finance building a large-scale molecular recycling facility; small-scale solutions could be developed more quickly and serve hyper-local wastesheds (2).

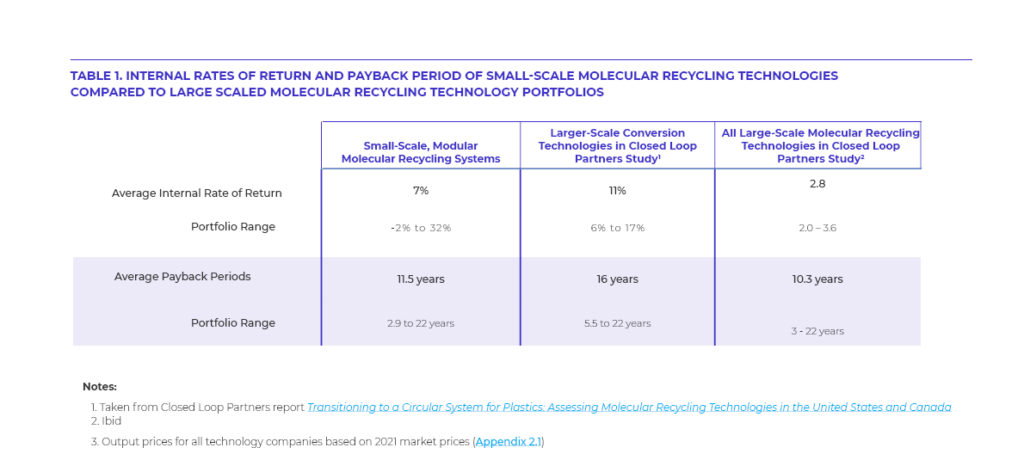

Our case study looked at the projected internal rate of return and payback periods of small-scale systems and compared that to larger-scale technology processes. In order to model how these small-scale distributed processes could integrate into a U.S. market, where to-date, there are no subsidies or tax credits provided for processing plastic waste, we modeled all technologies on the same set of assumptions for tipping fees and output pricing, in line with our main study (see Appendix 2.1). The average IRR observed in the small-scale cohort was 7%, which is in line with the lower-end of the conversion internal rate of return that we observed in our study. The payback periods of small-scale technology processes, however, were among the shortest that we evaluated; this is due to the low CapEx setup costs for these technology processes. The shortest payback period in the small-scale molecular recycling cohort was 2.9 years. Technology processes with the longest payback period had higher CapEx costs amongst the small-scale cohort and would rely on subsidies in markets that they operate in. Table 1 summarizes the internal rate of return observed in this case study and compares that to the average IRRs and payback periods of the larger-scale conversion technologies.

The key of these small-scale units is the speed at which they can be set up and the size of real-estate required which can be a benefit in many densely populated locations where plastics waste concentration is high. In our interviews, most of the molecular recycling companies commented that their technology could be pre-fabricated and shipped around the world in shipping containers. Contrast that to the often multi-year process spent raising capital to finance building a large-scale molecular recycling facility; small-scale solutions could be developed more quickly and serve hyper-local wastesheds.

Our case study looked at the projected internal rate of return and payback periods of small-scale systems and compared that to larger-scale technology processes. In order to model how these small-scale distributed processes could integrate into a U.S. market, where to-date, there are no subsidies or tax credits provided for processing plastic waste, we modeled all technologies on the same set of assumptions for tipping fees and output pricing, in line with our main study (see Appendix 2.1). The average IRR observed in the small-scale cohort was 7%, which is in line with the lower-end of the conversion internal rate of return that we observed in our study. The payback periods of small-scale technology processes, however, were among the shortest that we evaluated; this is due to the low CapEx setup costs for these technology processes. The shortest payback period in the small-scale molecular recycling cohort was 2.9 years. Technology processes with the longest payback period had higher CapEx costs amongst the small-scale cohort and would rely on subsidies in markets that they operate in. Table 1 summarizes the internal rate of return observed in this case study and compares that to the average IRRs and payback periods of the larger-scale conversion technologies.

Small-scale molecular recycling solutions can help create additional revenue streams for materials recovery facilities by paying for their “residues” and transforming them into something of value, in doing so diverting material from landfill. Larger-scale molecular recycling solutions have business models that economically incentivize upstream stakeholders to support their operations.

All nine molecular recycling technology companies that we evaluated in our main study required some level of feedstock preprocessing. For the larger-scaled processes, including some conversion companies, this meant that these companies were paying for feedstock, going as far as economically incentivizing their feedstock suppliers (i.e. material recovery facilities (MRFs)) to limit contamination to ensure the quality of their own outputs. Some companies were receiving nominal tipping fees for accepting plastic waste, but this made up less than 5% of their total revenue.

Small-scale conversion processes took one of two feedstock procurement approaches which directly correlated to the technology process’ feedstock constraints. The first approach was to co-locate or contract with MRFs to process residual plastic waste at no-cost or a low-cost which was less than landfilling. The second approach was to bypass the MRF altogether and charge a tipping fee to process mixed waste (i.e. polycotton blends, refuse derived fuel) from customers. All three of the small-scale molecular recycling companies in our study generated 10 to 20% of their total annual revenue from tipping fees.

The United States has some of the lowest landfill tipping fees among the world’s developed countries, which challenges any business model that competes for material that is currently sent to landfill. We observed that small-scale molecular recycling companies were able to reduce their customers’ operating costs (i.e. residue/disposal costs). However, these same companies can not support paying for feedstock and may be at risk of feedstock dislocations in an absence of policy or long-term contracts with suppliers.

