Accelerated Filtration Closes $1.5M Pre-Seed Funding Round, Led by Closed Loop Partners

July 12, 2022

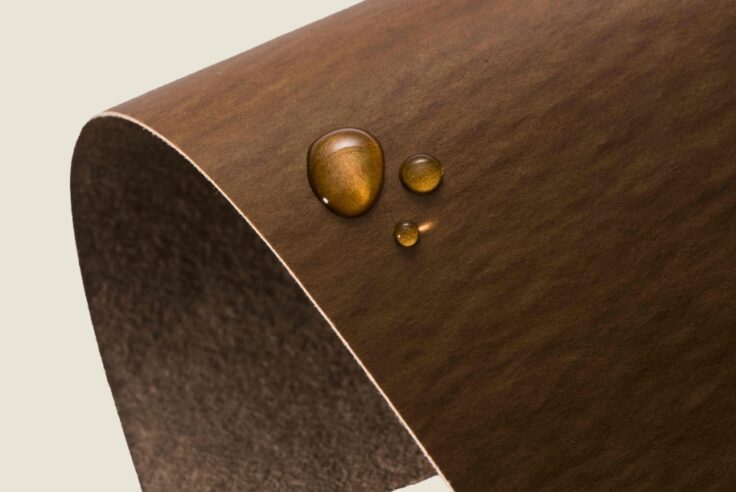

A new era in fine particle industrial water filtration is here with the launch of the VelRay XTM, the debut product of Accelerated Filtration, Inc.

Midland, Mich. (July 12, 2022) – Accelerated Filtration, Inc. (AFI), a water filtration company based in Midland, Michigan that develops industrial water filtration technologies, announced today that it has raised $1.5 million in pre-seed funding. Closed Loop Partners’ Ventures Group led the financing round, with participation from Michigan Capital Network, Anthropocene Ventures and Oxcart Equity Partners.

The company will use the funding to advance product development, marketing and launch its first water filtration solution into the market later this year. AFI delivers packaged turn-key filtration solutions for the consistent removal of fine suspended solids in variable water streams. AFI’s innovative technology offers fine particle filtration for large and small water processing challenges across a range of industries and applications.

“Our product offers customers a compact, robust solution for removing fine particles from water and wastewater streams. Its ability to economically filter out low and high levels of suspended solids sets it apart as an extended range, fully automatic, fine particle filter,” said Scott Burr, President and CEO, Accelerated Filtration. “The VelRay XTM filter is an essential product needed to address growing global water challenges, enabling greater capability in processing source water, recycling and reusing process water, and treating wastewater. We’re thrilled our investors see the incredible value for the marketplace.”

The investment takes place amidst an increasingly urgent global water crisis. Already water stressed regions are becoming more so due to the effects of climate change and population growth. With world populations expected to exceed 9 billion by 2040, the increase in both urban and industrial demand will be competing for limited water resources. Technology developments in water processing are needed to enable a resilient and robust global water management capability.

“Building a circular economy that reduces waste means ensuring that all resources are efficiently managed and kept in circulation. As we face intersecting challenges with a growing world population and the critically urgent climate crisis, water has become one of the most important and valuable resources we need to manage,” said Danielle Joseph, Managing Director and Head of the Ventures Group at Closed Loop Partners. “Our investment in Accelerated Filtration is a key step forward in our work to advance a waste-free water management system. We look forward to working with their team to scale their technology for more efficient water recycling and reuse.”

###

About Closed Loop Partners

Closed Loop Partners is a leading circular economy-focused investment firm and innovation center. The New York-based investment firm manages venture capital, growth equity, private equity and catalytic capital funds. The firm’s business verticals build upon one another, bridging gaps and fostering synergies to scale the circular economy. Learn more at closedlooppartners.com

About the Closed Loop Ventures Group at Closed Loop Partners

Closed Loop Partners’ venture capital arm launched in 2017 with one of the first venture funds dedicated solely to investing in early-stage companies developing breakthrough solutions for the circular economy. The Closed Loop Ventures Group targets leading innovations in material science, robotics, agri-tech, sustainable consumer products and advanced technologies that further the circular economy. The Closed Loop Venture Fund II builds on the venture capital group’s first fund’s strategy, supported by an existing portfolio with strong financial performance, coupled with robust environmental and social impact. To learn more about the Closed Loop Ventures Group, visit the Closed Loop Partners’ website.