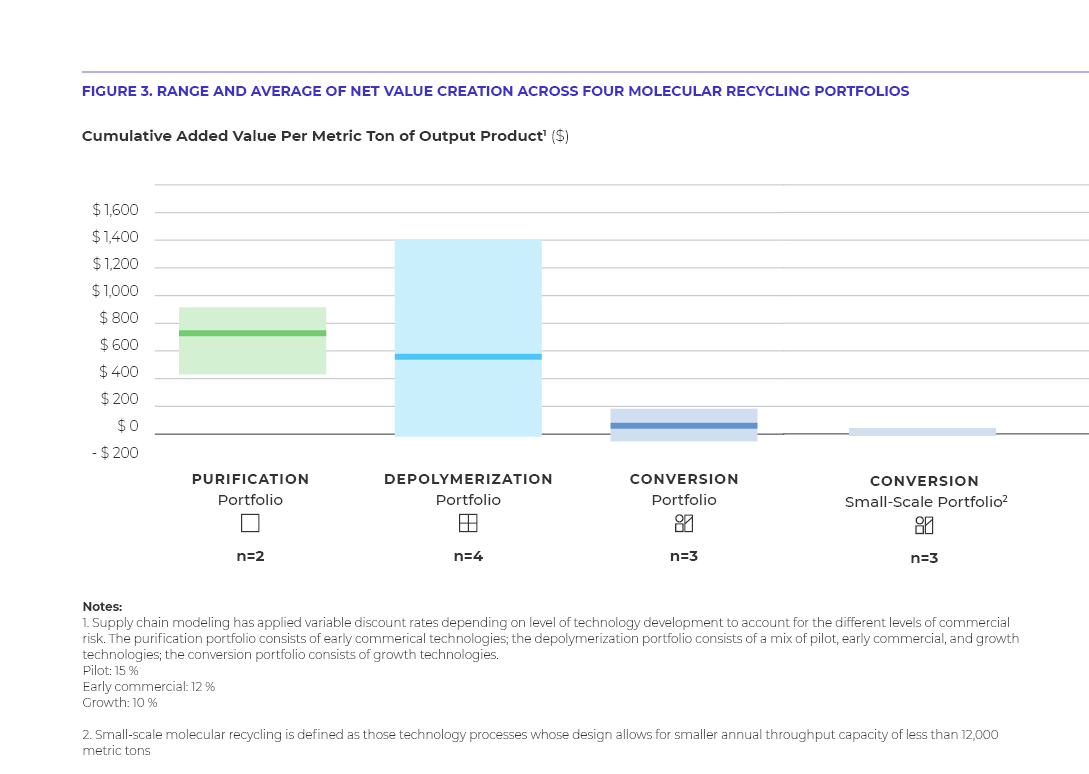

At this time, small-scale molecular recycling technologies are producing energy or a pyrolysis oil that requires upgrading to looped back into the plastics supply chain. Their customers are not looking to extract the maximum value out of waste, rather they are entities who benefit from receiving carbon credits from diverting waste from landfill (in markets that offer this) or campus operations wanting on-site waste management solutions (e.g. hospital). Based on the data we’ve gathered across our study, it appears that larger-scale processes are able to deliver more economic value to the existing value chain today. Figure 3 summarizes the value delivered by each technology process and where modular companies fall in that range.

Continued innovation and collaboration is required to scale a distributed molecular recycling system.

There is strong interest to integrate distributed molecular recycling technologies into the circular plastics economy, but technology and system barriers persist. All three small-scale molecular recycling companies are marketed as solutions to support the circular plastics economy; this represents a goal to-date, and this segment of the molecular recycling sector is early in its development.

There are opportunities to align technology to the needs and end markets in the circular plastics economy. For example, one technology company in the small-scale cohort mentioned that their output needs to be upgraded (i.e. hydrotreated) in order to integrate into downstream plastics manufacturing supply chains, a common but nonetheless extra cost and step that can become a barrier to incentivize using outputs from molecular recycling in plastics production. Such upgrading may need to be performed at a central location close to the off-take since transportation may cause chemical degradation.

Other companies in our study that offer multiple technology units, both large-scale and small, noted that their small scale units had been optimized for energy production with its existing distributed offtake network, while their larger units were more ideal for plastics-to-plastics recycling due to the size of existing offtake customers for plastics feedstocks. Petrochemical companies, for now, seem focused on large-scale molecular recycling processes, since these can more easily integrate with their centralized plastics infrastructure, and leverage common downstream investments (e.g. steam cracker, cleaning, production). In comparison to the petrochemical industry’s scale, large-scale molecular recycling solutions are considered small-scale. Also, as fuel costs have increased, transportation costs have also increased. This influences the total transportation costs of off takers to aggregate outputs like recycled naphtha to make plastics which is a highly centralized industry.

For now, small-scale molecular recycling facilities appear positioned to be more quickly deployed to divert plastic waste from landfill, but in order to ensure plastics-to-plastics outcomes and derisk distributed supply chains that has yet to materialize in this sector, more R&D is needed to improve integration to downstream supply chains and demonstrate that small-scale modular solutions can enable large scale businesses based on their outputs.

- This choice was informed by analyzing the commercial size capacities of other technologies in our study which ranged from 18,000 to over 250,000 metric tons per year.

- Wasteshed – geographic area that serves as supply of post-consumer and post-industrial plastics for recycling technologies

Industry Case Study

Insights on companies on-the-ground

How Strategic Investments Can Scale Emerging Molecular Recycling Technologies

In November 2021, Closed Loop Partners released its latest report on molecular recycling, Transitioning to a Circular System for Plastics: Assessing Molecular Recycling Technologies in the United States and Canada. As part of this study, our team released a series of case studies meant to highlight best practices and lessons learned from molecular recycling companies advancing these technologies on-the-ground.

As many molecular recycling companies transition from lab to pilot phase, a combination of strategic partnerships and staggered investments can help overcome funding gaps

For many capital-intensive technology sectors like solar energy, biofuels and water infrastructure, there has been a “valley of death” where capital is critically needed to support technology commercialization between the lab to pilot stage, and then from demonstration facility to the first commercial facility. During this path to critical mass, without sufficient revenue or capacity, many companies face the challenges associated with building operational leverage before reaching commercial scale and while conducting costly technology and customer pilot testing (1). Many other technology companies fail at this stage.

As molecular recycling rapidly evolves as a diverse technologically intensive, industrial sector, this gap has also proven to be a challenge for many companies operating in the space. In a study of 60 companies, we found that it took an average of 17 years for a molecular recycling company to move from lab to pilot to growth stage (2). Today, many often rely on strategic grants and loans to fill the funding gap and finance their technologies through the early stages of the company.

How to Transition from Lab to Pilot

- Navigating the early stages of development to breakeven and secure the capital needed to continue scaling the technology

- Forming strategic partnerships with organizations familiar with the molecular recycling space

- Securing staggered investments for immediate future capital commitments

- Conducting a phased roll out to provide ongoing investor updates, build trust with partners and prove viability for further funding

PureCycle Technologies’ Solutions

PureCycle Technologies leveraged these strategies to develop its technology, which takes post-consumer and post-industrial polypropylene waste and purifies the materials of colorants and additives to create high-quality food grade polypropylene content.

Strategic Partnerships

The PureCycle technology was developed by P&G in 2013 and licensed by PureCycle in 2015. The technology started small, hitting initial process goals. As additional tests were able to replicate the purification process to a point of successfully creating high-quality recycled propylene from dirty polypropylene inputs, PureCycle began to build out its business model. Since the company’s purification process was developed by P&G, PureCycle greatly benefited from an elevated profile.

PureCycle was the first portfolio company of the venture capital firm, Innventure, the first global, open-architecture venture firm dedicated to sustainability. With experience taking disruptive technologies and building businesses around them, Innventure was key to commercializing PureCycle’s purification process (3). The firm’s experience was critical (4); the right partners can often expedite speed-to-market, saving a company millions of dollars.

In the midst of building its first plant in Lawrence County, Ohio, PureCycle announced its partnership with Milliken, a global industrial manufacturer, and Nestlé S.A., the world’s largest food and beverage company. Milliken formed an exclusive supply relationship with PureCycle, while Nestlé worked with PureCycle to develop new packaging materials to reduce plastic waste. Other companies such as L’Oreal have followed suit (5). These strategic partnerships across the recycling value chain––including consumer packaged goods (CPG) companies, converters and resin producers––further de-risked and accelerated the technology’s commercial route to market.

In 2019, PureCycle successfully produced the first initial batch of ultra-pure recycled polypropylene from waste carpet from their Feedstock Evaluation Unit (FEU). They transformed the discarded carpet into clear Ultra-Pure Recycled Polypropylene (UPRP) resin through their proprietary plastics recycling technology. Leveraging the FEU demonstration unit, this ended up being the best way to showcase the technology to partners, given that the unit itself is 11,000 sq/ft and 50 feet tall (6).

Staggered Investments

For an early stage, disruptive technology company, it is critical to partner with investors who understand the space––the feedstock risks, end market commodity price fluctuations, and technology alignment to sustainability goals within CPG companies––and are not only willing to commit capital immediately, but are also willing to reserve capital for future commitments. PureCycle’s seed capital investor provided a very large letter of credit that the company was able to draw upon, and some strategic partners agreed to tranche funding based on achieving milestones. Furthermore, secured offtake agreements, feedstock agreements, permits, and fully negotiated (Engineering-Procurement-Contract) EPC contracts, helped advance the development of the facility, and mitigated risk for investors looking to see significant progress and milestones.

Not only was it PureCycle’s association with major multinationals and key strategic partners that derisked investment for investors, but also the merits of the technology, its broader applicability and strong team. Having a viable product to show investors, as well as a unit to conduct process improvements and ensure strong mechanical performance, aesthetics and throughput, proved critical to secure funding for the company. PureCycle offered a differentiated product output that was in high demand in the market. Polypropylene’s diverse use cases, strong market pull and attractive greenhouse gas (GHG) profile proved to be an attractive investment for Closed Loop Partners, an investor in the company. Through the operation of the FEU and prior to closing on the bond, PureCycle identified a number of technology improvements based on operating the FEU which include: creating redundancy with extruders on the front end, adding non-stick coating to increase the amount of contaminants that could be present in the feedstock, using steam jacketed piping, and automating waste handling.

In late 2020, PureCycle completed a $250 million bond raise through municipal bond and debt offerings that are being used to roll out the second phase of the company’s commercial plant in Ironton, Ohio. This plant is expected to produce over 105 million pounds (47,000 metric tons) of ultra-pure recycled polypropylene (UPRP) per year. As PureCycle saw increasingly strong demand for their UPRP, the Company began the process of de-linking the price from commodity pricing while selling the UPRP at a premium to virgin polypropylene resin manufacturers. Given the abundance of waste polypropylene available that PureCycle can process, like carpet fiber, the company secured long term contracts for the feedstock to supply the commercial plant production and entered into long-term offtake agreements with leading global customers and Fortune 500 partners for the UPRP generated from the facility. Moving forward, PureCycle intends to expand its global footprint and have 30 commercial plants operational by 2030 and 50 plants by 2035. In 2021, PureCycle Technologies PureCycle Technologies (NASDAQ: PCT) went public on NASDAQ via a SPAC merger with Roth CH Acquisition I (NASDAQ: ROCH).

Call to Action

To lay the groundwork for successful capital raises, molecular recycling companies need to take the extra steps to derisk loans and investments as much as possible. This will require forming early partnerships to strengthen the business model of the technology, continuously improving and developing the technology at every stage, and creating products that align with market need. Ultimately, from proof of concept to early commercial stage, molecular recycling companies must identify strategic partners and investors who are supportive of and aligned with molecular recycling technologies. By staggering investments, molecular recycling companies are also better positioned to draw upon additional reserves of capital when needed, especially during the growth stages of the company.

[1] Process of Technology Commercialization – Valley of death – the problem is that when private alignment and capital is needed at most, risks are unfortunately high, and the organization may be unable to attract resources needed.

[2] https://www.closedlooppartners.com/research/advancing-circular-systems-for-plastics/

[3]https://www.globenewswire.com/news-release/2019/09/25/1920757/0/en/PureCycle-Technologies-Celebrates-Successful-Run-of-Groundbreaking-Plastics-Recycling-Technology.html

[4] https://purecycletech.com/2020/11/frequently-asked-questions-about-pcts-purification-technology/

[5] https://www.globenewswire.com/news-release/2019/07/18/1884973/0/en/PureCycle-Technologies-and-L-Oreal-signed-an-agreement-for-the-supply-of-Ultra-Pure-Recycled-Polypropylene.html

[6] https://purecycletech.com/2019/09/successful-run-of-feedstock-evaluation-unit/

Industry Case Study

Insights on companies on-the-ground

How Collaborations in the Molecular Recycling Space Can Drive Closed-Loop Plastics Supply Chains

In November 2021, Closed Loop Partners released its latest report on molecular recycling, Transitioning to a Circular System for Plastics: Assessing Molecular Recycling Technologies in the United States and Canada. As part of this study, our team released a series of case studies meant to highlight best practices and lessons learned from molecular recycling companies advancing these technologies on-the-ground.

Plastic Energy, SABIC, Sealed Air, Tesco and Bradburys Cheese join forces to build a closed loop system for plastic packaging, diverting waste from landfills and incineration

Achieving a 30% recycling rate across all plastic packaging in the U.S. and Canada by 2030 would require nearly 1 million metric tons of mixed plastic containers for recycling, 755,000 metric tons of polyethylene (PE) films, and about 300,000 metric tons of polypropylene (PP) containers. Currently, the recycling rate of PE film is at 11%, and the recycling rate of mixed plastics containers and packaging is even lower at 5% (1).

Leveraging molecular recycling technologies like conversion or purification, which can both process polyolefins waste (i.e. PP and PE resins), can divert mixed rigid plastics or mixed plastic films that are not suitable for mechanical recycling from landfill. While these materials today are minimally being collected and sorted, Closed Loop Partners’ supply chain analysis illustrates that integrating molecular recycling technologies into the existing plastics recycling system can add economic value to stakeholders across the collection and sortation value chain (see Deep Dive in XXX report on page XX in report).

Purification can process a subset of flexible films (i.e., PP and PE film); however, purer streams are usually required for processing. For the majority of complex films, including multilayer packaging (2), conversion is a better suited downstream solution since it is more amenable to today’s reality of mixed waste, and can fill in gaps in areas where collections and sortation infrastructure are limited (3). Conversion technology is one downstream solution to advance circular applications for recycled films, particularly for multilayer films. If these technologies help to meaningfully decarbonize the plastics industry and are aligned to circular incentives, they can play an important role in closing the loop on plastics that cannot be recycled (i.e. multilayer films) or converted to easier-to-recycle formats or reuse models.

Today, film and flexible plastics in particular, such as wrappers and multilayer films, are not easily recycled at the materials recovery facilities (MRF) because traditional recycling equipment is designed for rigid plastics and is challenged by sorting small, flat plastics; in addition, films and flexible plastics recycled mechanically typically have inferior properties compared to virgin materials which limits their end markets . Yet, packaging trends indicate a continuing shift away from rigid packaging towards flexibles and multilayer pouches, underscoring the need for upstream solutions like continued packaging design innovation and downstream solutions like advanced recycling that can process these packaging formats.

Plastic Energy’s Solution

For the past 10 years, Plastic Energy has been paving the way for the molecular plastics recycling sector with its patented Thermal Anaerobic Conversion technology. The company converts mixed post-consumer plastic waste into TACOIL, an alternative feedstock oil that is used in the creation of virgin-quality plastics for food-grade packaging. In 2020, Plastic Energy, SABIC and Sealed Air launched an industry-first closed-loop pilot project with UK supermarket chain, Tesco, and Bradburys Cheese. Flexible plastics returned by consumers to in-store collection points at Tesco supermarkets were recycled back into virgin-quality food packaging for Bradburys Cheese.