About Michigan Capital Network

Michigan Capital Network (MCN) MCN exists to educate, grow, and diversify the base of early-stage investors in communities across the state. Wealth creation through early-stage investing done well in turn helps create healthier, thriving communities and economies. To learn more about Michigan Capital Network, visit the Michigan Capital Network website.

About Anthropocene Ventures

Anthropocene Ventures is a global, early-stage venture capital firm investing in founders that leverage exponential technologies & hard science to make humanity more resilient. To learn more about Anthropocene Ventures, visit the Anthropocene Ventures website.

About Oxcart Equity Partners

Oxcart is a stage-agnostic private holding company investing to help catalyze a more just, equitable and ecologically sustainable future for the planet and all its inhabitants.

Contact:

Scott Burr, President and CEO

Accelerated Filtration, Inc.

www.acelfil.com

Source: Accelerated Filtration

Disclaimer:

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management’s views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision. Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words “believe”, “expect”, “anticipate”, “optimistic”, “intend”, “aim”, “will” or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

Related posts

Blog Post

How AI Can Reduce Food Waste at Restaurants

Closed Loop Ventures Group led the seed investment...

Blog Post

Why We Invested in Mycocycle: Nature-Inspired Circular...

Closed Loop Partners’ Ventures Group saw a key opportunity...

Press Release

Closed Loop Partners Leads $4M Seed Round for LAIIER,...

Investment in the innovative liquid leak detection...

Blog Post

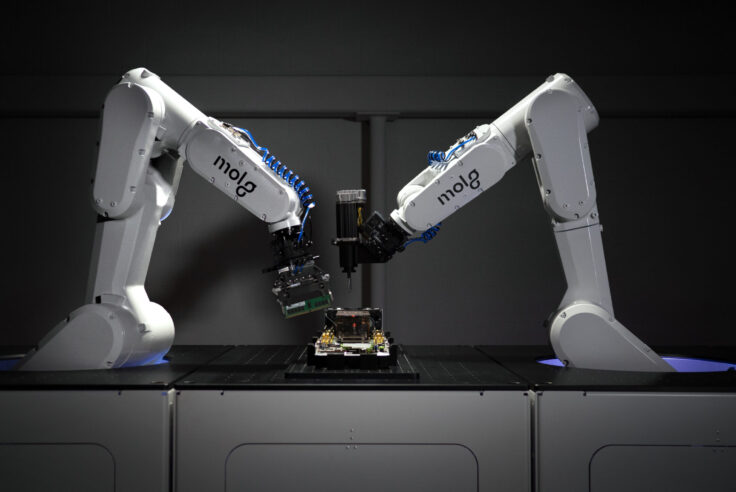

Making Circularity Stick: Electronics

A conversation with Rob Lawson-Shanks, CEO of Molg...

Press Release

Closed Loop Partners Doubles Down on Investment in...

Closed Loop Ventures Group joins Earthodic's $4 million...

Blog Post

Why We Invested in Neutreeno: Engineering Circular...

Neutreeno offers a game-changing solution that seamlessly...

Press Release

Molg Raises $5.5 Million in Seed Funding to Tackle...

Closed Loop Partners' Ventures Group leads seed funding...

Blog Post

How the Apparel Industry Is Challenging Us to Think...

The high cost of textile waste has sparked the need...

Blog Post

Why We Invested in Aerflo: Making Reuse an Everyday...

Closed Loop Ventures Group is thrilled to announce...

Blog Post

Why We Invested in Capra Biosciences: How Microbes...

Today, we are witness to a rapidly changing manufacturing...

Blog Post

Why We Invested in VALIS Insights: Bringing Circularity...

Closed Loop Partners invested in VALIS Insights because...

Blog Post

Why We Invested in Found Energy: The Importance of...

Closed Loop Ventures Group invests in Found Energy,...