The multi-stakeholder project enabled collaborations at every point of the plastics value chain. Tesco first collected flexible plastic through collection points set up across its retail stores in the UK. The used flexible plastic collected was then converted into TACOIL by Plastic Energy at its facility in Seville, Spain. The TACOIL was then sent to SABIC, the world’s largest diversified chemicals company, to use this oil to create certified circular plastic resins, which form part of SABIC’s TRUCIRCLE™ portfolio. Sealed Air, one of the world’s leading packaging producers, then uses these plastic pellets to create new food-grade flexible packaging designed to be ultrathin and to protect the shelf life of perishable foods. The new film contains a minimum of 30% recycled content. As of September 2020, seven different products under Bradburys Cheese’s line use this flexible plastic packaging, which are sold in Tesco stores. The plastic packaging produced in the pilot project is certified under the recognized international sustainability certification scheme, ISCC PLUS, which traces the recycled materials along the supply chain, from feedstock to final product.

Creating a closed loop system for plastics across a diverse set of stakeholders involved overcoming three major challenges. First, the film formulation needed to be redesigned to achieve the desired level of recycled content, while retaining recyclability in the Plastic Energy process. Second, it was necessary to keep accurate records of the source and use of the recycled resin, to certify recycled content in the final product. Finally, it was critical that the resulting film complied with all food safety regulations and provided the minimum necessary performance and product protection for the target application. Once these three considerations were secured, this pilot proved the possibility of a complete plastics value chain collaboration, paving the way for more circular systems for plastic. Close collaboration and open lines of communication among partners can help ensure the quality of the product meets each company’s specifications, driving toward overall success.

As the need for circular solutions for flexible film packaging increases, Plastic Energy’s collaborative pilot will play a role in reducing plastic waste now and in the future. This pilot project demonstrates four key points:

- end-markets for this material exist,

- mixed flexible plastics can be recycled multiple times into new food-grade plastic,

- non-curbside collection systems, like retail locations, can serve as critical collection points for select materials,

- and accounting mechanisms for recycled content will be critical to validate recycling outcomes of these partnerships.

Call to Action

Three kinds of investment are needed to realize a circular value chain for plastics.

- Investment in collection, sorting and recycling infrastructure to enable efficient plastics recycling. Increased investment in recycling infrastructure that complements mechanical recycling, such as molecular recycling technologies, can increase recycling rates for plastic films and flexibles. Additionally, increased collection of post-consumer flexibles in curbside programs, in addition to store drop-off locations, can divert plastics from landfills or incineration, and toward recycling processes.

- Investment in design and manufacturing innovations. Technology is not a silver bullet solution, and investment in new innovative designs and manufacturing processing will be equally important to solutions like molecular recycling. Investment upstream and downstream ensures that materials use minimal raw resources, and are made from recycled content.

Investment in education. Consumers, businesses and governments each have specific roles to play in driving circularity and reducing greenhouse gas emissions. Education to help identify the actions, policy, and investments that can commercialize a circular system for plastics is necessary as we transition our systems from linear to circular.

[2] Multilayer packaging makes up approximately 10% of all flexible packaging produced according to the AMI European Polymer Demand 2020 report and based on CLFEX definitions of flexible film.

[3] Conversion technologies like pyrolysis and gasification are not exempt from pre-processing but do not require single-stream feedstock, like most purification and depolymerization technologies.

Industry Case Study

Insights on companies on-the-ground

How Vertical Integration Opens Access to Hard-to-Recycle Plastic Inputs for Molecular Recycling

In November 2021, Closed Loop Partners released its latest report on molecular recycling, Transitioning to a Circular System for Plastics: Assessing Molecular Recycling Technologies in the United States and Canada. As part of this study, our team released a series of case studies meant to highlight best practices and lessons learned from molecular recycling companies advancing these technologies on-the-ground.

When existing infrastructure is unable to supply sufficient plastic inputs for molecular recycling technologies, vertically integrated systems can help ensure consistent inflow

Each year, 92 million tons of clothing and textile scrap are discarded worldwide (1). With the limited recycling and reuse options for these materials, most end up being incinerated or buried in landfills. While the technology to process a wide variety of textiles and polyester fabrics exists, the success of these operations is also dependent on the ability to effectively secure feedstock at the right specifications.

JEPLAN’s Solution

To combat this challenge, JEPLAN, a depolymerization technology company based in Japan, developed the BRING™ system, enabling the company to collect large quantities of discarded clothing, including polyester waste, which can then be fed into their molecular recycling technology process. This enables the company to produce Bis(hydroxyethyl) Terephthalate (BHET) flakes (intermediate) and recycled polyethylene terephthalate (rPET), which can be used to create PET packaging or polyester yarn, as part of the outputs of their Kitakyushu Hibikinada plant and their subsidiary, PET Refine Technology (PRT). The clothing made of the recycled polyester is then sold under the BRING™ clothing brand.

In Japan, JEPLAN has successfully connected consumers who are looking to donate and recycle their used clothing with manufacturers and businesses interested in sponsoring recycling and housing drop-off points. The BRING™ project works as a platform for sustainable apparel, with the cooperation of consumers and corporate partners such as Muji, Patagonia and the North Face, to recycle unwanted clothing and textiles. To date, JEPLAN has collected over 3,000 metric tons of used clothing under the BRING™ project, the equivalent of almost 15 million T-shirts. With an estimated 510,000 tons of clothing disposed of as waste in Japan annually (2), JEPLAN has a significant opportunity to grow.

By operating their own collection program, JEPLAN has greater control of feedstock inflow, as well as the sorting, separating and preparation of input for their system. However, since apparel and textiles are often blends of several types of fibers, such as polyester, cotton and wool, JEPLAN alone cannot recycle all the collected items. When the material arrives at JEPLAN’s facility, sorters determine which clothing and textiles can be reused, reworn or recycled. Some of the companies JEPLAN partners with are able to collect back their apparel or textiles and resell them secondhand, if they meet minimum quality requirements. Other materials are recycled through JEPLAN’s molecular recycling process, where possible. Today, 5% of the textiles collected have high-enough polyester content to be recycled by JEPLAN. This post-consumer polyester is shredded and densified, so that they meet the feedstock specifications. The feedstock is then depolymerized, cleaned and repolymerized as recycled textile grade PET resin. By vertically integrating their supply chain in this way, JEPLAN has been able to successfully gain direct access to a portion of their feedstock (3).

A circular system for textiles requires consistent infrastructure, reuse and recycling systems, as well as enabling technologies. Given that JEPLAN, through its BRING™ system, is committed to creating sustainable end-of-life options for their partners’ collected materials, they will require partnerships with a wide variety of companies that can provide solutions for the different materials. For situations like this, data and material tracing could streamline sorting systems, further facilitating the transport of discarded textiles and goods to companies who can appropriately provide sustainable end-of-life recovery options for these materials.

Recently, JEPLAN established a consortium that collects used PET bottles, with the goal to continuously recycle all PET bottles produced in Japan.

Other Collection Models

The supply chain for collecting and sorting textile waste at end-of-life is grossly underdeveloped, lacking commercially available collections and sortation infrastructure. In order for companies like JEPLAN to operate efficiently, investments will be required to establish organized systems to collect, sort and appropriately pre-process the materials.

On a broader level, policies that incentivize used material collection, including landfills bans and Extended Producer Responsibility (EPR), can provide larger and more consistent quantities of recycled plastic inputs for molecular recycling companies. To further strengthen these collection systems, local laws and policy could play a role. Currently, there are a variety of programs that aim to improve material collection, including deposit refund schemes (DRS) and curbside collection. DRS levy a deposit when the product is sold, and then provide consumers with a refund of the deposit when the container or product is returned. This can encourage the collection of unwanted goods, prevent littering and contribute to higher rates of recycling (4). Investing in DRS infrastructure can also generate cleaner and more reliable feedstocks for recycling, to advance a more sustainable future that keeps a greater volume and variety of materials in circulation. However, while DRS can enable lower contamination of materials, at this point, lower participation rates and therefore lower volumes of collection can take place. This leads to high unit economics for collection, decreasing incentives to shift toward recycled inputs.

Curbside collection, on the other hand, has been implemented in a number of communities across the United States. In Illinois, the City of Elgin has recently implemented curbside textile collections, increasing access and convenience for textile recycling (5). Residents of Elgin can use the Simple Recycling curbside municipal recycling service, which collects items including clothing, shoes, small appliances, lamps and more. Residents can request orange Simple Recycling bags online, to fill and leave on their curb for the city to pick up on garbage collection days. While the convenience of this option can lead to higher participation rates and therefore higher volumes of textile collected, this may also lead to higher contamination rates depending on how items are sorted or placed in curbside collection bins or bags.

In addition to municipal collection programs, private companies have also developed services to collect residential waste, giving communities another way to send out recyclable items and further increase recycling rates. Retrievr, a Closed Loop Partners portfolio company operating in Pennsylvania and New Jersey, developed an on demand clothing & electronics recycling service, collecting clothing and electronic waste directly from residential doorsteps and ensuring the materials collected are responsibly recycled or resold.

Call to Action

In markets where molecular recycling companies are unable to access sufficient amounts of plastics as input for their technology process, vertically integrated systems within companies, such as JEPLAN’s, can enable better control of feedstock inflow. By managing the entire process from collection to processing, molecular recycling companies can better ensure the quality of materials received, which can determine the quality of output produced by their technology.

[1] BBC. “Why clothes are so hard to recycle”. https://www.bbc.com/future/article/20200710-why-clothes-are-so-hard-to-recycle

[2]Japan Times. “Japan looks to reduce environmental burdens of its fashion industry”. https://www.japantimes.co.jp/news/2021/05/06/business/economy-business/environment-emissions-fashion-japan/

[3] Anthesis Decomposition Technology Summary

[4] Site Anthesis study / any sources they used

[5] https://www.cityofelgin.org/2375/Clothing-Shoes-and-Textiles

Industry Case Study

Insights on companies on-the-ground

Getting Creative: Novel Molecular Recycling Products Allow for Increased Resource Efficiency in New Sectors

In November 2021, Closed Loop Partners released its latest report on molecular recycling, Transitioning to a Circular System for Plastics: Assessing Molecular Recycling Technologies in the United States and Canada. As part of this study, our team released a series of case studies meant to highlight best practices and lessons learned from molecular recycling companies advancing these technologies on-the-ground.

Building a circular economy for plastics means addressing all kinds of plastic waste, including and beyond single-use plastic packaging waste.

In the United States and Canada, two-thirds of the plastic produced, from children’s toys to lawn chairs, do not currently have end of life solutions and end up in landfills, incinerators, or worse, the natural environment. Meanwhile, companies across the world have made ambitious sustainability pledges to limit their waste and increase their use of recycled content in products and packaging, but many are struggling to source enough recycled plastic to meet demand. There are two primary reasons for this. First, federal regulations limit the use of recycled plastic content in specific applications, especially with regard to food grade plastics, making it difficult for recycled content to re-enter the industry it came from and maintain its highest economic value. Second, incorporating higher levels of recycled plastic content can be challenging for plastic producers who struggle to process highly variable plastic waste that could cause performance issues in the final products.

Increasingly, innovative molecular recycling technologies are being recognized for their ability to (1) expand the scope of what we can recycle, processing a wider set of plastic waste feedstock into like-new materials without compromising quality or being downcycled and (2) upcycle waste feedstocks into materials suitable for new markets that were not previously open to using recycled plastic, thereby incentivizing collection and diversion from landfill.

GREENMANTRA’s Solution

GREENMANTRA is a Canadian-based molecular recycling company that uses a patented catalytic depolymerization process to transform discarded plastic into unique polymer additives and specialty waxes. The company creates novel specialty products from plastic waste, bringing end-of-life solutions to plastics that are currently overlooked, and increasing the sustainability of industrial sectors like construction and infrastructure.

Because GREENMANTRA molecularly transforms plastic waste into new materials, the company can design the products for specific markets that did not previously utilize recycled plastics. For example, GREENMANTRA’s specialty waxes are engineered to easily mix into asphalt formulations that are ultimately used to build pavements, roads, and roofing products etc. The products are completely compatible with asphalt and can displace other petrochemical derived products to enhance and strengthen the durability of asphalt formulations. Furthermore, the products can reduce the overall carbon footprint for asphalt product manufacturers by reducing paving temperatures and energy demands.

GREENMANTRA prides itself on the company’s ability to reduce overall manufacturing costs for customers — a market advantage they have had time to develop and validate since their first paving project with the City of Vancouver in 2014. Since then, the company has partnered on other recycled plastic modified (RPM) asphalt paving projects with companies including, most recently, Nova Chemicals and Shell Polymers, which together expect to divert more than the equivalent of three million single-use plastic bags.

GREENMANTRA targets recycling hard-to-recycle plastics that don’t currently have end-of-life solutions like markers. The company has partnered with Crayola to turn post-use markers into additives that are used by companies like Malarkey, a major roofing product manufacturer.

A major part of the company’s success has been its ability to perfect the technology to create consistent products out of inconsistent waste feedstocks and deliver value to a wide range of customers: from roofing product manufacturers all the way to paving companies. They have been a formidable force in building new end markets for recycled plastics in the paving and roofing industry, and they have been able to do so through thoughtful communication, consistent customer education, and successful pilot projects along the way.

Call to Action

Innovators, entrepreneurs, and corporations striving to increase sustainability in manufacturing all have a role to play to ensure that we explore and expand ways to maintain resources in our economy for multiple cycles. Policymakers can spur end market development too. For example, the Save Our Seas Act 2.0, which passed in December 2020, allocates a large amount of funding to finding new uses for recycled plastics in infrastructure and road applications. And the recently passed ~$1 trillion Infrastructure Bill, combined with the pending Build Back Better Act, offers an unprecedented opportunity for the United States to upgrade our highway systems and infrastructure resilience with climate friendly technologies, encouraging construction companies to reduce their carbon footprint in their supply chains and manufacturing operations. GREENMANTRA and other innovative companies in the molecular recycling space will be ready to support these exciting initiatives in the coming years.

It begs the question of what circularity will look like in the future where resources are maintained in the system for multiple generations, but not always in the same sector. New end-markets for recycled plastic waste will continue to develop as technologies mature, and it will take creativity, innovation, and patience to unlock the economic value from plastic waste in our collective transition from a linear to circular plastics economy.

Industry Case Study

Insights on companies on-the-ground

How Collaboration Can Catalyze the Commercialization of Molecular Recycling Technologies

In November 2021, Closed Loop Partners released its latest report on molecular recycling, Transitioning to a Circular System for Plastics: Assessing Molecular Recycling Technologies in the United States and Canada. As part of this study, our team released a series of case studies meant to highlight best practices and lessons learned from molecular recycling companies advancing these technologies on-the-ground.

Significant progress within the molecular recycling sector will require a high level of collaboration among technology companies and across the molecular recycling value chain

As the nascent molecular recycling sector continues to mature, increased collaborations and transparency across the sector are critical to expediting best-in-class performance of molecular recycling technologies that meet direct market needs. A non-competitive approach to developing processes and business models can better position all technologies, and the sector as a whole, laying the foundation for a more cohesive integration of molecular recycling technologies within the broader recycling system.

To successfully commercialize and de-risk technology processes for early-stage molecular recycling companies, a much higher degree of collaboration needs to exist, rather than the status quo.

How molecular recycling companies can strengthen collaboration across the sector:

- Partnering across the public and private sectors––including with universities and governments––to foster a collaborative approach and leverage the appropriate resources to develop and deploy technologies.

- Building strong relationships with current investors who are also industrial companies that have interest in the molecular recycling company. Engaging with commercial partners is important for technology development.

- Getting involved with the sector at large and recognizing the relevant legislative frameworks. Knowledge of and involvement with policy is important for new, disruptive innovations.

Gr3n’s Solution

Gr3n, a molecular recycling company based in Lugano, Switzerland, produces, commercializes and maintains depolymerization plants. The company developed a proprietary technology––an innovative process that applies microwave technology to an alkaline hydrolysis, providing an economically viable recycling process of Polyethylene Terephthalate (PET) that can be implemented at an industrial level.

With the aim of getting to market quickly and strategically, the company used their resources and relationships to communicate transparently about their technology, providing relevant insights for other technology companies. They are one of the most forthcoming technology companies in the world, transparent both about their technology process, its environmental impact, and needs from stakeholders who want to see technologies like it scale. By working closely with key stakeholders across the value chain at every phase of development, the company has been able to identify areas of improvement to bring their technology to market.

Business Development and Certification: Founded and first lab tested in 2011, Gr3n has prioritized industry involvement, transparency and collaboration across the value chain throughout the development of its technology. In 2011, shortly after its founding, the company enrolled in the USI Start-Up Program, a service promoted by the Foundation for the Lugano Faculties of USI, in collaboration with USI and SUPSI. In 2014, Gr3n was awarded with a CTI label, which helps accelerate business development for emerging companies. To receive this label from the CTI Certification Board, Gr3n underwent a three-phase, firmly guided process with a dedicated expert to prepare the company for certification. Later that year, the company was selected as a European finalist of the Cleantech Open (CTO)’s annual business accelerator (1).

Industry Collaboration: In 2017, Gr3n joined DEMETO (Modular, scalable and high-performance DE-polymerization by MicrowavE TechnolOgy), a European project that received funding from the European Union’s Horizon 2020 research and innovation program. The 13 partners in the consortium are based around Europe, representing the entire molecular recycling value chain––from research organizations, to molecular recycling technologies, recyclers, packaging textiles and PET producers (2). They are each leveraging their industry strengths and knowledge to collectively bring to market a new way to chemically recycle PET––invented by Gr3n. As the owners of the depolymerization technology utilized by DEMETO, Gr3n is the scientific core of the consortium.

Technology Development Process: Gr3n’s involvement in DEMETO was critical to its development process and market acceptance, especially for the implementation of its technology at an industrial level. The company formed relationships with the DEMETO advisory board and fellow consortium members––which includes policymakers, global brands and waste agencies––helping expedite its road to commercialization. Within the first 18 months of the DEMETO project, technical work was focused on designing a reactive unit, creating a purification process and optimizing microwave design. In 2018, Gr3n won the Innovation Radar Prize at the major ICT event in Vienna, Austria, organized by the European Commission (3).

Sector Advancement: In addition to DEMETO, in 2019 Gr3n was among the founders of Chemical Recycling Europe (ChemRecEurope), a group established with the goal of promoting and implementing molecular recycling solutions in Europe, to help reduce waste and close the loop for the plastics industry (4). Through ChemRecEurope, molecular recycling companies across the value chain are given a platform to coordinate amongst each other, and further develop the molecular recycling community in Europe. By joining key industry groups, Gr3n positions itself to form strategic partnerships that are key to its route to market.

Proof of Concept: Currently, Gr3n operates a research & development hub, where the company runs all refinements and iterations needed before upscaling the technology. The site has a fully equipped lab for testing and characterization, as well as a pilot plant, which can depolymerize and purify 10-kilogram batches. In 2021, as a product of the DEMETO project, Gr3n began construction of a demonstration plant located in Chieti, central Italy, which is part of the Parco Scientifico e Tecnologico d’Abruzzo. This demonstration plant is smaller than the commercial-sized 30,000 metric ton/year plant and provides the company the opportunity to showcase its process and test the operations of the plant (5).

Calls to Action

Molecular recycling companies need to strengthen multitudes of partnerships with a range of stakeholders, including universities, brands and policymakers. Strategic relationships and collaborations can help companies gain better visibility in the market, plugging them into relevant supply chains and positioning themselves for commercialization and scaling. At this point in the development of the molecular recycling sector, significant collaboration is needed to strengthen the industry as a whole, and more emerging molecular recycling companies must advance a collaborative, non-competitive approach to technology development.

[1] https://gr3n-recycling.com/about.html

[2] https://www.demeto.eu/partner

[3] https://gr3n-recycling.com/about.html

[4] https://gr3n-recycling.com/about.html

[5] https://gr3n-recycling.com/about.html

Industry Case Study

Insights on companies on-the-ground

How Molecular Recycling Can Create Backflows of Recycled Content from the Textile Industry Towards Packaging

In November 2021, Closed Loop Partners released its latest report on molecular recycling, Transitioning to a Circular System for Plastics: Assessing Molecular Recycling Technologies in the United States and Canada. As part of this study, our team released a series of case studies meant to highlight best practices and lessons learned from molecular recycling companies advancing these technologies on-the-ground.

As the demand for high-quality rPET increases, strengthening collaborations and plastic material flows between the apparel and packaging sectors can ensure sufficient supply

Of the 3.75 million metric tons of recycled PET (rPET) packaging produced a year in the U.S. and Canada (1), more than fifty percent of the material is used to create synthetic fibers for polyester textile production (2). However, as polyester textile production continues to grow, there are no commercially available end-of-life solutions that allow for the recycling of these fibers. As a result, the majority of recycled PET, in the form of polyester textiles, will follow a linear path to disposal. In 2017, 85% of textile waste in the U.S.––14.3 million metric tons––was landfilled or incinerated (3, 4)

By 2030, the demand for rPET in North America will be nearly 1.5 million metric tons per year (5); one third of which will be for bottle-grade quality rPET needed by beverage companies to meet their sustainability goals of incorporating post-consumer recycled (PCR) plastic content into their packaging (6). If rPET production trends hold, in the next decade there will not be enough rPET produced to meet the demands of the year. This poses a challenge for beverage companies, as well as apparel and textile companies, who have all made commitments to incorporate rPET into their packaging and products and often compete with other sectors for the limited supplies of rPET in the market.

Simultaneously, supply chains for collecting and sourcing textile waste at end-of-life continue to be significantly underdeveloped, even more so than PET bottle recycling systems. This gap emphasizes the need to invest in technologies that can strengthen end-of-life collection for a variety of PET formats, and allow for a greater scope of plastic materials to be kept in circulation and converted into high-quality recycled content.

Carbios’ Solution

Founded in 2011, France-based Carbios is the only depolymerization company that utilizes a biological process based on enzymes to recycle polyester fibers in textiles into bottle-grade PET. This creates a new circular pathway for polyester textiles, not only closing the loop for synthetic fibers, but also strengthening the flow of recycled materials between the beverage and apparel sectors. Recycling polyester textiles at end-of-use can significantly bolster rPET supply, helping both the beverage and apparel industries meet growing demand for recycled plastics.

In addition to processing textiles into high-quality monomers for bottles and fibers, Carbios can also take a range of other PET-based plastics, such as colored, opaque and multilayer laminates. By converting those waste streams into high-quality outputs that can then be used to create virgin-like plastics and textiles, Carbios can help piece together a solution that could potentially support the recycling and circular flow of PET-based plastics and polyester fabrics.

Between 2011 and 2020, the company developed its enzymatic PET recycling technology to convert a range of PET-based plastics into PET pellets. In November 2020, it reached its newest technological milestone, successfully demonstrating the conversion of polyester textile waste into recycled Purified Terephthalic Acid (rPTA), a monomer used in PET production, which was then used to manufacture clear plastic bottles (7).

To advance their solution, and prove the viability of using their technology for packaging in the market, Carbios works closely with leading cosmetics and beverage companies. In 2017, Carbios and L’Oréal co-founded a consortium to industrialize Carbios’ molecular recycling technology. In 2019, Nestlé Waters, PepsiCo and Suntory Beverage & Food Europe joined the Consortium, expanding reach to the beverage industry. By working together to industrialize Carbios’ technology, the Consortium’s partners aim to increase the availability of high-quality recycled plastics in the market.

As a result of the Consortium, each partner company has successfully manufactured sample bottles based on Carbios’ enzymatic PET recycling technology. These bottles have been created for some of their leading products including: Biotherm®, Perrier®, Pepsi Max® and Orangina®. In 2021, Carbios’ consortium unveiled its first branded bottles––a culmination of nearly 10 years of research and development to optimize an enzyme that naturally occurs in compost heaps and normally breaks down leaf membranes of dead plants, to break down any kind of PET plastic and turn it back into virgin-quality plastic.

In addition to partnering with leading consumer goods companies, Carbios has also formed partnerships with experts in the bio-based solutions space. In 2020, they signed an exclusive co-development agreement with Novozymes, the world leader in enzyme production. Since 2017, Carbios has also partnered with Technip Energies, a world leader in engineering in the areas of energy, chemistry and bio-sourced industries to advance the industrial development of Carbios’ PET enzymatic recycling process.

At a time when the world’s largest consumer goods and apparel brands have made commitments to incorporate recycled plastic content into their packaging and products, early-stage and promising solution providers like Carbios are well positioned to help address two challenges: the shortage of high quality rPET in the market and the overabundance of polyester textile waste without sustainable end-of-life solutions.

Call to Action

The demand for high-quality recycled plastic packaging and recycled synthetic fibers by brands and retailers is driving global interest and investment in molecular recycling technologies, like Carbios, which are uniquely positioned to process both PET thermoforms and synthetic textiles.

The plastics recycling system will need to move beyond bottle-to-bottle recycling to meet public commitments for recycled plastic content, circularity and sustainability goals. Stakeholders that are looking to increase their access to rPET are best-positioned long-term if they work together to scale solutions that enable circulation of PET across multiple sectors. To achieve this, apparel brands and retailers need to deepen their collaboration and strengthen their flow of resources to close the loop on PET. Collecting clothing and other industrial waste (i.e. carpet, polybags), not only closes the loop on millions of metric tons of materials that today end up in landfill, but also has the potential to change the unit economics of molecular recycling technologies that can process diverse PET feedstock.

Integrating molecular recycling technologies into the current recycling infrastructure and bridge the gap between the supply and demand of high quality recycled plastics will require investment into the collections and sortation infrastructure. Cross-sector collaboration is essential to ensure that these systems are developed in ways that address the complexity and diversity of plastics, including polyester textiles.

[1] IHS Markit 2018

[2] Wood McKinsey Data

[3] “White Paper: Textile Recovery in the U.S. – Recycle.com.” Recycle.com, 29 June 2020, recycle.com/white-paper-textile-recovery-in-the-us/. Accessed 10 Mar. 2021.https://recycle.com/white-paper-textile-recovery-in-the-us/

[4] https://resource-recycling.com/recycling/2020/10/26/data-corner-supply-possibilities-to-meet-u-s-rpet-demand/

[5] Values taken from US rPET file

[6]https://resource-recycling.com/recycling/2020/10/26/data-corner-supply-possibilities-to-meet-u-s-rpet-demand/

Industry Case Study

Insights on companies on-the-ground

How Partnerships Between Advanced Recyclers and Material Recovery Facilities Are Strengthening the Plastics Recycling System

In November 2021, Closed Loop Partners released its latest report on molecular recycling, Transitioning to a Circular System for Plastics: Assessing Molecular Recycling Technologies in the United States and Canada. As part of this study, our team released a series of case studies meant to highlight best practices and lessons learned from molecular recycling companies advancing these technologies on-the-ground.

As advanced recycling develops as a circular solution for hard-to-recycle plastics, partnering with materials recovery facilities can strengthen the plastics recycling system as a whole

A circular system for plastics does not rely on one type of technology to process the material at end-of-life; rather, it employs distinct, yet complementary circular solutions that can drive value to one another. To achieve this, stakeholders across the plastics value chain must collaborate with one another. Yet, many plastics processors today, across advanced recycling and mechanical recycling, work in silos, creating a disjointed system that is unable to capture the full value of plastics. Understanding the different roles of stakeholder within the plastics value chain, as well as their relationships with each other, can enable collaboration instead of competition, and create value for all––from materials recovery facilities (MRFs), to advanced recycling companies, to retailers and consumers.

How to Align Incentives

Today, MRFs often receive piles of mixed waste, some of which can be processed by their machines, and others that cannot. To effectively recycle the latter, advanced recycling technologies often need to step in. However, for MRFs to send these materials to advanced recycling companies, they typically have to pay a tipping fee. Furthermore, advanced recycling companies are not guaranteed that the material they receive is at the quality they need.

Unless the tipping fees charged by advanced recycling companies are significantly less than those charged by landfill companies, or unless policies mandate private MRFs to recycle, there is little incentive for MRFs to transition material pathways from landfill to advanced recycling processes. As a result, excess material from MRFs is often sent to landfill, where the value of these materials is forever lost.

To address these waste challenges, best-in-class advanced recycling companies must ensure that they:

- Partner with materials recovery facilities that are supportive of advanced recycling, are willing to explore new opportunities for various material classes, and are financially and operationally sound;

- Test their technology to identify the plastic feedstock that can be processed by their machines and develop detailed specifications that correspond to these;

- Build flexibility into the collaborations, as the market and policy landscape shifts rapidly.

Brightmark’s Solution

Brightmark, one of the largest pyrolysis facilities in the United States, strategically capitalized on a confluence of supportive policies and dearth of recycling infrastructure, to incentivize better plastics sortation and demonstrate the important role conversion technology plays within the plastics recycling system.

Based in Ashley, IN, Brightmark operates in and around two of the 13 states that recognize advanced recycling as a manufacturing process: Indiana and Illinois. Coupled with the lack of robust recycling supply chains in Chicago, Brightmark saw an opportunity to strengthen their material inflow. Taking on a partnership approach, Brightmark’s business model incentivizes other plastics processors to send them plastics that the latter are unable to process. Through detailed material specifications and structured contracts, they also incentivize materials recovery facilities to sort and remove non-target plastics, like oxygenated PET or PVC, from their bales, ensuring the optimal material mix for Brightmark’s technology. With these contracts in place, Brightmark buys these pre-sorted bales from the MRFs––rather than having the MRFs pay a tipping fee––differentiating themselves in the market. The materials received by Brightmark undergo in-plant shredding and pelletizing to convert the material into desired outputs.

When Brightmark went about forming partnerships with MRFs around the Chicago area, the advanced recycling company first demonstrated its ability to adapt to changing market conditions as an off-taker. When selecting which MRFs to partner with, the company evaluated finances and operations, track record of sorting material for value, and safety of operations. The 12 MRFs selected not only passed these criteria, but supported advanced recycling, and invested in creating new markets for low-value materials. Together, Brightmark and these MRFs collaboratively explored opportunities to extract value from the MRFs’ material flows, proving that advanced recycling can provide value to mechanical recycling stakeholders, while increasing the volume of plastic diverted from landfill.

Beyond materials recovery, Brightmark’s collaborations with MRFs drive value in other ways. Their partnership with Indianapolis-based RecycleForce is for both feedstock and employee recruitment. “’They process a lot of electronic waste,’ said Bob Powell, CEO of Brightmark. ‘We’ll be taking plastics that otherwise would have been landfilled from them.’ RecycleForce also runs a training and development program that Brightmark will tap into. ‘They’re an Indiana partner that hires formerly-incarcerated individuals and provides training and employment services. We’re mission-oriented, and we seek partners who share our mission.’” (1)

Brightmark has also formed partnerships beyond MRFs. In July 2020, they completed a pilot collection program for boat wrap, with a marine services dealer location near the company’s Ashley, IN facility. Supported by the Northeast Indiana Solid Waste Management District (NISWMD), Brightmark proved the viability of using boat wrap––which is made of hard-to-recycle contaminated linear low-density polyethylene (LLDPE)––as feedstock to produce transportation fuel and wax.

To ensure that the feedstock they receive through partnerships is optimal for their processing capabilities, Brightmark spent nearly a decade testing various combinations of post-use plastic, as part of their technology commercialization process. Today, their plastics renewal process accepts co-mingled, single-stream plastics, which they can transform into fuel and wax. The company landed on a specification for input material that was both robust and forgiving, building in flexibility that enables them to process ever-changing co-mingled streams, while producing a predictable hydrocarbon liquid output. That specification is embedded in their supply agreement, and informs their pre-qualification process for new suppliers and new material streams.

By purchasing and receiving on-spec material, Brightmark reduces sorting costs on their end, ensures that their pre-treatment process runs safely and efficiently, and only feeds their machinery high-quality material that can be optimally sorted by pyrolysis technology. The less additional sorting required, the better their process’ uptime and throughput as a continuously operated conversion technology. As a result, they can create high-quality paraffin wax, fuels and naphtha that can be sold at a premium through offtake agreements. Brightmark prides itself on having one of the strongest financial performances in the advanced recycling space.

Brightmark has ambitious goals to divert 8.4 million tons of plastic waste from landfills and the natural environment, and to offset 22 million metric tons of greenhouse gas emissions, by 2024 (2). Moving forward, the company plans to grow their Plastics Renewal Platform, through established supplier relationships, as well as potential new partnerships. They also aim to identify strategies to economically and logistically work with brands on the post-consumer side of the value chain.

Call to Action

Advanced recycling companies must collaborate with existing recycling infrastructure to align on needs and capture material that would otherwise be sent to landfill. The plastics recycling system will only be optimized if every stakeholder across the value chain is aligned on their complementary roles, and the shared value of plastic. Economic incentives must complement mechanical recycling and address the gap in the plastics recycling system, to divert plastics from landfill, deliver economic value across stakeholders, and enable companies to derive value for themselves. Advanced recycling will scale only if they align with stakeholders across the plastics system––from collection facilities, to MRFs, to reclaimers. On a broader scale, policymakers must introduce legislation that incentivizes private MRFs to recycle more, diverting plastics from landfill and keeping the materials flowing within the plastics value chain.

[1] Forbes. https://www.forbes.com/sites/jimvinoski/2021/01/28/brightmark-circularity-is-the-solution-to-plastic-pollution-and-co2/?sh=19577b9a3b59

[2] Forbes. https://www.forbes.com/sites/jimvinoski/2021/01/28/brightmark-circularity-is-the-solution-to-plastic-pollution-and-co2/?sh=19577b9a3b59

Industry Case Study

Insights on companies on-the-ground

How Molecular Recycling Companies are Meeting Safety Standards to Keep Plastics in Play

With the growing demand for high-quality recycled resin, a combination of product testing, industry standards and policy are needed to ensure the safety of recyclable plastics

To advance circular systems and strong end markets for recycled plastic, technology companies must provide a consistent supply of high-quality recycled content that can be used in a wide range of applications. Within the molecular recycling landscape, solvent-based processes offer a considerable advantage toward this goal, as they can be used as the first stage of recycling plastics with known problematic substances, such as chlorinated pigments and brominated flame retardants (1), and can produce high-quality polymers that can meet food-grade and other product standards. In effect, they can help transform plastic feedstock––with a mix of unknown and hazardous additives and contaminants––into high-quality resin output, if the solvent and contaminants are effectively removed in the process.

How to Create Safe and High-Quality Post-Consumer Recycled Plastic (PCR)

Currently, 5.7 million metric tons of polyethylene (PE) film are in circulation in the U.S. and Canada, with a recycling rate of only 11% for post-consumer PE film (2). Purification of hard-to-recycle, low-value plastics, like low-density polyethylene (LDPE) addresses the most abundant form of plastic packaging waste, with the greatest efficiency (3). However, despite the capabilities of purification technology, less literature is available on its ability to ensure solvent does not end up in the final product. It is unclear whether solvent losses can be found in wastewater effluent (4), or if there is occupational risk from exposure to the fugitive emissions of the process. In terms of outputs, it is also unclear how effectively these solvent processes remove chemical additives from the feedstock polymers (5). In the meantime, to sell recycled polymers to compounders, residual additives in the post-consumer recycled (PCR) content must be low enough to comply with standards, especially if the output is high-quality plastic.

To address these solvent-related challenges, best-in-class molecular recycling companies must ensure that they:

- Have low solvent make-up rates;

- Test their outputs to ensure their process removes solvents or contaminants from the final products, in line with health standards and certifications; and

- Evaluate the facility fugitive emissions.

APK’s Solution

APK, a molecular recycling company that employs purification technology, succeeded in creating high-quality recycled products through a proactive combination of certification and refinement of their product. With one commercial facility operating in Merseburg, Saxony-Anhalt, Germany, the company specializes in the production of plastic granulates, leveraging an efficient solvent-based plastic recycling process called Newcycling®––transforming mixed LDPE, HDPE, PA, PP waste and multi-laminates into pure-sorted PE, PP and PA granulate pellets, for a wide range of production applications. The facility in Germany, which has been online since June 2019, features an annual capacity of 8,000 tons per annum. To achieve ‘virgin-like,’ high-quality output, APK’s Newcycling® technology physically purifies mixed polymer waste factions, mostly from post-industrial and post-consumer sources, including different polymer types found in multi-layer films and mixed plastic waste fractions.